Wrestling for access: how China, US firms are navigating technology’s separate universes

With two technology universes – one inside and another outside China’s Great Firewall – tech companies are dividing their products in order to conquer

Chinese tech companies have cultivated a technology universe so large that it exists almost exclusively on its own – sustained by the country’s 1.4 billion people – but cut off from the rest of the world by Beijing’s Great Firewall which blocks content not approved by the government.

Outside the firewall, a parallel internet ecosystem exists where companies banned in China, like Facebook, Google and Twitter, market their products to the remaining six billion people on the planet.

Protected from foreign competition, Chinese companies like Tencent and Baidu have flourished, attaining market valuations that rival global firms like Facebook. But the strong growth of China’s closed technology ecosystem means that US companies wanting to enter the massive market or Chinese ones going global now have to offer two sets of products – one geared for the rest of the world, and another specifically for China.

Wow Way or Huawei? A readable Chinese brand is the first key in unlocking America’s market

“There are very specific requirements for driving autonomous cars in and outside China,” said Daniel Kirchert, Byton’s co-founder and chief executive. “In China, we definitely need partners with the China experience. But outside China, we will work with global partners.”

The Nanjing-based carmaker has teamed up with Amazon’s Alexa for voice control, but plans to work with a local company for the Chinese model, Kirchert said. Currently, Byton is working with Baidu on the latter’s autonomous driving system Apollo, although Kirchert declined to reveal if Byton will be powered by Apollo in China.

How the mainland went from ‘Made in China’ to ‘Created in China’

