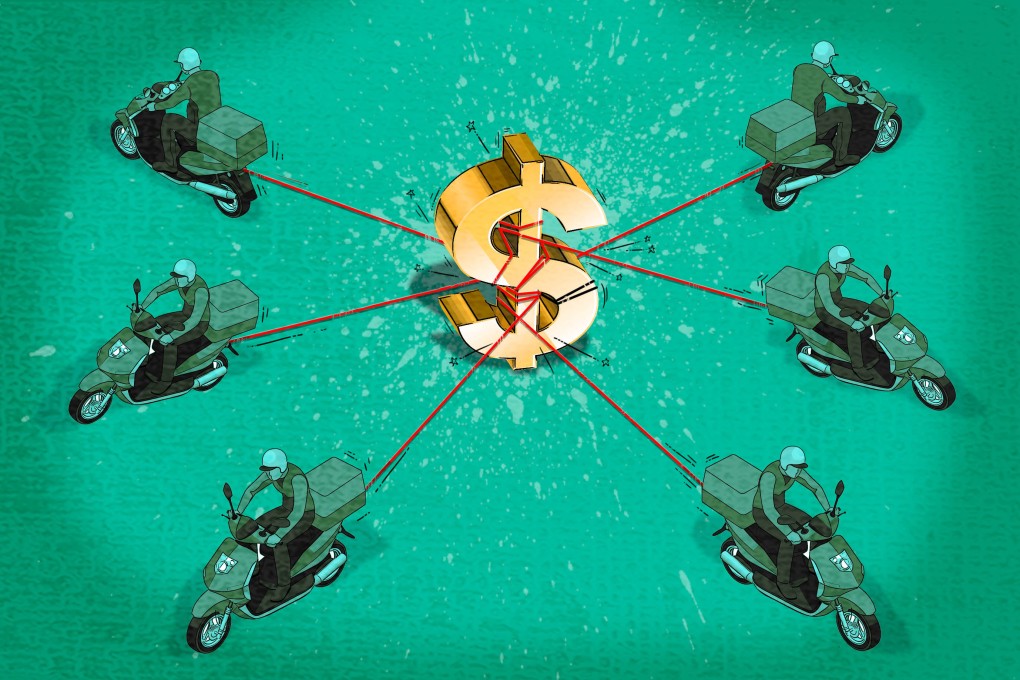

A brutal price war is ravaging couriers in China’s live-streaming e-commerce hub, where not even SF Express is spared

- Indonesia’s J&T Express was punished by Yiwu’s municipal postal authority for dropping delivery prices to 15 US cents per parcel

- The resulting price competition has hammered couriers trying to keep up with demand from the many e-commerce shops in the city, known for its cheap goods

In a village 250 kilometres (150 miles) southwest of Shanghai, along a street peppered with rickshaws of various colours and flanked by five-storey buildings brimming with goods, mountains of boxes sit waiting for the myriad delivery workers who have to handle them, keeping the couriers from wading through the hundreds of matchbox-sized shops in the area to find everything they need to collect.

The massive logistics flow in Beixiazhu is a result of the village’s booming live-streaming e-commerce industry. Located in Yiwu, a manufacturing hub known for cheap wares such as socks and much of the world’s Christmas decorations, Beixiazhu has become the go-to place for enterprising live-streamers to hawk an endless supply of local products online in the age of Covid-19.

This has also made it the site of China’s most vicious price war among delivery companies after a new market entrant, Jakarta-based J&T Express, offered its services for as little as under 1 yuan (15 US cents) per package, raising government scrutiny and keeping China’s largest private courier, SF Express, at bay, according to interviews with dozens of merchants and delivery crews in the area.

“The price war is intensifying – express delivery companies are locking horns and revenue from single-package [deliveries] is still declining,” said Dai Mingzhe, an analyst at research firm LeadLeo. “It is still difficult to predict the turning point of the price war in the short term, and it is possible for the single-package price to further decline.”

The area’s massive output has created economies of scale that make delivery service charges in Yiwu among the lowest in China. The scale of commerce also attracted J&T Express, armed with investment from the likes of Hillhouse Capital, Sequoia Capital and Boyu Capital, which has driven down bulk order pricing to the point of drawing ire from other companies.