China’s top memory chip maker can’t wean itself off US for now

- Yangtze Memory Technologies Co currently gets more than 80 per cent of its chip manufacturing equipment from the US and Japan

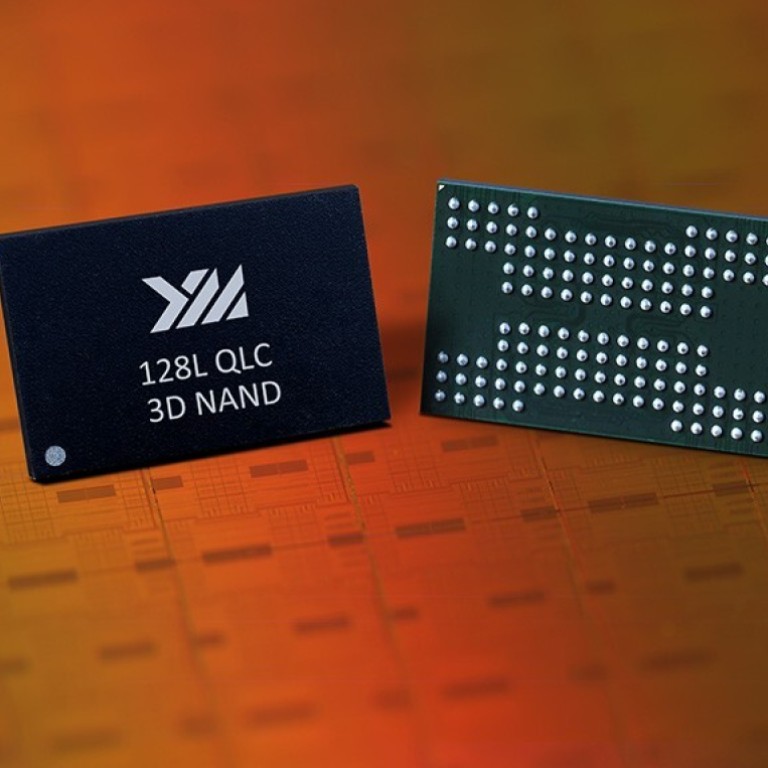

- The company has said it will invest US$22 billion in a facility in Wuhan that is by far China’s most advanced factory for 3D NAND flash memory chips

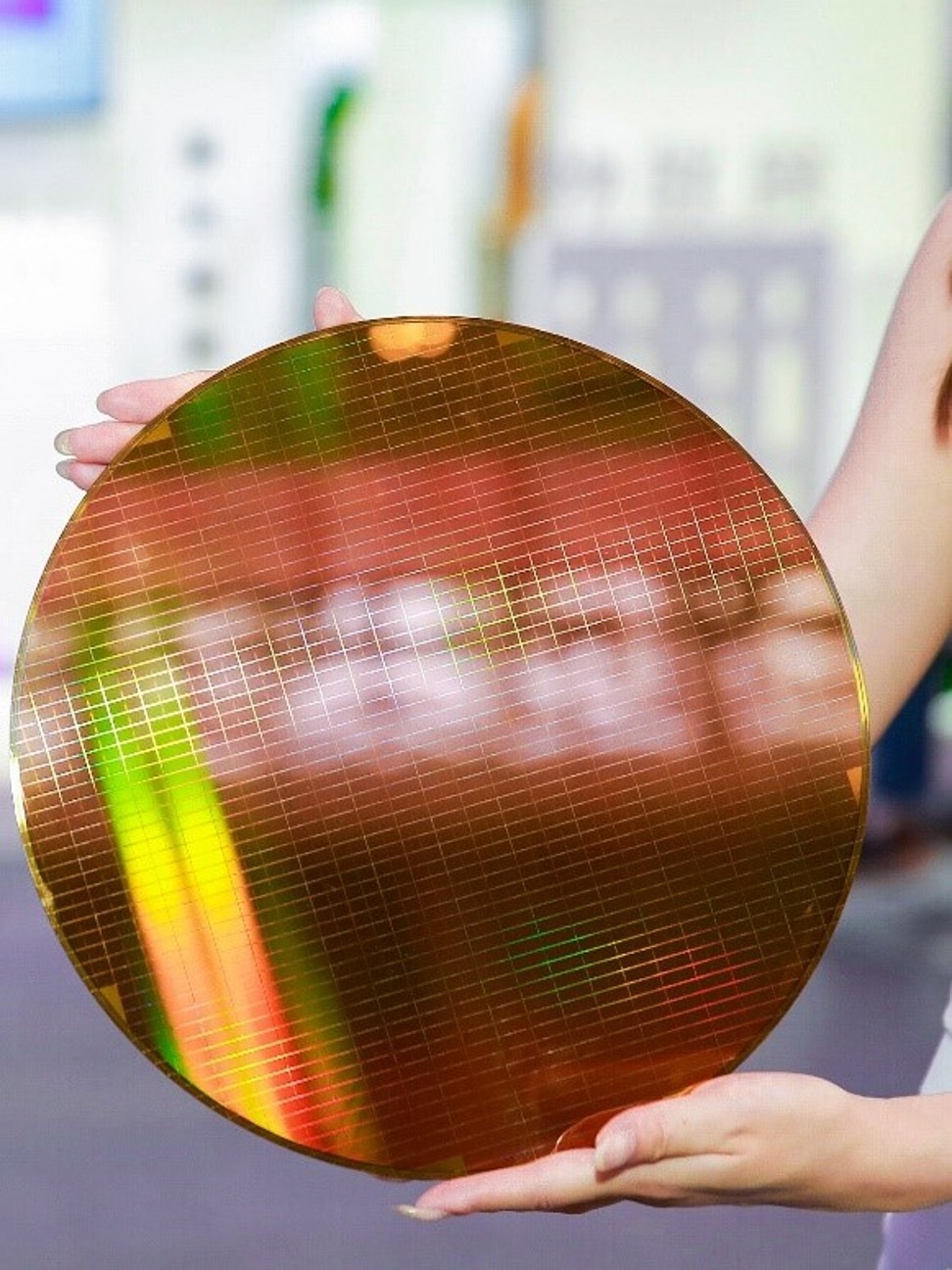

Yangtze Memory Technologies Co currently gets more than 80 per cent of its equipment from the US and Japan, according to Zheng Jiuli, vice-president in charge of supply chain management. While some Chinese suppliers have made breakthroughs in areas including etching, cleaning and coating, there are not enough local alternatives to replace everything, he added.

“Long-term investments in innovation and R&D have led to technological advantages” at US and Japanese suppliers, Zheng said. “This is also the reason why their products are currently in the mainstream and are difficult to replace.”

The deficit of basic chip making equipment complicates Beijing’s ambitions to reduce its reliance on its geopolitical rival.

Production of these chip sets, which are mainly made of materials such as silicon carbide and gallium nitride, only has limited exposure to US vendors, analysts at Citigroup have said.

Yangtze Memory has not set a target for domestic procurement, Zheng said, adding that it would be “unscientific” to do so.

It has been collaborating with chip firms from the U.S., Japan, South Korea and Europe on talent and technology and will continue working with these global companies, he said.

The company has said it will invest US$22 billion in a facility in Wuhan that is by far China’s most advanced factory for 3D NAND, the latest iteration of storage used in smartphones and high-end computing.

Unigroup and other Tsinghua affiliates have pulled off a number of acquisitions over the years, including of RDA Microelectronics and Spreadtrum Communications, to strengthen their design capability, and signed partnership deals with global players including Western Digital Corp.