Fintech start-up Curve has a new feature that processes your business expenses for you

The start-up believes it could allow businesses to contribute £7.2 billion (US$9.6 billion) more to the U.K. economy

By Ryan Browne

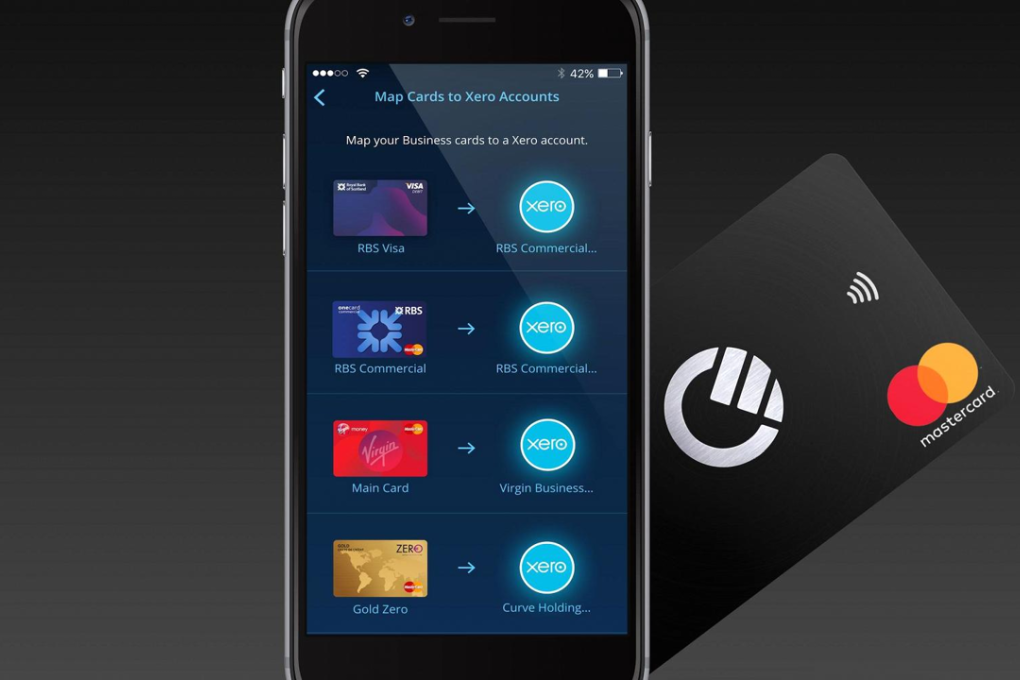

Fintech start-up Curve will now let users claim business expenses across multiple bank cards through its app.

The London-based firm’s app allows its users to link all of their bank cards to one contactless MasterCard. Curve said it hopes to automate the tedious process and remove any friction associated with business expenses. It is predominantly targeted at small business owners and the self-employed.

Curve said Monday it would add online accounting software developer Xero to the app, meaning users will now be able to claim business spending across all their accounts.

“Everyone hates doing their expenses. It’s a tedious, manual job that takes up too much time. But it doesn’t have to be that way. Now, Curve will do the job for you, regardless of the bank you use,” Arthur Leung, product lead at Curve, announced Monday.

“Instead of wasting one day a month on business expenses admin, just connect your cards to a Xero account through the Curve app, and Curve will do your expenses for you. It’s effortless.”