Samsung to invest US$3.3 billion, produce new chip parts in Vietnam amid China’s concerns over US-led semiconductor alliance

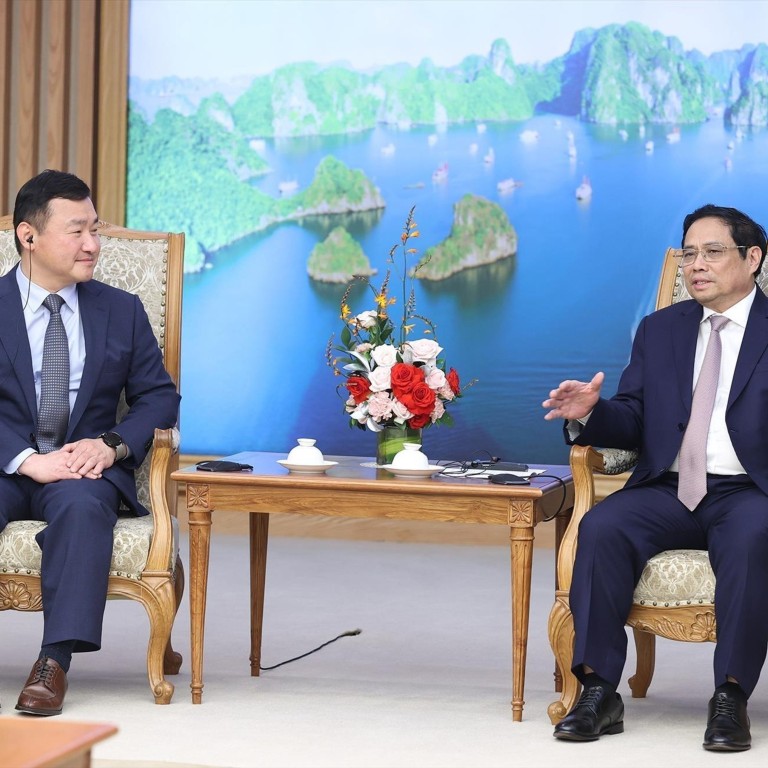

- Samsung president Roh Tae-moon discussed the new investment and other initiatives in Vietnam with Prime Minister Pham Minh Chinh last Friday

- The firm is preparing trial production of its flip-chip ball grid array, used for semiconductor packaging, at its Samsung Electro-Mechanics complex

“Relevant government agencies will study and discuss the issue in a way to preserve national interests,” Yoon said. “People don’t have to worry about it too greatly.”

South Korea plays down concerns over move to join US-led chip alliance

Yoon made the statement after Seoul reportedly informed Washington of its intention to take part in the preliminary meeting of the Chip 4 Alliance.

South Korean Foreign Minister Park Jin is also expected to make his first visit to China on Monday, as Seoul seeks to reassure Beijing about their long-standing ties.

Samsung, meanwhile, said total exports from its Vietnam operations reached US$34.3 billion in the first half of this year, up 18 per cent over the same period last year, to make up nearly 50 per cent of its 2022 export target of US$69 billion from the Southeast Asian country.

In February this year, Samsung invested US$920 million to expand its production capacity in Vietnam, where it already makes printed circuit boards, camera modules and about 50 per cent of its global smartphone output.