China technology funding hits record high on boom in semiconductors, health care amid tech war, Covid-19

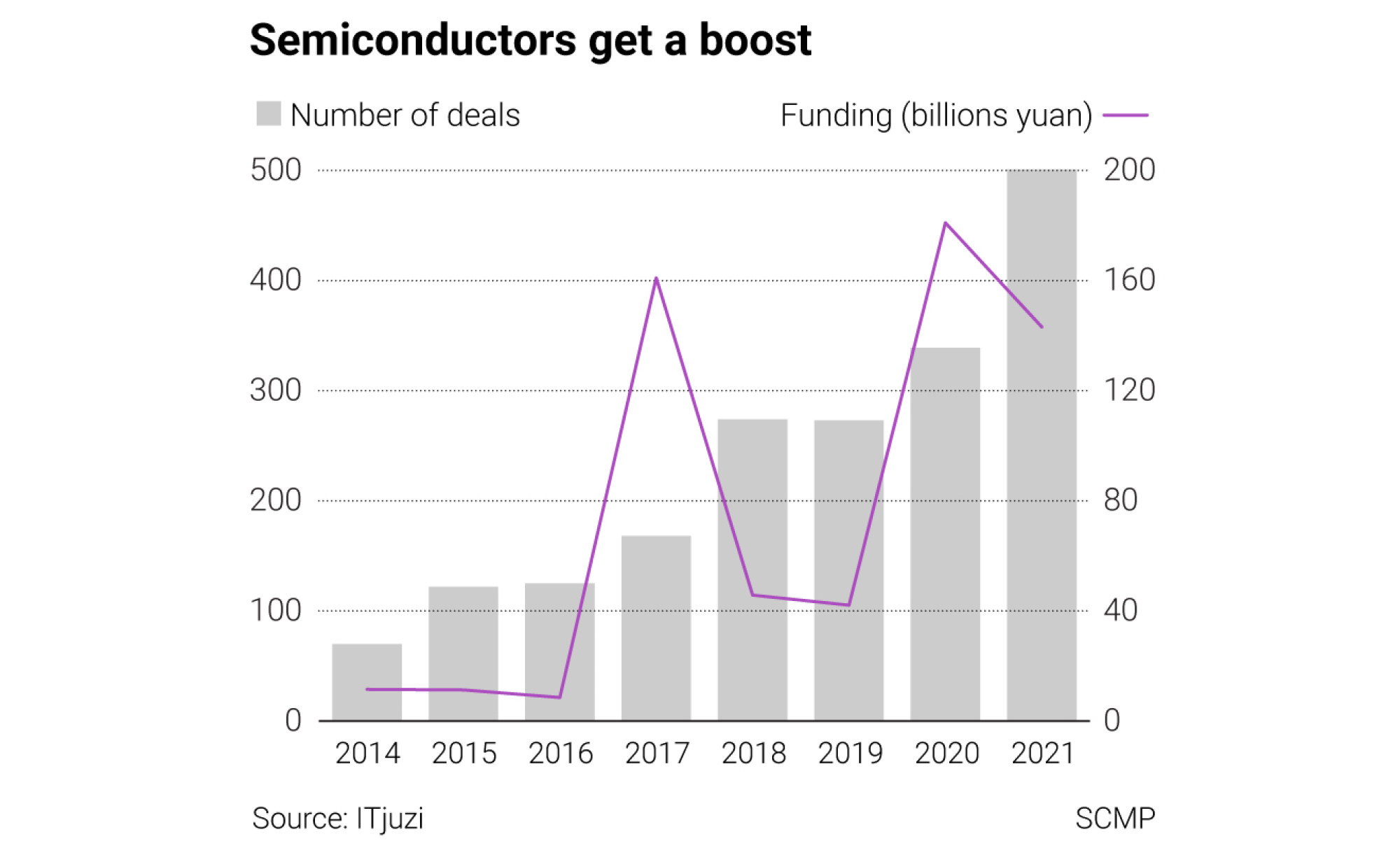

- Start-ups involved in semiconductors, the core components that are in short supply globally, raised US$22.5 billion last year across 501 deals in China

