Sequoia’s Neil Shen tops the list of China venture capital investors according to CB Insights ranking

- Although China VC investment reached a record high in 2018 the market has since cooled amid a slowing economy and tighter regulation

Now that China has become land of the unicorns, home to nearly 200 unlisted start-up companies valued at US$1 billion or more, competition is rising for who can be crowned the most visionary venture capital investor.

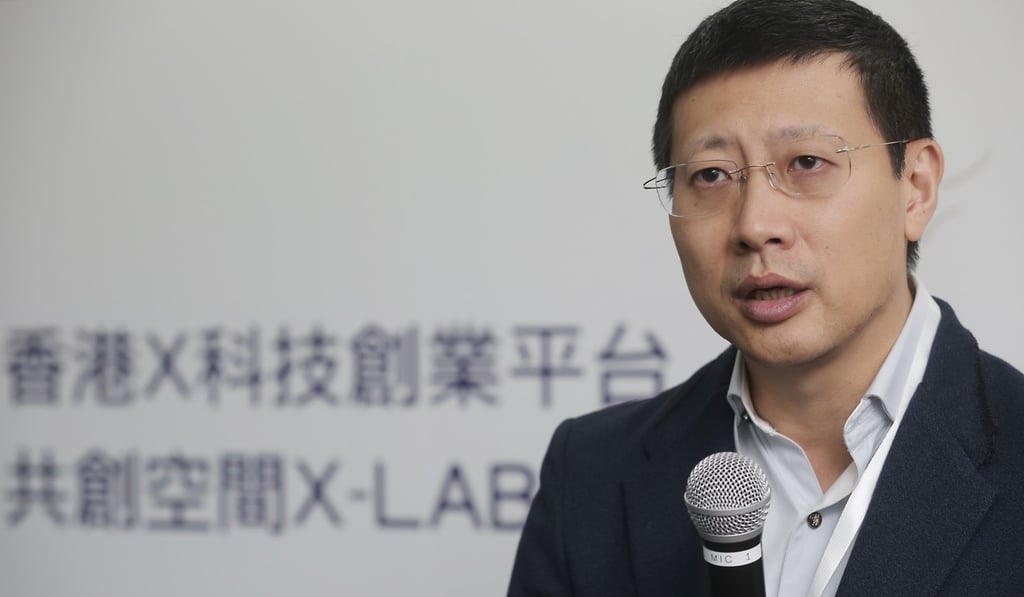

Taking the award for 2019 is Neil Shen, founder and managing partner of Sequoia Capital China, according to a ranking by research agency CB Insights.

Shen’s Sequoia, which has previously invested in e-commerce giants Alibaba Group Holding and JD.com, has invested in about 50 unicorn start-ups, including ride-hailing platform Didi Chuxing and drone maker DJI, which remain privately-owned and are currently valued at about US$60 billion and US$20 billion respectively.

Sequoia Capital China also provided strategic capital to Chinese food delivery service platform Meituan Dianping and e-commerce operator Pinduoduo, which completed initial public offerings in Hong Kong and the US respectively in 2018.

Although China VC investment reached a record high of US$70.5 billion in 2018, according to an analysis by global accounting firm KPMG in February, the market has since cooled amid a change in sentiment. Both the value and number of deals dropped more than 60 per cent year on year in January 2019, according to data from China-based researcher Zero2IPO. Many analysts see this as a necessary correction though amid tighter regulation and slowing economic growth.