Coming to America: Huawei aims to make a big splash in Apple’s home market

China’s largest smartphone brand takes a major leap forward at this week’s CES trade show in Las Vegas, as it woos US consumers away from main rivals Apple and Samsung

More than five years since a US Congressional investigation named it a national security threat, Huawei Technologies, the world’s largest telecommunications equipment maker, is set to relaunch in America as a major smartphone brand, backed by one of the country’s biggest mobile network operators.

Huawei is widely expected to introduce mobile carrier AT&T as its partner at the annual CES trade show in Las Vegas this week, enabling the Shenzhen-based company to bring its branded smartphones across the US for the first time to compete against popular devices from main rivals Apple and Samsung Electronics.

AT&T had about 153 million total wireless subscribers in the US and Mexico as of the third quarter of last year, which may provide a solid starting point for Huawei’s expansion plans in North America.

Still, making a big splash with consumers in the world’s third-largest smartphone market is likely to be a tough task for privately-held Huawei.

“So far, the biggest obstacle for Huawei had been to position itself as a world-class smartphone brand, like Apple or Samsung, that can independently survive and sell on the store shelves of mobile carriers,” Counterpoint Research director Neil Shah said in an interview.

“Huawei has come a long way in building an attractive [product] portfolio, but it will have to spend a lot on marketing to convince US consumers to warm up to its brand.”