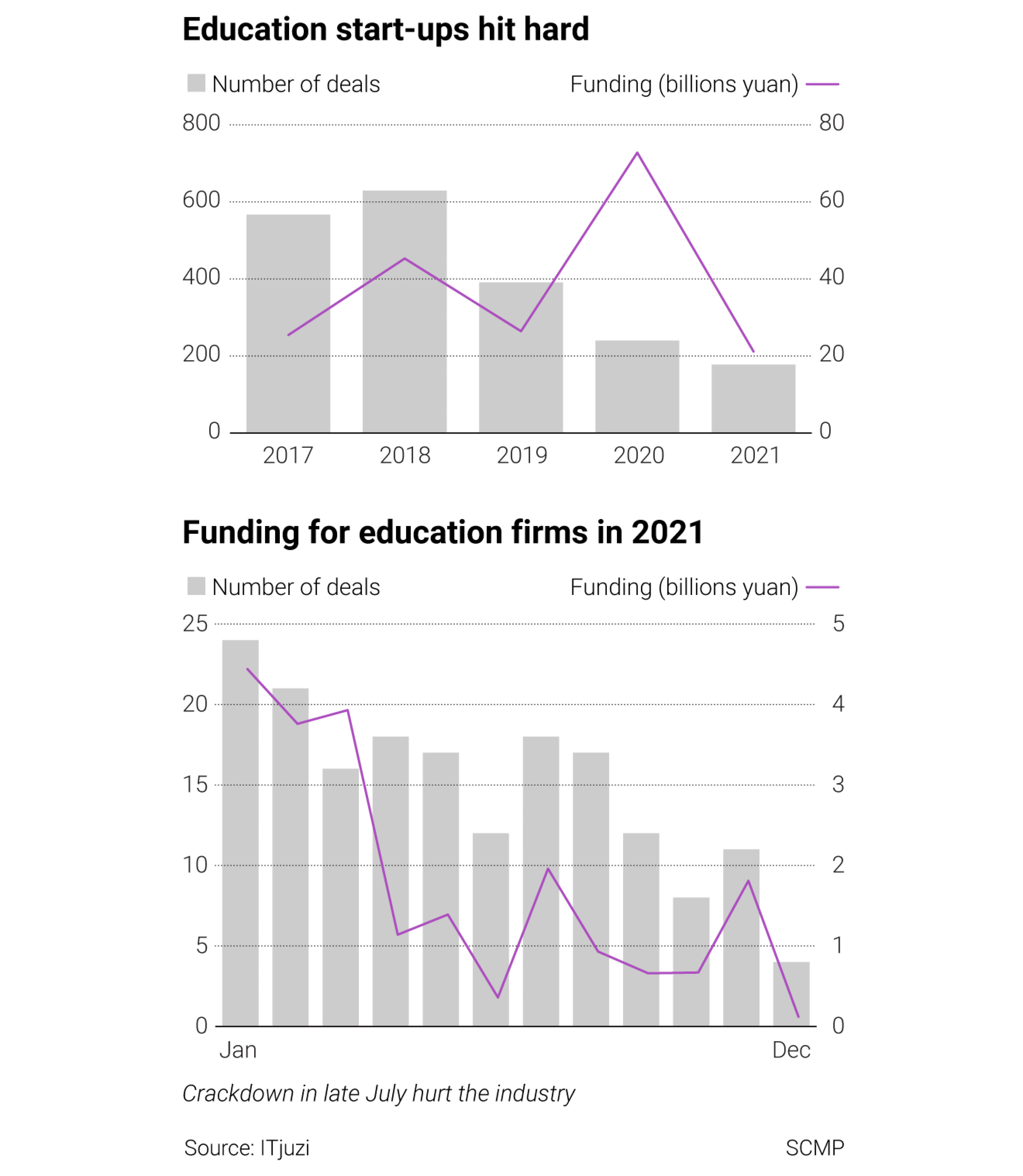

- The education technology sector, which enjoyed a boom when Covid-19 lockdowns popularised remote schooling in 2020, raised only US$3.3 billion in 2021

