Chinese equivalent to Netflix? No, we want to be China’s online Disney, says iQiyi CEO

The Nasdaq-listed company, which was spun off from online search giant Baidu, has sharpened its focus on artificial intelligence, big data analytics and other technologies to improve its efficiency in content production, sourcing and even censorship

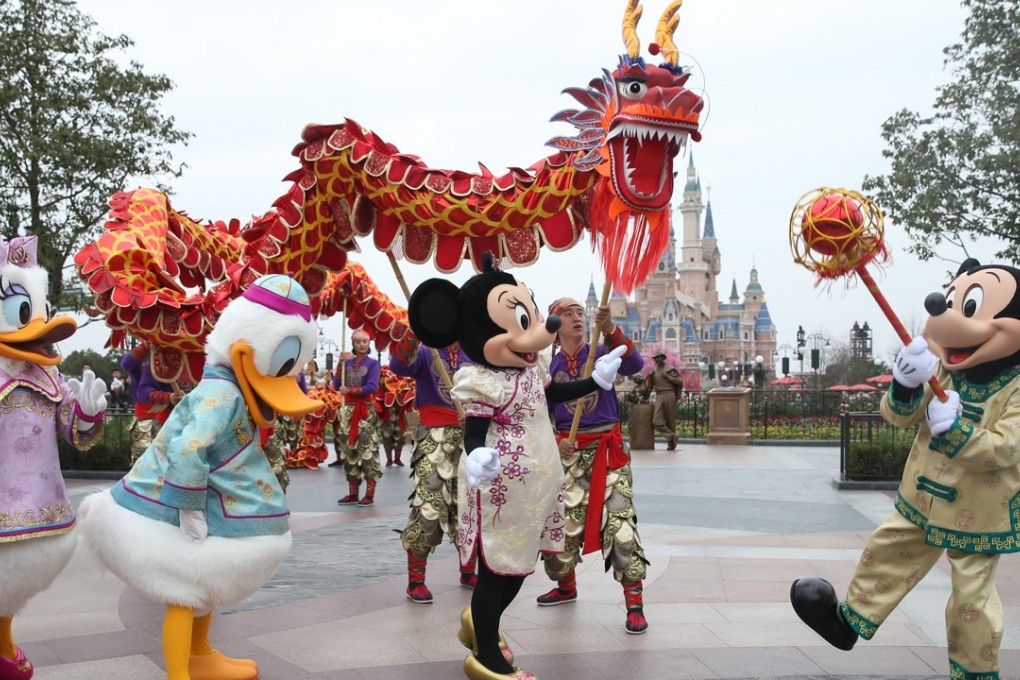

While many investors compare iQiyi to US-based Netflix, the head of China’s largest online video-streaming service said it was built to be like The Walt Disney Company, the media and entertainment conglomerate behind Mickey Mouse and the Star Wars franchise.

“Our business model is more like Disney’s than Netflix’s,” said Tim Gong Yu, iQiyi’s founder and chief executive, in a recent interview at the firm’s headquarters in Zhongguancun, a hi-tech zone in Beijing.

Describing Netflix’s subscription business model as one that is “simple and can be easily replicated in any country in the world”, Gong said following that same path will not help iQiyi achieve sustainable growth in future.

“Netflix has mainly English-language content, with Hollywood culture at its core,” Gong said. “For iQiyi, what we have is a big domestic market. But neither Chinese-language content nor Chinese culture has a huge audience overseas.”

Foreign streaming giants miss out on China online video boom

Compared with the “horizontal” expansion of Netflix worldwide, iQiyi will focus on a “vertical” business model in the near-to-mid-term that will entail going deeper in the Chinese market, he said.

That strategy does not include building bricks-and-mortar theme parks like Disney. Instead, iQiyi plans to sharpen its focus on creating a Disney-like ecosystem of businesses.