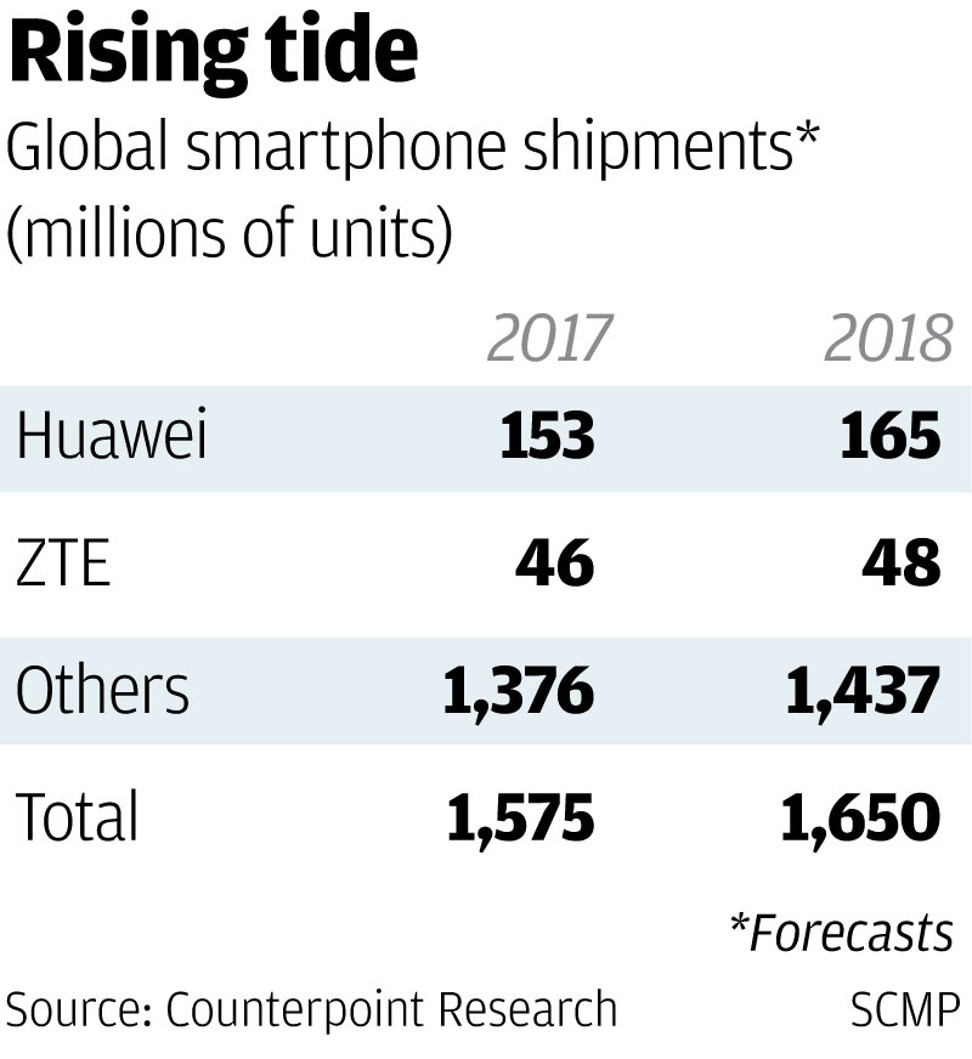

China’s biggest smartphone brand is forecast to ship 165 million handsets – including devices from its Honor sub-brand – around the world this year, up from an estimated 153 million last year, according to Counterpoint.

It predicted total smartphone shipments worldwide to achieve modest growth this year to 1.65 billion units from 1.57 billion last year.

“Huawei feels the US is important because it is one of the few markets globally that is expected to sustain a decent volume in the premium segment of the smartphone market, despite overall industry growth slowing,” said Ryan Reith, a vice-president at technology research firm IDC.

Samsung and Apple, which IDC ranked as the world’s two largest smartphone suppliers by shipment volume in the third quarter of last year, currently dominate the mid to high-end smartphone segments in the US.

So penetrating the US market would be a critical step forward for third-ranked Huawei to be more competitive against those two brands, according to Reith.

He said Huawei will have to ensure that it has good deals in place in terms of distribution, marketing and sales push in the US.

That strategy has already helped Huawei’s consumer business group, led by chief executive Richard Yu Chengdong, to become the company’s fastest-growing unit.

It estimated the consumer business group, which covers smartphones and tablets, to have posted 236 billion yuan (US$36.3 billion) in revenue last year, up 30 per cent from 2016.

That contributed nearly 40 per cent to the projected 600 billion yuan total revenue of Huawei the past year, which was still led by its carrier network equipment business.

Huawei last month ratcheted up its efforts to take the lead in setting the direction of the smartphone market by forging an artificial intelligence (AI) alliance with Chinese internet search giant Baidu.

Their goal is to foster a new mobile and AI ecosystem by leveraging Huawei’s advanced system-on-a-chip platform and Baidu Brain, a compendium of the company’s growing AI assets and services.

Research firm Gartner last week predicted that 80 per cent of smartphones that will be shipped by 2022 will have on-device AI capabilities.

“Your smartphone will track you throughout the day to learn, plan and solve problems for you,” said Angie Wang, a principal analyst at Gartner. “It will leverage its sensors, cameras and data to accomplish these tasks automatically.

Such an advanced smartphone, for example, can order a vacuum bot to clean when the user’s flat is empty, or turn a rice cooker on 20 minutes before the user arrives home.

Huawei’s Yu said the company’s plans with Nasdaq-listed Baidu, which has been rapidly transforming itself into an AI-first company, will involve integrating natural language and image-processing technologies into future generation of advanced smartphones.

In September, Huawei introduced its Kirin 970 chip to provide built-in AI capabilities on its new flagship smartphone, the Mate 10.

Yet optimism about Huawei’s US foray is likely to be tempered by the amount of baggage that the company must deal with in that market.

Huawei and mainland rival ZTE Corp had faced the prospect of getting kicked out of the US in 2012, following a House of Representatives intelligence committee report that said both companies posed as threats to national security because of their ties to the Chinese government.

While they caught a break after a favourable White House review, Huawei and ZTE’s carrier network businesses in the US have been moribund since then.

“ZTE has moved from completely operator-branded handsets four years ago to co-branded and now its own brand, with the ZTE logo clearly visible on each device,” he said. “It has captured double-digit market share in the US since the fourth quarter of 2016.”

Should Huawei eventually gain support from multiple US mobile carriers and successfully launches flagship-level smartphone, Shah said the company could be able to seize market share away from Lenovo, LG Electronics or even Samsung this year.

“The following year could be the inflection point for Huawei to push a higher volume of mid- to high-tier devices in the US with various carriers,” he said.