Advertisement

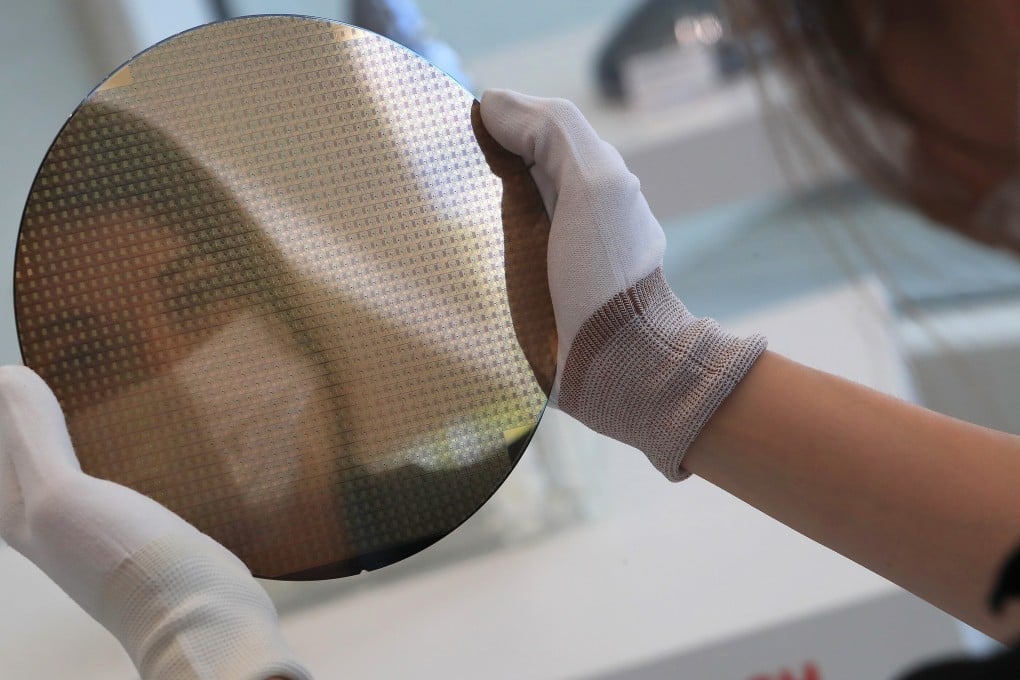

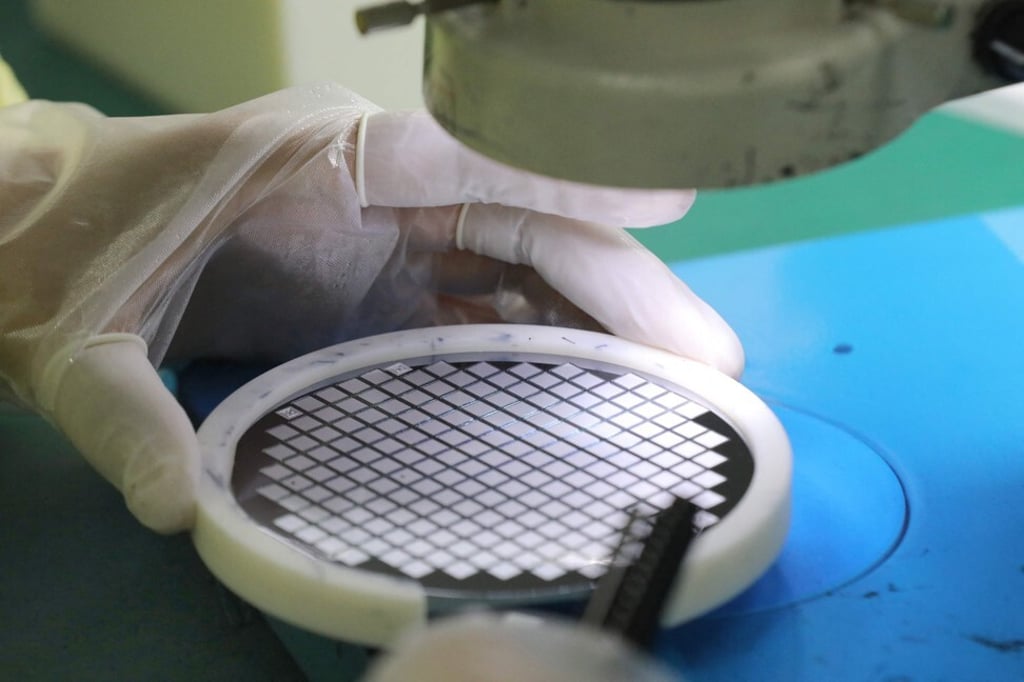

China must pursue chip assembly, packaging breakthroughs to catch up with semiconductor leaders, experts say

- The stakes are high for China to innovate in chip assembly and packaging amid US efforts to counter that development

- The landmark US Innovation and Competition Act identifies China as a major rival to America’s technological dominance

Reading Time:3 minutes

Why you can trust SCMP

1

China must pursue breakthroughs in chip assembly and packaging technologies to catch up with global industry leaders, according to experts who spoke on Wednesday at the World Semiconductor Conference held in the eastern city of Nanjing.

The world’s second-largest economy now has an opportunity to catch up as the semiconductor industry grapples with maintaining annual growth in chip performance, which declined to 3 per cent this year from a high of 57 per cent in 2002, said Wu Hanming, a fellow at the Chinese Academy of Engineering (CAE), according to conference transcripts obtained by the South China Morning Post.

The focus on integrated circuit (IC) assembly and packaging innovations falls in line with a call by Chinese officials for potential disruptive semiconductor technologies, as Moore’s Law potentially reaches its physical limit. First observed by Intel co-founder Gordon Moore in 1965, Moore’s Law has become a “rule of thumb” on advances in computing power. It maintains that the number of transistors on a chip doubles roughly every two years, while the overall cost of that computing power halves.

Advertisement

One way China can stay ahead of the industry is through “heterogeneous integration”, according to Mao Junfa, vice-president of Shanghai Jiao Tong University and an academic with the Chinese Academy of Sciences.

Advertisement

“Heterogeneous integration is the new direction for the industry in the post-Moore’s Law era,” Mao said. “It is also an opportunity for China to change lanes and overtake others in the IC industry.”

Advertisement

Select Voice

Select Speed

1.00x