China’s bike-sharing unicorns may be forced to merge with rivals to ensure survival

Bike-sharing became a hot sector in China after investors pumped billions into start-ups, but competitors face a stark choice as the money begins to dry up

During its first year in business, Bluegogo carpeted China’s major cities with more than 600,000 bicycles, catapulting it to No. 3 among the country’s bike-sharing firms.

About 20 million people signed up to rent a bike for the equivalent of a few US cents per hour. The Tianjin-based start-up received more than 400 million yuan (US$60 million) in venture capital funding before it went belly-up. Bluegogo’s offices are shut, the founder Li Gang has yet to speak to media about the closure, and questions remain over the rider deposits placed with the company.

From its peak of about 100 companies offering similar services, there are now just three major providers with deep-pocketed investors that can potentially survive another price war.

“The gold rush is over,” said Shi Rui, an analyst with Beijing-based consultancy iResearch. “Smaller companies won’t survive unless they get more funding. As investors become more cautious, merging with a well-capitalised bigger player can increase their chances of survival.”

For the investors of Mobike, Ofo and Hellobike, the three biggest bicycle-sharing firms still standing, the critical question remains: do they merge with a rival to gain scale and cut costs, or sink more money in the hope of outlasting each other in a ruinous race.

Shareholders in Ofo and HelloBike declined to comment when contacted and Bluegogo’s main phone line has been disconnected.

The most recent example of merging for scale is HelloBike, which earlier in December announced it had raised US$350 million from investors including Alibaba affiliate Ant Financial, one month after its merger with Changzhou Youon Public Bicycle System. The funding is the first high-profile financing round since Ofo raised US$700 million in July, while media reports this week said the company has secured an additional US$1 billion, though Ofo declined to comment.

Alibaba owns the South China Morning Post.

The merger and much-needed capital injection has immediately pumped life back into China’s third largest bike-sharing player, despite HelloBike’s eight million active users lagging far behind Mobike and Ofo, which each have about 35 million.

Wang Huie, an analyst with Analysys, said the industry has reached a stage of “deep consolidation”. “There is a strong possibility that a merger will happen among the top three players, namely Mobike, Ofo and HelloBike,” she said.

Once dubbed “Uber for bikes”, China’s bike-sharing industry is actually quite different from the car ride-sharing business model. Neither Uber or its Chinese equivalent Didi Chuxing own their fleets of vehicles, instead they use apps to connect consumers needing a lift to drivers who are available. But companies like Ofo and Mobike have had to purchase tens of millions of bicycles, not to mention paying for the labour cost of staff to do maintenance and repair of the bikes.

Yet for users, the cost of a ride is a pittance – about one yuan, or 15 US cents, for an hour – with much cheaper deals available. In a recent promotional campaign to lure riders from its competitors, Mobike offered unlimited rides for three months for only five yuan. Rival Ofo has a similar incentive scheme.

Despite the unattractive economics, Jeffrey Towson, an investment professor at China’s elite Peking University, said bike sharing is “definitely not a fad”.

“The economics of the business are becoming clearer. Rental revenue is still the foundation. Advertising revenue may be part of the picture,” he said. “Some Ofo bikes, for example, have had Minions advertisements on them. And perhaps delivery and e-commerce revenue will come in the future.”

While Towson is bullish on the industry’s business prospects, he is not confident that more than a couple of companies can peacefully coexist.

“If it was in the United States, I think it could end up as giants with many smaller players coexisting. But there seems to be a Chinese phenomenon to eliminate the competition by taking over the entire industry,” he said.

One example in the car hailing business was the fierce rivalry between Didi Dache and Kuaidi Dache. In 2015 they merged to form Didi Chuxing, which absorbed Uber China the following year, becoming the only dominant player in the mainland Chinese market.

“Investors tend to step in to stop a price war because it is their money. It is better to spend the money on growth than fighting each other,” Towson said.

