Advertisement

Bitcoin dreams dry up in China as country’s last mining refuge falls in line with Beijing amid national crackdown

- Bitcoin mining companies in Sichuan, once held up as model consumers of abundant hydropower, are now being pushed out of the province

- Energy-intensive mining operations conflict with Beijing’s environmental goals, but Sichuan’s surplus of clean energy has not spared it from the crackdown

Reading Time:3 minutes

Why you can trust SCMP

2

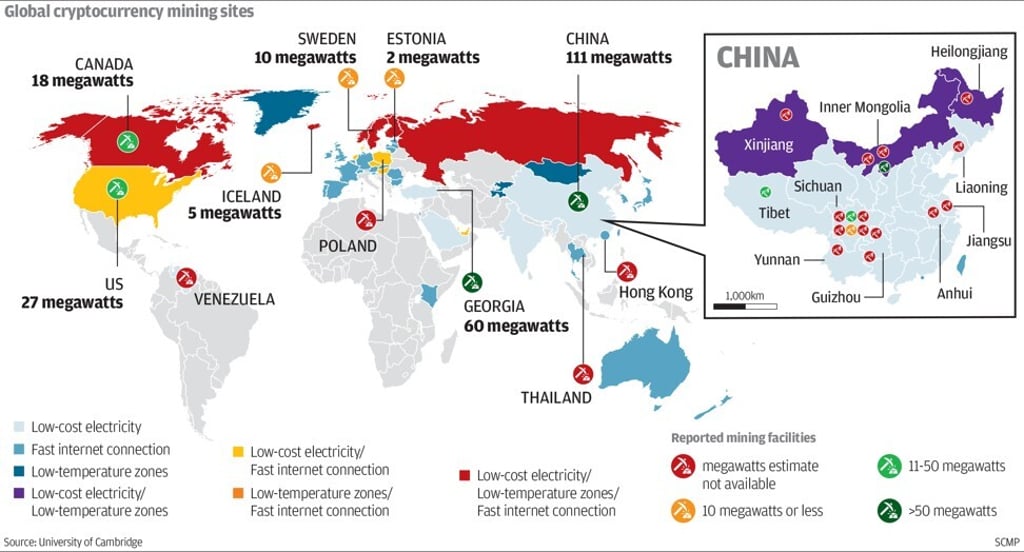

China’s crackdown on bitcoin has turned dozens of companies from model energy consumers into pariahs in the span of a year, sowing confusion and frustration in an industry that has an outsize share of the world’s cryptocurrency mines.

Nine out of 26 bitcoin mines named in a shutdown order last week in southwestern Sichuan province were once feted as model enterprises, helping the landlocked region at the foothills of the Tibetan Plateau soak up its surplus electricity produced by abundant hydropower. Most of the mines call themselves technology or big data companies, including the words in their names.

Bitcoin farms, where arrays of energy-sapping computers solve tough mathematical problems to generate new digital “coins”, have sprouted up all over Sichuan, Inner Mongolia and Xinjiang in recent years, driven by dreams of instant wealth as the price of the largest cryptocurrency surged sevenfold over the last year, surpassing US$63,000 per bitcoin in May before losing nearly half that value over the following month.

Advertisement

Local authorities eager for investment had largely welcomed the mining operations taking advantage of the cheap electricity in those regions.

Advertisement

An investor of one of the 26 named entities, who spoke on condition of anonymity because of the sensitivity of the issue, said he is now trying to move his bitcoin mining farm to Russia.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x