Li Ka-shing-backed fintech company embraces market downturn as ‘good timing’

MioTech provides an investment management platform powered by artificial intelligence to help asset managers make better-informed decisions

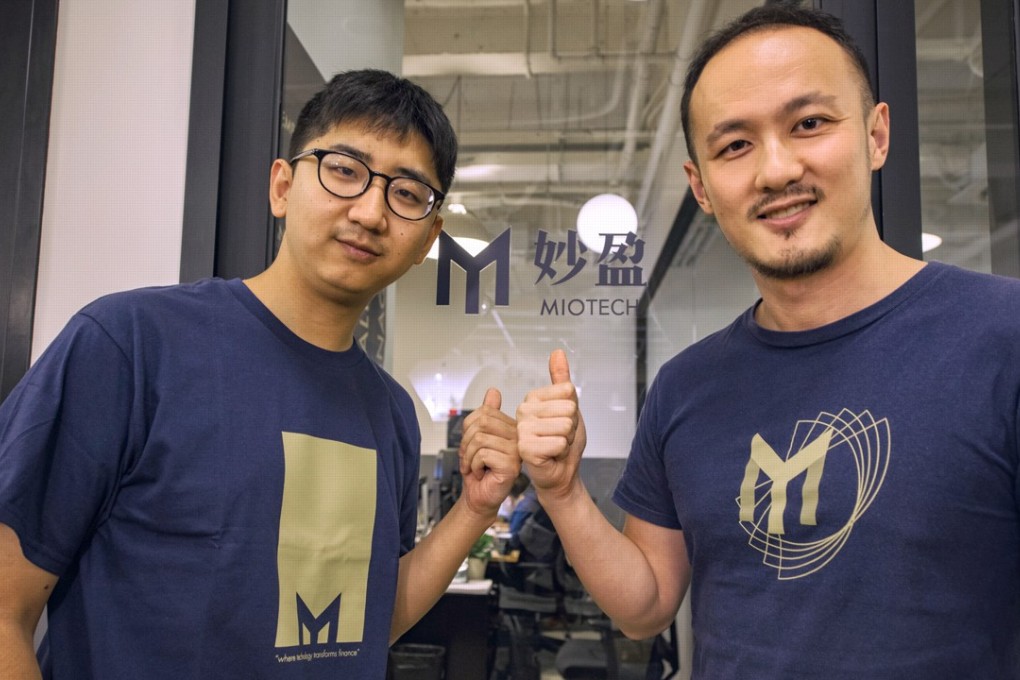

The recent volatility in China’s stock market may be the “good timing” that financial technology companies need to sharpen their focus on new business opportunities, according to Jason Tu Jianyu, co-founder and chief executive of start-up MioTech.

“When the market experiences a downturn, everyone is thinking about ways to technically differentiate themselves from their peers,” Tu said on Thursday on the sidelines of Google’s Demo Day in Shanghai, where MioTech was among 10 start-ups to make presentations. “Financial institutions in the Chinese mainland used to emphasise distribution and earning a quick bucks in the old days.”

Those institutions are now giving increased attention to data analytics, he said.

That trend has caught on amid China becoming one of the worst-performing stock markets in the world, with its benchmark Shanghai Composite Index plunging 15.4 per cent for the year to date on Friday.

Tu said there are not many data aggregators in China, compared with markets overseas. That means the potential “will be huge for AI-empowered data crunching and analysis” in the domestic market, he said.