Genshin Impact rakes in US$245 million in first month, ending Tencent’s stranglehold on mobile games

- China, Japan and the US were the title’s top three markets, generating US$82m, US$50m and US$45m on mobile respectively in the first 30 days

- Genshin Impact has also become the biggest mobile role-playing game launch in the US to date

Chinese game Genshin Impact has earned US$245 million in its first month, ending Tencent Holdings’ dominance in mobile games, but stirring controversy over its potential addictiveness.

Developed by Shanghai-based miHoYo, the anime-style action adventure racked up about US$60 million in its first week and averaged a similar amount each week since, according to data firm Sensor Tower.

“Genshin Impact [has been] the biggest revenue generator globally on the App Store and Google Play since its release [on September 28],” Craig Chapple, mobile insights strategist at Sensor Tower, wrote in a report published on Wednesday.

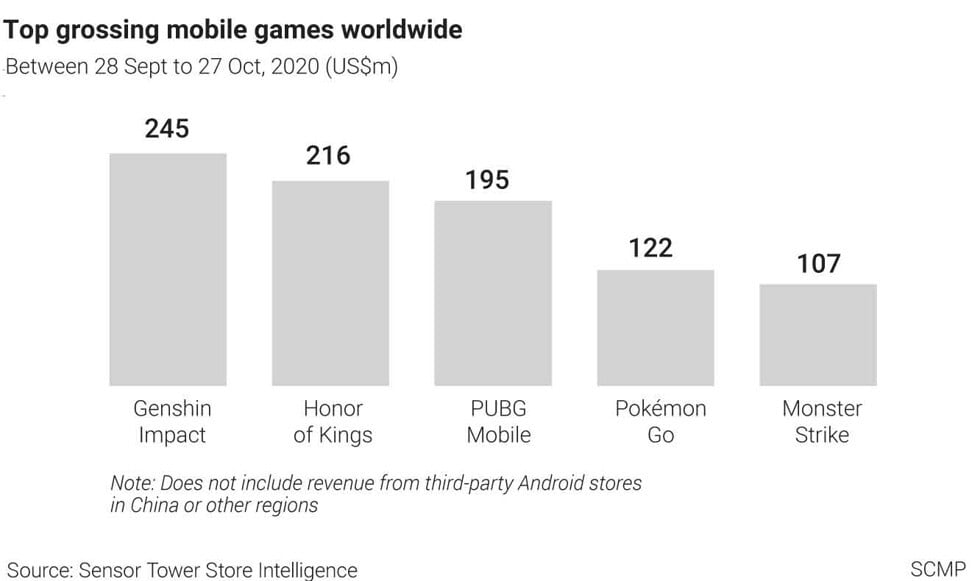

The role-playing title, set in a “magical fantasy” world, is on track to become the most profitable mobile game in October, displacing Tencent titles which have dominated the sector. Since September last year the top grossing games on mobile platforms have been either Honour of Kings, also known as Arena of Valour outside China, or PUBG Mobile, both developed by Tencent.

But in the 30 days following Genshin Impact’s release, the miHoYo title earned more than Honour of Kings and PUBG Mobile did individually in the same period.

Chinese game Party Animals breaks concurrent player record on Steam

Chapple said China, Japan and the US were the title’s top three markets, generating US$82 million, US$50 million and US$45 million on mobile platforms respectively in the first 30 days. The Sensor Tower data does not include revenue from PCs and console platforms, where the title has a significant number of players, so the game’s total revenue may be substantially higher.

Genshin Impact has also become the biggest mobile role-playing game launch in the US to date.

“It’s a well-made game launching across multiple platforms and regions … with a simultaneous China and non-China launch for mobile. The big question becomes, what’s the … staying power of this title once it inevitably levels off,” said Bloomberg Intelligence analyst Matthew Kanterman.

The way Genshin Impact makes money from players – using a mechanic known as gacha or loot boxes – has created controversy because its lucky draw nature has been compared to gambling.

Fall Guys is coming to smartphones in China after success on PC and PS4

As a Chinese game, Genshin Impact also has to disclose loot box odds under regulations implemented in 2017, unlike games developed in the West.

Chenyu Cui, a senior research analyst for games at London consultancy Omdia, said loot boxes were also a common feature in anime-style games such as NetEase’s Onmyoji and Fate/Grand Order from Delightworks. Fate/Grand Order was the last mobile game to beat Honour of Kings and PUBG Mobile in earnings, a feat it accomplished in August last year, according to data from Sensor Tower.

Serkan Toto, founder of Tokyo-based consultancy Kantan Games, believes Genshin Impact has targeted the right demographic. “It has a strong anime and manga element, making it attractive for the otaku crowd, the highest-spending users on the planet,” he said.

Genshin Impact could see a long life cycle if the success of Honkai Impact 3rd, miHoYo’s previous title, is anything to go by. Cui said both titles target a similar demographic but Genshin Impact has improved the game design of its predecessor.

“A game’s life cycle depends on consistent gameplay upgrades and new content updates as well as the publisher’s marketing activities, so [long term success is] hard to predict at this initial stage,” Cui said.

Justin Shriram Keeling, general partner at the gaming-focused Lumikai Fund, said the success of Genshin Impact also has an important symbolic meaning for the industry.

“It has helped break the stigma that very high quality RPGs can be developed in China and break out to a truly global audience,” he said.