How China’s reputation as the world’s smartphone manufacturing hub is being shaken by plunging confidence at home

- A prolonged cooling of China’s smartphone market is sending shivers across supply chains as factories face cutbacks in production orders

- Analysts say makers of display and camera modules are under particular pressure, as smartphone clients clear inventory.

Few industries more exemplify China’s central role in global supply chains than smartphone manufacturing: in 2021, for every three smartphones produced in the world, two were made in China.

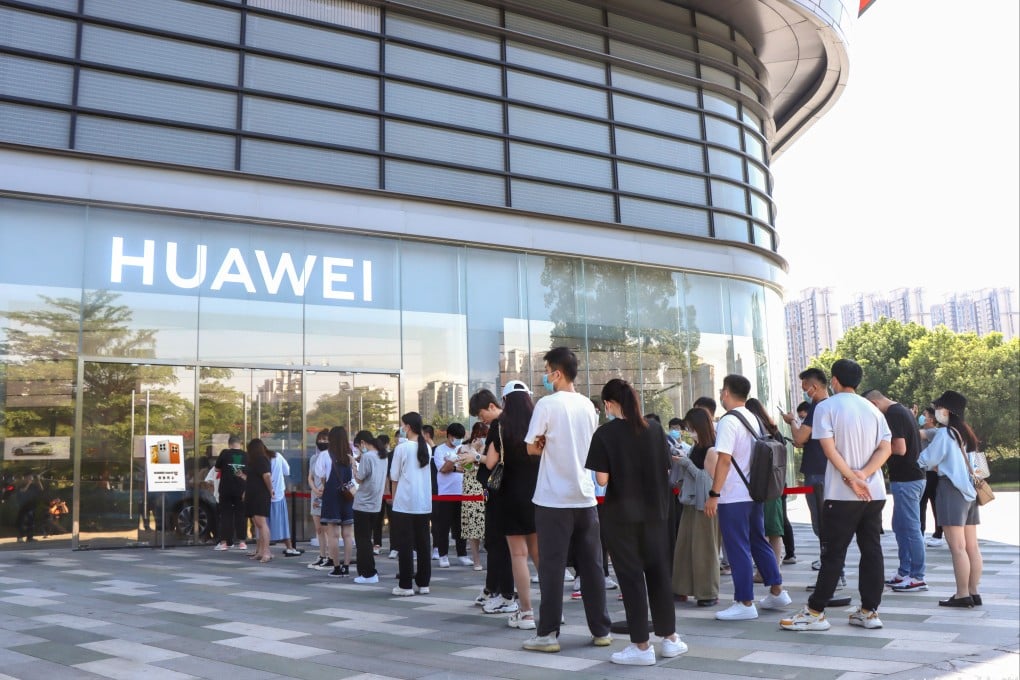

China is also the world’s single largest smartphone market – one out of every four phones sold last year was bought by a consumer in China, giving local brands such as Xiaomi, Huawei Technologies Co, Oppo and Vivo a big home market in which to grow first before venturing overseas to take on the likes of Apple and Samsung Electronics.

But a prolonged cooling of China’s smartphone market is sending shivers across supply chains as factories face cutbacks in production orders and local smartphone brands struggle to convince consumers to buy their latest models amid an economic downturn.

The usual buzz around smartphone brands and suppliers has faded, according to an executive at a handset supplier in southern China’s Guangdong province, with clients now making very conservative estimates about upcoming orders after reviewing forecasts for the year ahead.

“Now we don’t know how many [handsets] we are supposed to produce for the next month until the last minute, since our clients have no clarity on how many they can sell either,” said the executive, who declined to be named as he is not authorised to talk with the media. “Their forecasts now are purely symbolic, and it really depends on how consumption power will change under future Covid-19 policies.”