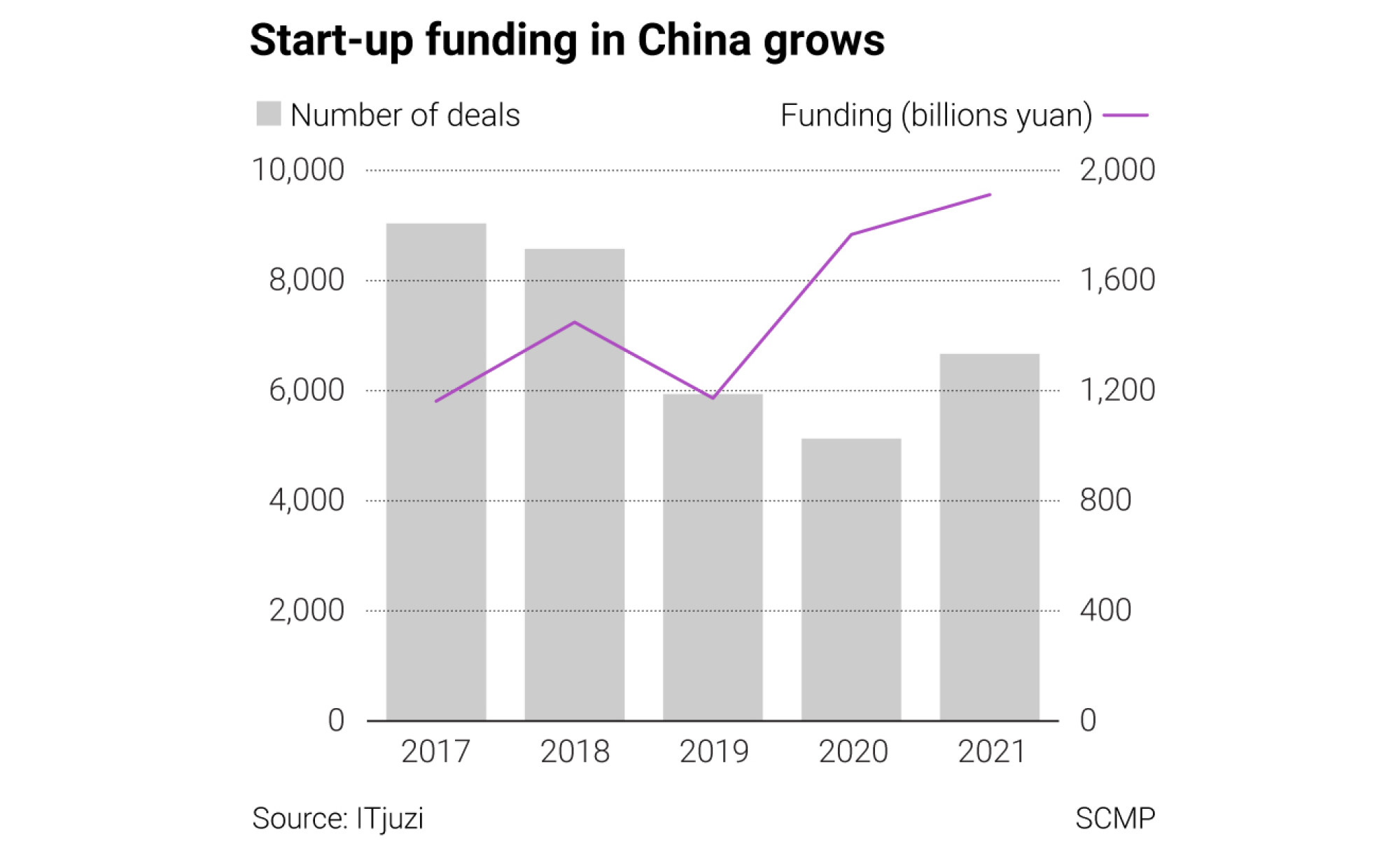

Funding for Chinese start-ups hit a record high last year, boosted by investments in semiconductors and health care amid a tech war and ongoing Covid-19 restrictions, while the internet and video gaming sectors fell out of favour after Beijing’s harsh regulatory crackdown.

Total funding for private sector firms in the “new economy” – a term that covers 21 sectors mostly in hi-tech and the internet – totalled 1.89 trillion yuan (US$296 billion) in 2021, up 6.6 per cent from the year before, according to Beijing-based market researcher ITjuzi.

China venture funding hits record US$131 billion despite crackdown

Geopolitical tensions between Beijing and Washington over the past two years, which has seen dozens of Chinese companies restricted from doing business with American tech suppliers, has given China the urgency to cultivate self-made chip makers.

Funding for semiconductor start-ups was relatively modest before 2020, with total investments of 42.1 billion yuan and 45.7 billion yuan in 2019 and 2018, respectively, ITjuzi data showed.

Health care was another industry that saw strong growth in funding, up 27 per cent year on year to 330.9 billion yuan in 2021.

“Most of the capital went to hard tech such as health care and semiconductors”, said Liu Xiaoqing, an analyst at ITjuzi.

“Funding for the internet sector is winding down,” she said. “The trend is highly related to how [government] policy encourages new infrastructure while regulating the internet platform companies.”

Funding for e-commerce companies last year was 103.8 billion yuan, the second consecutive year of negative growth, and well below the peak of 170 billion yuan in 2014.

Video gaming companies raised only 13.6 billion yuan in 2021, up 28 per cent from the year before, but a steep drop from the 33.5 billion yuan in 2019, according to ITjuzi.

The education technology sector, which enjoyed a boom when Covid-19 lockdowns popularised remote schooling in 2020, raised only 21.2 billion yuan in 2021, a significant drop from 72.8 billion yuan the year before.

ITjuzi’s Liu said that overall investment in the new economy would be more active this year, especially in sectors that “are strategically new industries that innovate on business models, operation concepts or drive technology development”, such as information technology, health care, new energy and new materials.