Ten Chinese semiconductor start-ups that got a leg up from their founders’ foreign experience

- AMEC has a 1 per cent share of the global etcher market dominated by US players but it holds 14 per cent of the Chinese etching systems market

- GigaDevice was established in Silicon Valley but founder Yiming Zhu moved the company to China after he saw there were no indigenous memory chip makers

Although China imports US$300 billion worth of chips annually – about US$160 billion of which are re-exported in finished electronics products – it is a laggard when it comes to making them.

Chinese President Xi Jinping has repeatedly urged the country to become more self-reliant when it comes to core technologies like semiconductors, which power all manner of electronics from AI to smartphones.

Officially, the Chinese government has never stipulated that chip making technologies should be of Chinese-origin. Rather, it has emphasised the need to attract foreign capital, technology and talent.

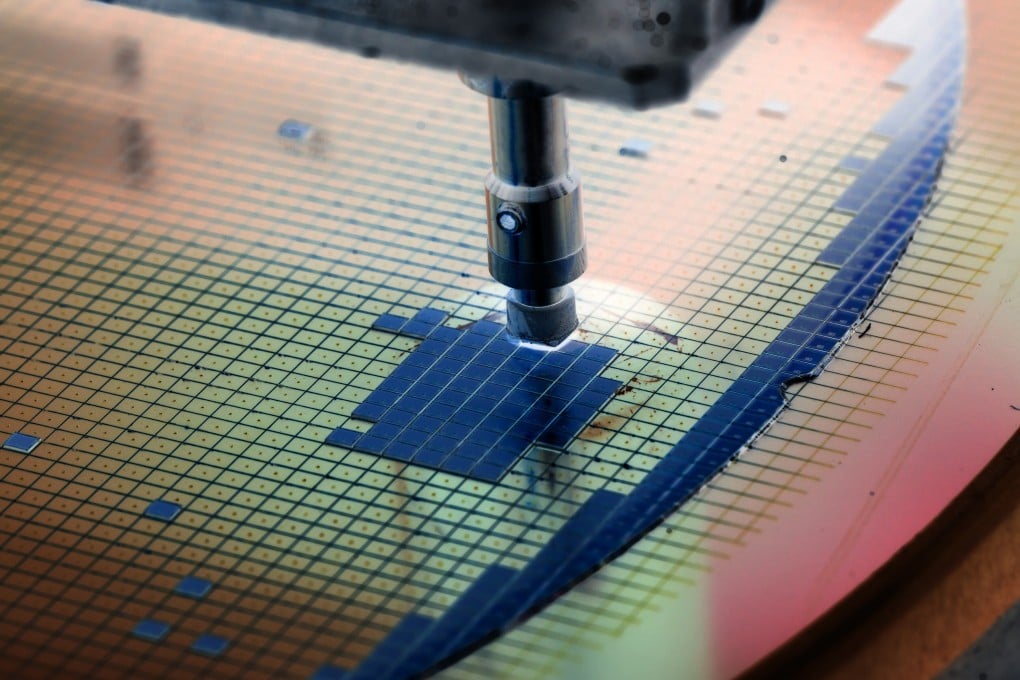

To that end, a large number of overseas trained and educated Chinese nationals have heeded the call and returned to China to establish start-ups in the semiconductor field, ranging from electronic design automation (EDA) software and IC design to silicon foundry and wafer processing equipment.

Most of the founders on this list started their companies well before the US-China tech war, but have had to navigate a more difficult external environment amid US bans on certain core technologies over national security concerns.

China’s most advanced chip maker, Semiconductor Manufacturing International Corp (SMIC), was established in 2000 by Richard Chang, who worked for more than 20 years as a wafer fab specialist at US chip major Texas Instruments.