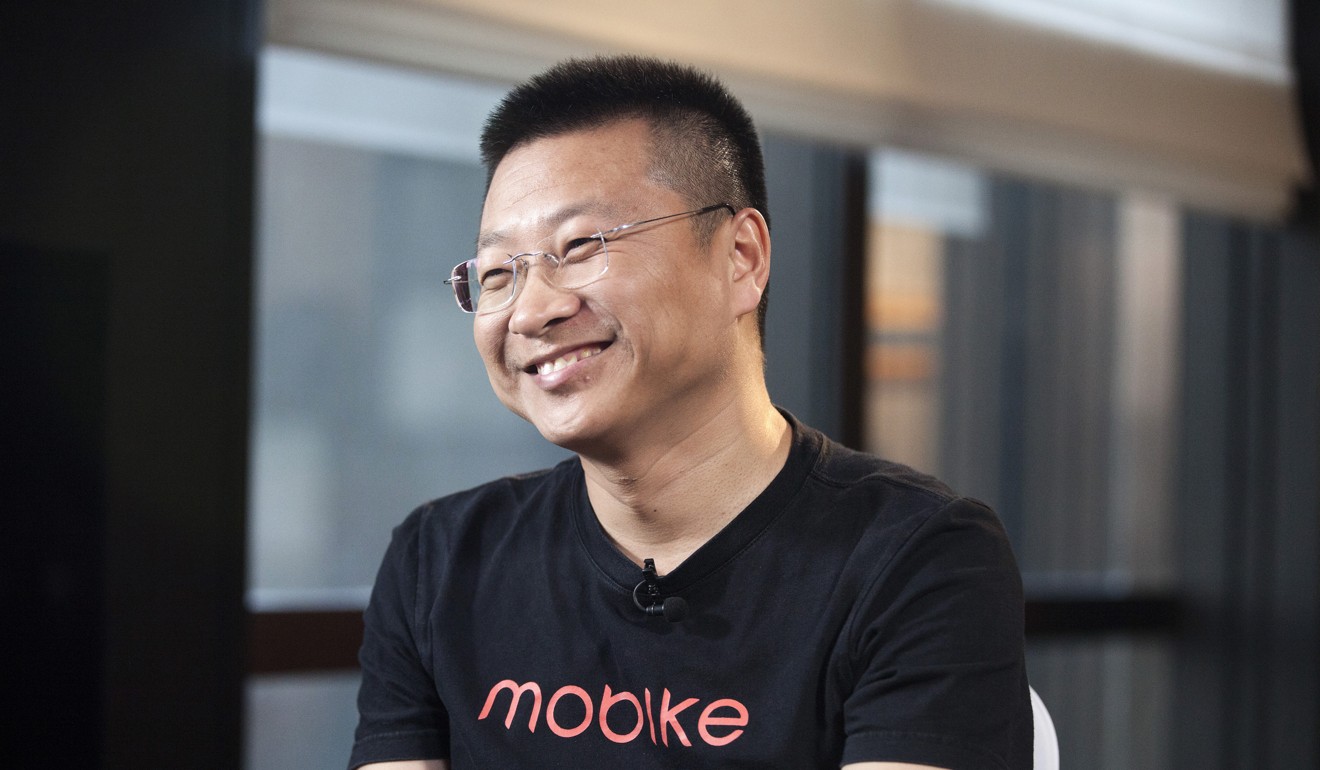

Bloomberg first reported in October that Ofo and Mobike were in merger talks, but neither company would confirm the speculation. In November Zhu Xiaohu, a tech sector venture capitalist and early investor in Ofo, called for such a merger during a forum attended by Mobike co-founder Hu Weiwei.

Despite pressure from investors, there is no sign that the two bike-sharing giants will merge any time soon. Ofo is raising another US$1 billion from investors, including Alibaba, and is expected to put any proposed merger plan with Mobike on hold, according to a number of news outlets, citing market sources. Ofo has declined to comment.

“The merger of Ofo and Mobike is going to be a big topic of discussion in 2018,” Towson said. “But [whether it happens] depends on the availability of capital … and in China there is a lot of capital.”