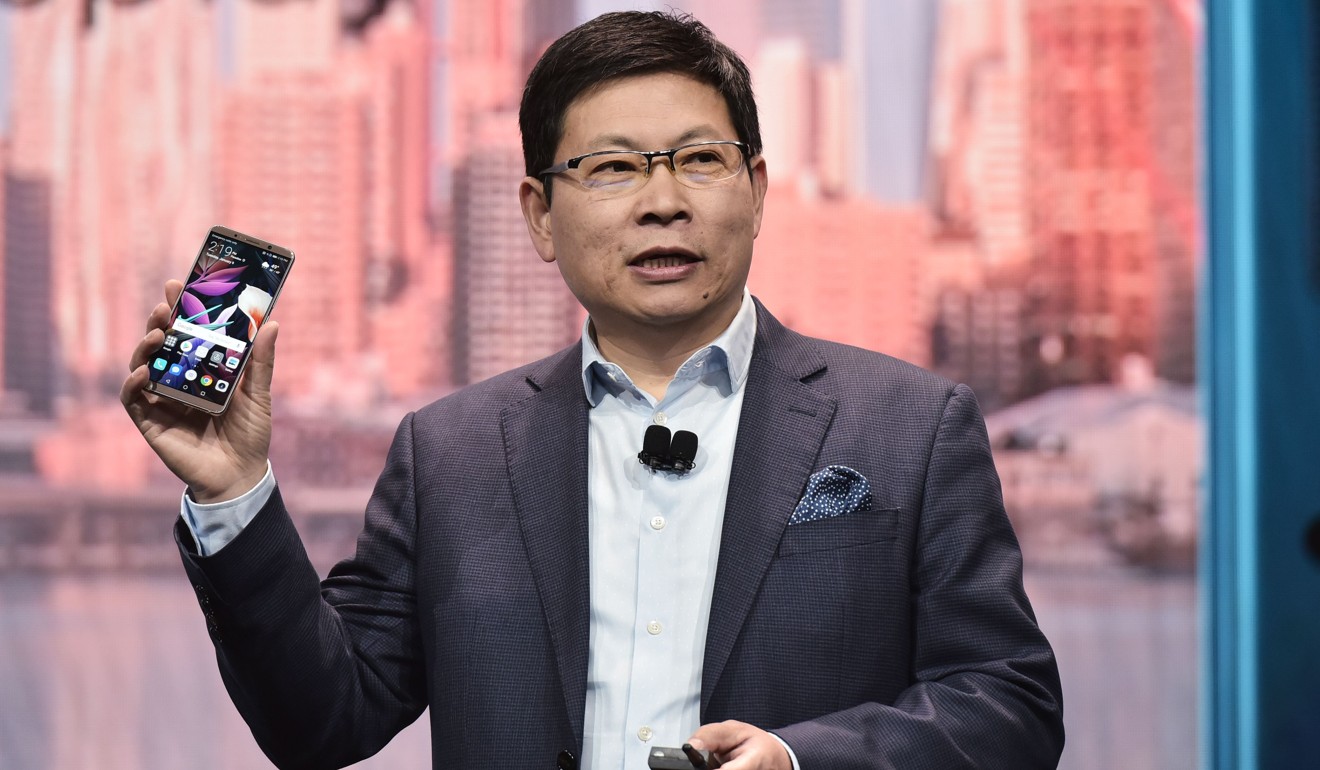

“[China and US] devices have different partners because we want to optimise the user experience,” said Osman Hsieh, senior retail manager of Huawei’s Consumer Business Group.

“Apps like Google, Gmail or YouTube [on the US version of the Mate 10] are not going to work in China.”

Collapse of Huawei deal with AT&T ‘will threaten China-US trade ties’

“The timing is probably coincidental but security concerns are behind the failure of both deals. It doesn’t help that the Chinese market is largely closed to Western companies when domestic alternatives exist,” said Kirk Boodry, an analyst with New Street Research.

Ant Financial’s Moneygram deal a victim of ‘quite difficult’ political environment, say analysts

Ant Financial is an affiliate of Chinese e-commerce giant Alibaba Holdings, owner of the South China Morning Post.

The increasing difficulty for Chinese and US companies to break into each other’s markets has forced both sides to adapt and change as they look to appeal to one another.

For many Chinese technology companies with ambitions to become global, the first step often is to play down their roots, or at least not advertise them.

One such exhibitor at CES, Hangzhou-based smart-home robotics provider Rokid, is branding itself so that its products appeal to both Chinese and US consumers.

At CES, the company’s smart speaker, home robot and mixed reality glasses were displayed on minimalist, Scandinavian-style wooden tables, and the booth was designed tastefully in white. Apart from the Chinese staff at the booth, there was little sign that the company was from China.

“From the start, Rokid wanted to build an international company and go global, so we don’t want to be recognised as just a traditional Chinese company, a Chinese-only company,” said Reynold Wu, Rokid’s director of products. “It’s a matter of how you brand yourself to the world, to the industry.”

Makeblock, an educational tech robotics start-up based in China’s hi-tech hub of Shenzhen, was another company that showed little signs of its Chinese origins at CES. About 70 per cent of Makeblock’s revenue comes from outside China, mainly from European countries. Currently, the US makes up 15 per cent of Makeblock’s business, but the start-up aims to double its sales this year, according to the company.

Zuckerberg-backed US school teaches coding with robotics kits designed by Chinese farmer’s son

“I think that it is good to almost disguise the company so you can’t tell where it’s from … people have a sense of recognition with brands that they feel are part of their community,” said Patrick Boyle, a marketing manager with Makeblock in the US.

“Every culture and market is different and has different demands. If you’re in Japan, you’d want to look like a Japanese company, and if you’re in Europe you’d want to look like you’re a company from Europe.”

The real competitive battleground for US and Chinese companies will be emerging markets

More Chinese start-ups are becoming international because many of the founders were born in the 1990s and have a more global mindset, said Antonio Wang, associate vice president of client system research at IDC China.

“But even as internationalisation takes place, there’s a need to strengthen the Chinese elements to build a new generation of China brands,” Wang said.

Similar to their Chinese counterparts, US companies wanting to tap the mainland Chinese market are making adjustments to meet local tastes and regulations.

William Carter, deputy director and research fellow of technology policy at the Centre for Strategic and International Studies (CSIS), a Washington DC-based think-tank, said both the US and China are building an “expansionary presence [in technology] across the world, targeting other markets”.

Opinion: Sino-US collision must be avoided at all costs

“The landscape of doing hi-tech businesses in each other’s market is changing, and may get more difficult,” Carter said. “US companies operating in China are watching nervously as to how the Chinese authorities will react to [Huawei and Ant Financial’s failed deals], and are concerned about a retaliatory approach.”

New Street Research’s Boodry echoed this sentiment, stating that he does not expect “reciprocal market entry in tech at all” for China and the US.

“The real competitive battleground for US and Chinese companies will be emerging markets,” Boodry said.