Explainer | What are virtual assets in Hong Kong and what do the city’s new rules mean for crypto trading?

- New rules on virtual assets are expected to apply to cryptocurrencies but not government-issued digital currencies and limited use tokens

- By creating a new asset class, Hong Kong is aiming to reclaim its status as Asia’s crypto hub while addressing concerns in the wake of the FTX crash

Hong Kong is poised to approve its biggest overhaul ever to cryptocurrency regulation in its bid to become a hub for the virtual asset (VA) market. These assets have so far been outside existing regulatory regimes in the city, as they do not qualify as securities under local law.

While the term on its own may sound vague, the SFC has something very specific in mind when it talks about these assets. Here is a look at precisely what the SFC will be regulating and what the changes mean for crypto trading in Hong Kong.

What does Hong Kong mean by virtual assets?

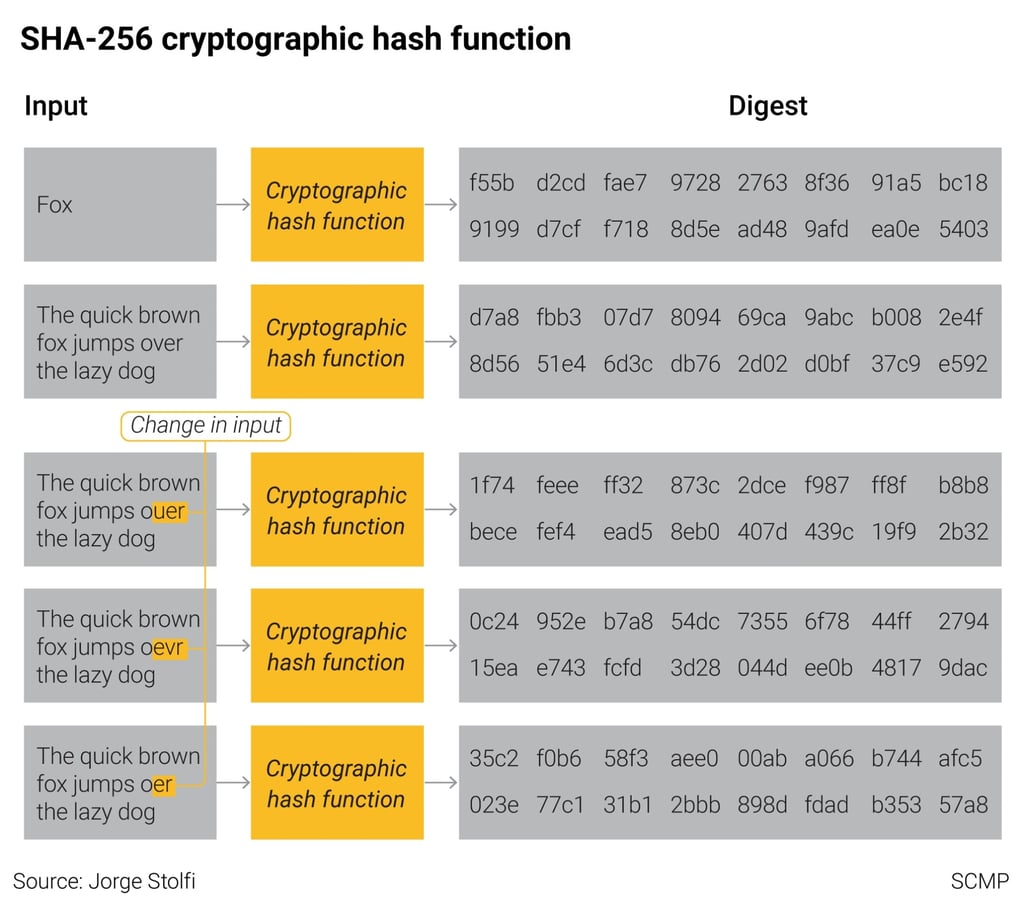

At the most basic level, Hong Kong defines a virtual asset as “a cryptographically secured digital representation of value”.

This is one of several attributes that the government specifies in its definition included in the amendment to the city’s anti-money-laundering law. While the document does not mention blockchain, this technology is widely understood to be the primary means of securing digital asset ownership by using cryptographic signatures on a public ledger.

This means that many NFTs and similar digital products could fall under the purview of the SFC once the amendment is passed. However, there are exceptions that could offer carve-outs for certain types of digital goods.

The amendment specifies that a virtual asset must either be used as a medium of exchange – whether for buying goods, discharging debt or investing – or provide the ability to vote on the management of affairs related to such assets. The latter point suggests that tokens granting rights for the governance of decentralised autonomous organisations (DAOs) also qualify as virtual assets even though they are not used as a medium of exchange.