Advertisement

US gaming site Roblox valued at US$30 billion, plans direct listing instead of IPO

- Roblox has raised around US$520 million in a private fundraising round led by Altimeter Capital and Dragoneer Investment Group

- It now aims to go public through a direct listing instead of an initial public offering as originally planned

Reading Time:1 minute

Why you can trust SCMP

Roblox Corp said on Wednesday it aims to go public through a direct listing, instead of an initial public offering (IPO) as originally planned, and has raised new funding in a deal that values the US gaming platform at nearly US$30 billion.

In a statement, Roblox said it had raised around US$520 million in a new Series H private fundraising round led by Altimeter Capital and Dragoneer Investment Group.

The funding round valued Roblox at US$29.5 billion, more than seven times the US$4 billion the company was valued at in its Series G round 11 months ago.

Advertisement

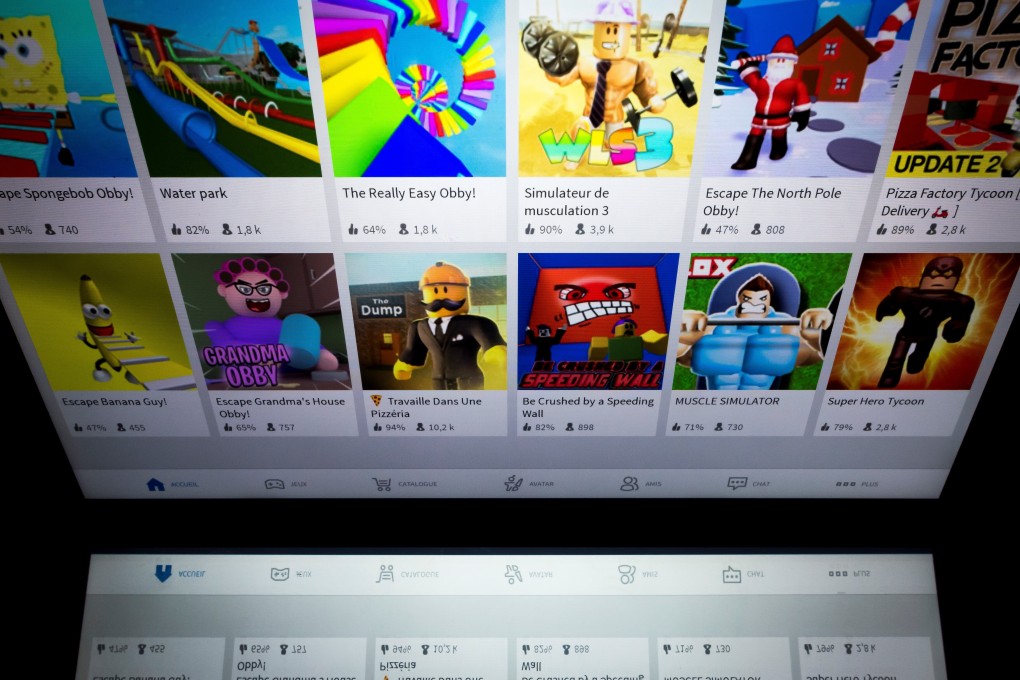

San Mateo, California-based Roblox is among the world’s most popular gaming sites for children and offers a host of games across mobile devices and games consoles.

US demand for video games has surged as consumers seek home entertainment while living under lockdown measures to curb the spread of Covid-19.

Roblox’s plans to switch to a direct listing were reported earlier by Reuters.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x