Advertisement

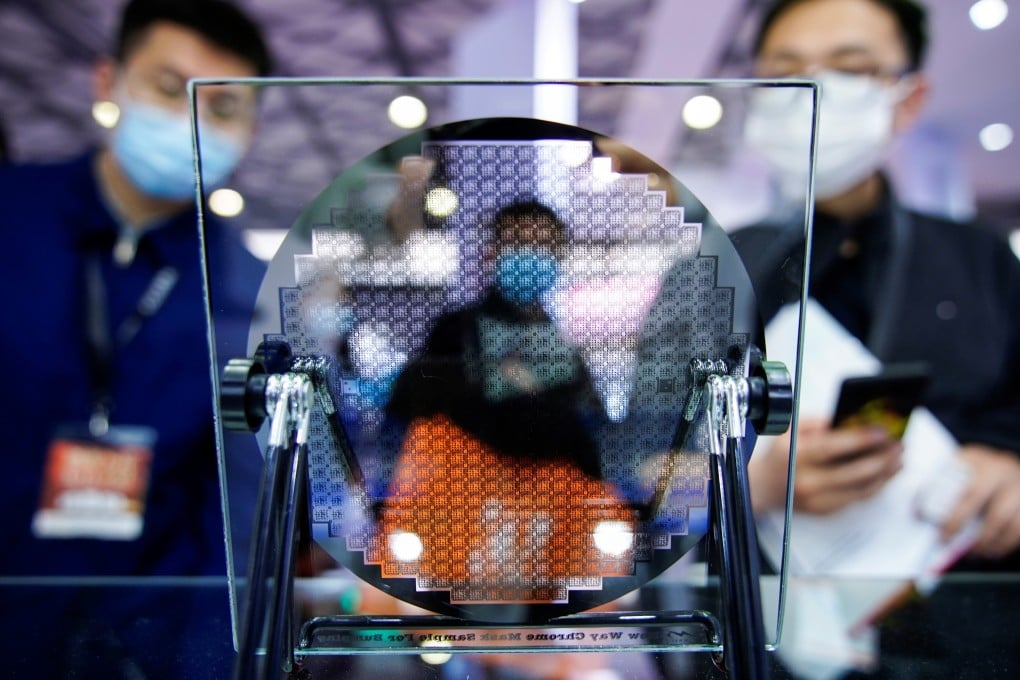

China’s semiconductor expansion raises risks of overcapacity, inefficient investment, Moody’s warns

- Small domestic semiconductor companies are likely to face high credit risk resulting from potential overcapacity in less sophisticated chips

- State-led investment efforts, according to the Moody’s report, have led to overcapacity issues in other industries in the past

Reading Time:2 minutes

Why you can trust SCMP

7

China’s semiconductor industry expansion efforts may raise the risks of overcapacity and investment inefficiency, hurting the country’s goal to become self-sufficient in this hi-tech field, according to a report from credit rating agency Moody’s on Monday.

“The government’s semiconductor industry investment plans could lead to fierce competition, resulting in overcapacity of certain types [of chips], starting with less sophisticated products,” the Moody’s report said. “Overcapacity is a particular risk at the fabrication stage as a result of the large amount of capital spending needed to set up fabrication plants.”

It said small domestic semiconductor companies, with less government support than larger firms, are likely to face high credit risk resulting from potential overcapacity in less sophisticated chips. The number of newly registered semiconductor companies in China more than tripled in the first five months of this year from the same period in 2020.

Advertisement

Potential overcapacity is likely to expose these small firms to refinancing risks from large debts because of “high price volatility, low profit margin and operational inefficiencies”, the report said.

Advertisement

Moody’s assessment indicated how state-led investment efforts have led to overcapacity issues in other industries in the past.

In the early 2010s, for example, huge global demand for solar photovoltaic equipment, accompanied by loose domestic regulations, led to irrational expansion of China’s solar sector, according to the Moody’s report. That “resulted in overcapacity, price declines, a collapse in profit, and consequently, high leverage and bankruptcies in the domestic solar sector”, it said.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x