China’s bitcoin crackdown raises cryptocurrency demand as they move to peer-to-peer platforms

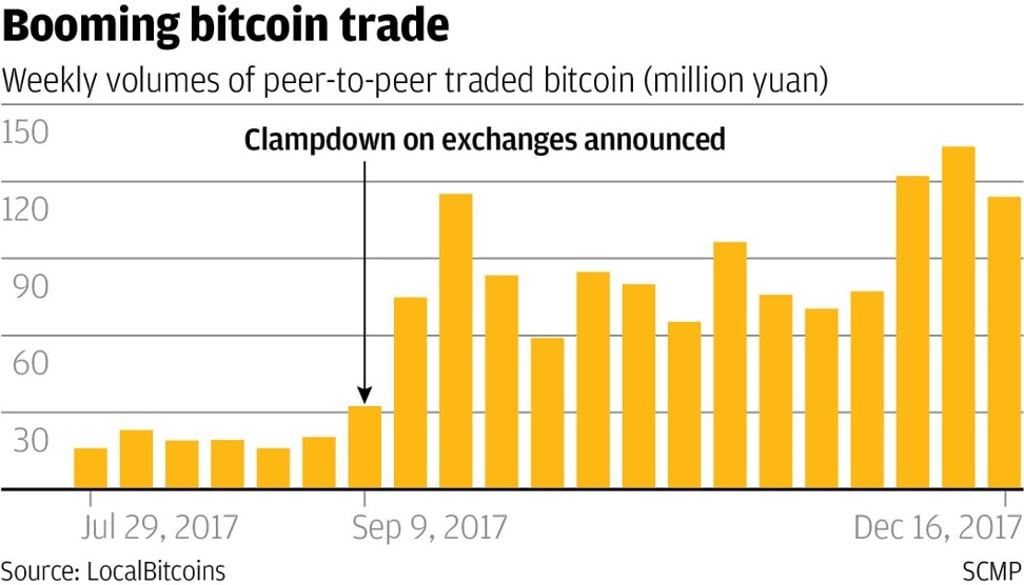

Peer-to-peer transactions of bitcoin is thriving in China, even after its ban in September, a trend that is likely to lead to further restrictions.

Bitcoin trading is booming in China despite an official clampdown on centralised exchanges, as traders take to investing in the virtual currency through peer-to-peer exchanges. And the Chinese government has taken note.

Unlike file sharing on torrent sites such as The Pirate Bay, peer-to-peer trade in bitcoin involves buyers interacting directly – on a one-to-one basis – with sellers on deals, instead of in a centralised marketplace or exchange.

“Over-the-counter trading is booming,” China’s National Committee of Experts on Internet Financial Security, a government-backed research group, said in its Bitcoin OTC Report for November. “This warrants further attention.”

Investors had feared a ban in September on trading on domestic exchanges by Beijing would dampen the appetite for bitcoin on the mainland, a key source of demand worldwide. But analysts say the authorities have found that where there is a will, there is a way, as more of the buying and selling of cryptocurrencies has gravitated towards the private over-the-counter market.

“Over-the-counter trading is booming.”

“After a period of caution following the September government actions, the China blockchain community is open for business,” said Matthew Graham, chief executive of Sino Global Capital, a Beijing-based technology advisory company. “We expect this to continue and even increase.”

The report pointed out that the number of over-the-counter platforms continues to grow – only four were active before October while 21 are active today. The weekly volume of peer-to-peer traded bitcoin has also risen by more than 250 per cent in yuan terms since September, according to data from LocalBitcoins, a site that allows buyers and sellers to trade directly.

On several bitcoin over-the-counter platforms, the South China Morning Post found buyers and sellers noting their preferred methods of exchanging yuan, including bank transfers, Alipay and WeChat Pay.

But Chinese investors are also using messaging platforms to connect, where users are introduced through acquaintances to negotiate bilateral trades, said Leonhard Weese, president of the Bitcoin Association of Hong Kong. While in the past, most peer-to-peer bitcoin trades originally used WeChat, China’s equivalent of the WhatsApp messenger, concerns about surveillance have pushed some traders to Telegram, an encrypted communication app that offers users more privacy.