Amazon just got one step closer to crushing America’s biggest clothing stores

New try before you buy Prime Wardrobe service offers free shipping and allows customers to leave returns by their front doors

By Hayley Peterson

Amazon just got one step closer to dominating department stores in clothing sales.

The e-commerce giant has launched a new service called Prime Wardrobe that lets customers try on clothing before buying it.

Customers can order multiple items and then decide whether they want to keep any of the clothing or send it back.

If shoppers keep at least three items, they get 10 per cent off their total purchase. Keeping five items will give them 20 per cent off their purchase. Shipping is free both ways, and customers can leave returns by their front doors instead of visiting a postal office.

The program resembles other popular “box” services like Stitch Fix and Nordstrom-owned Trunk Club.

Prime Wardrobe is the latest in a string of new investments by Amazon into the apparel industry this year, including the recent launch of its own athleisure brand and the release of a camera style assistant called Echo Look.

This latest move makes Amazon an even bigger threat to department stores like Macy’s, Nordstrom, and JCPenney, which have been battling years of declining shopper traffic to malls.

Amazon is expected to surpass Macy’s this year to become the biggest apparel seller in the US this year, according to Cowen & Co.

The company’s clothing and accessory sales are expected to grow nearly 30 per cent next year, to US$28 billion, according to the Cowen analysts. Macy’s apparel sales, by comparison, are expected to drop four per cent, to US$22 billion, in the period.

As Amazon’s sales grow, so will its share of the apparel market in the US.

Amazon currently claims about 6.6 per cent of the market. That share is expected to increase to 8.2 per cent by next year and further expand to 16.2 per cent within five years, according to Cowen analysts.

By 2021, Cowen expects Amazon to generate US$62 billion in annual apparel sales in the US. TJ Maxx is expected to be the No. 2 clothing seller, with US$26 billion in sales, and Macy’s is expected to claim the No. 3 spot, with US$23 billion in sales.

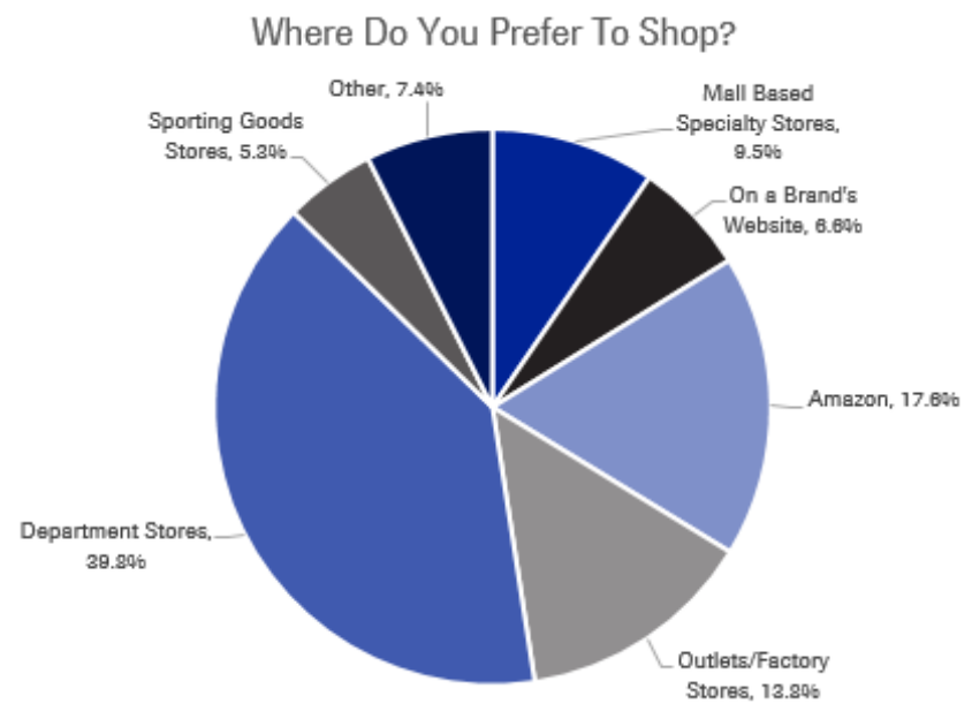

A majority of customers still prefer to shop in department stores over Amazon for clothing, shoes, and accessories, however.

A recent survey by Cowen found that nearly 18 per cent of consumers prefer to shop for those items on Amazon, compared to 40 per cent who prefer to visit department stores.

Over the past couple of years, Amazon has ramped up its investment in fashion by launching its own private-label clothing brands and sponsoring the first New York men’s fashion week.

The company has also hired executives from luxury fashion companies, such as Julie Gilhart, the Barneys New York fashion director whom Amazon reportedly hired as a consultant, and Vogue editor Caroline Palmer.

Also in the past few years, Amazon has started to shift its fashion strategy toward offering more high-end designer names such as Zac Posen and Stuart Weitzman.

That shift has had some industry experts scratching their heads. Luxury fashion websites are typically well merchandised and highly curated — not things for which Amazon is necessarily known.

Amazon also has the disadvantage of having no brick-and-mortar stores where shoppers can try on items or return purchases, he said.

But unlike most traditional department stores, Amazon offers free two-day shipping — even for its clothes — through its Prime membership program.

In a survey, shoppers told Cowen that Amazon Prime is the biggest lure for buying clothes on Amazon. They also praised Amazon’s customer service and breadth of product reviews.