From phones to game consoles: global chip shortage spreads beyond cars

- The dearth of supply is deepening as Apple, China hoard chips

- Worsening crunch could affect sectors well beyond carmaking, including the gaming manufacturers behind Nintendo Switches, PlayStations and Xboxes

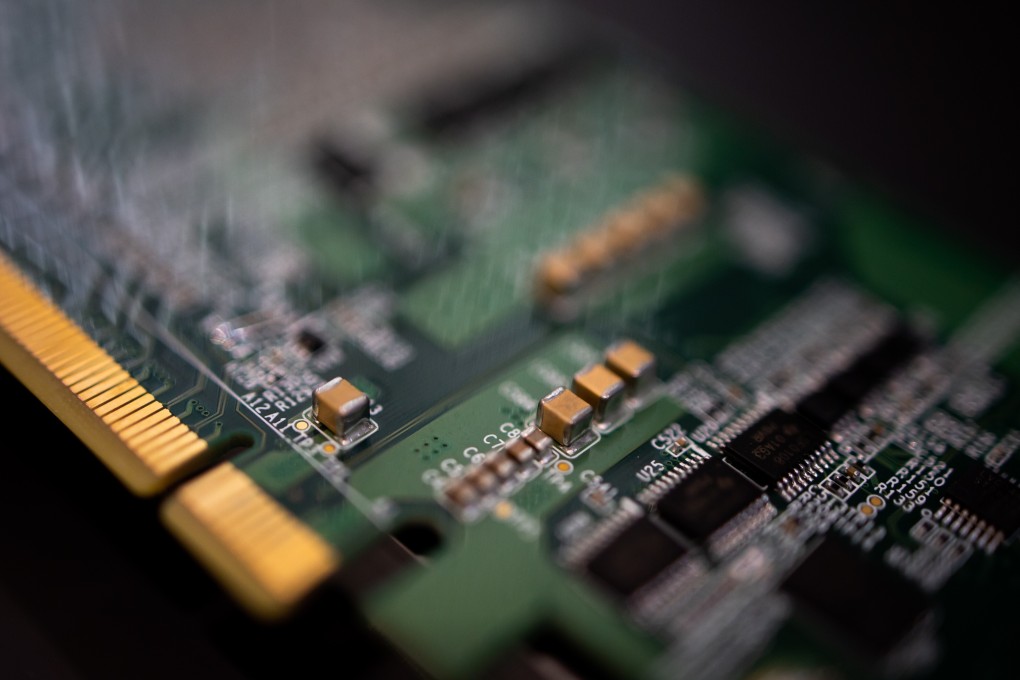

The first hints of trouble emerged in the spring of 2020. The world was in the early throes of a mysterious pandemic, which first obliterated demand then supercharged internet and mobile computing when economies regained their footing. That about-face – in a span of months – laid the seeds for potentially the most serious shortage in years of the semiconductors that lie at the heart of everything from smartphones to cars and TVs.

Amon joined a growing chorus of industry leaders warning in recent weeks they cannot get enough chips to make their products. Carmakers appear in direst straits and have spurred the US and German governments to come to their aid – General Motors Co this week was forced to mothball three North American plants and Ford Motor Co is bracing for a 20 per cent drop in near-term output. But more industries have lately copped to shortages, emphasising how Covid-19 and a boom in a new breed of 5G-ready smartphones like the iPhone 12 is exacerbating a shortage of capacity plaguing the entire consumer industry. Chip shortages are expected to wipe out US$61 billion of sales for carmakers alone, but the hit to the much larger electronics industry – while tough to quantify at this early stage – could be far larger.

Apple, a major Qualcomm customer, said recently that sales of some new high-end iPhones were hemmed in by a shortage of components. Europe’s NXP Semiconductors NV and Infineon Technologies AG – whose roles near the top of the supply chain grant them visibility over global chip flows – have both indicated the constraints are no longer confined to autos. And Sony Corp said Wednesday it might be unable to fully sate demand for its new gaming console in 2021 because of production bottlenecks.

“The virus pandemic, social distancing in factories, and soaring competition from tablets, laptops and electric cars are causing some of the toughest conditions for smartphone component supply in many years,” said Neil Mawston, an analyst with Strategy Analytics. He estimates prices for key smartphone components including chipsets and displays have risen as much as 15 per cent in the past three to six months.