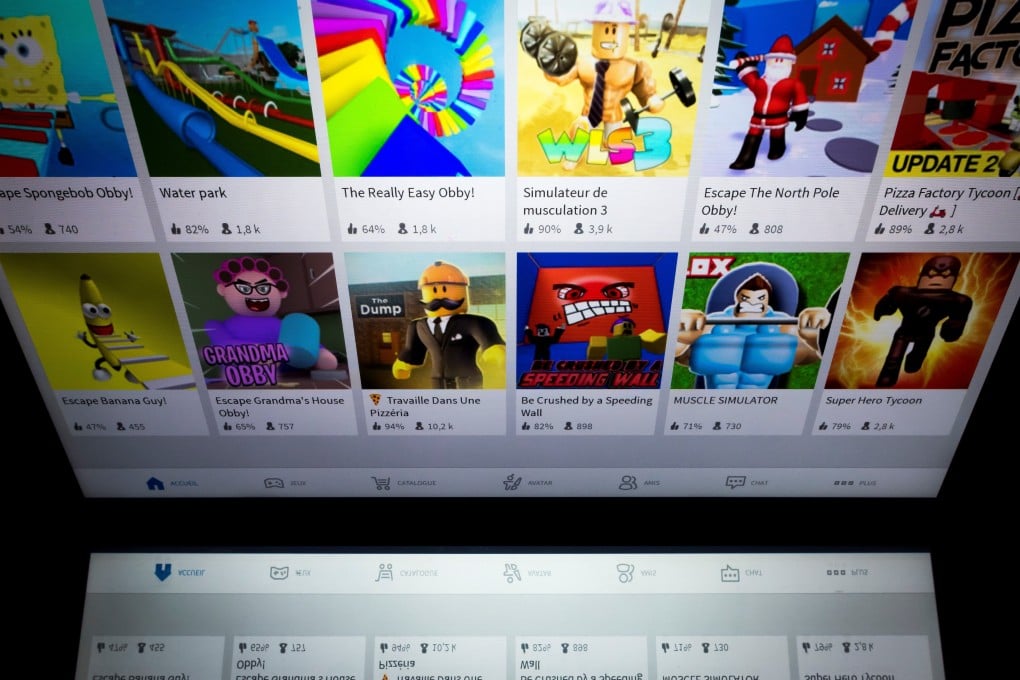

TikTok owner ByteDance boosts investment in Roblox-like video game platform in race with Tencent to create the metaverse

- ByteDance put another US$15 million into Chinese Roblox competitor Reworld, with its own platform for making and playing games

- Tencent has the rights to Roblox in China through a joint venture, which was licensed in December to release the platform on the mainland

With the new investment, Reworld added ByteDance’s head of gaming Yan Shou to its board of directors, awarding him an undisclosed number of shares, according to Tianyancha and Qichacha, Chinese platforms that track public registrations of Chinese businesses. ByteDance had previously invested US$43 million in Reworld.

Like Roblox, Reworld is a platform for designing and playing games using the company’s own simulation engine. It was founded by serial entrepreneur Xing Shanhu in 2017, as Roblox’s fortunes were rising after a decade of low-key growth.

Reworld, however, is primarily focused on China, where it wants to become the “best platform for user-generated content for teenagers”, according to its website.

The increased investment is ByteDance’s latest move to gain ground in an area dominated by rival Tencent, which has the rights to Roblox in China through joint venture firm Luobulesi, a Chinese transliteration of the name.