Advertisement

China’s podcast fans are tuning in, Big Tech firms are listening

- Major Chinese tech companies, including Tencent, NetEase and Kuaishou, are moving to address the rising demand for podcasts

- The challenge for Chinese firms in the podcast space is making money, despite the growing number of listeners across the country

Reading Time:4 minutes

Why you can trust SCMP

For more than a year, Beijing-based marketing associate Grace Chen has followed the same routine as many people around the world: pop in a pair of earphones and listen to a podcast on the commute to work.

“It just helps me relax, and I appreciate the effort it takes to make a good podcast,” she said. “I think everyone likes it for the same reason.”

It is a sentiment that tech heavyweights in China and overseas have noticed, prompting them to increase engagement with avid podcast listeners like Chen.

Advertisement

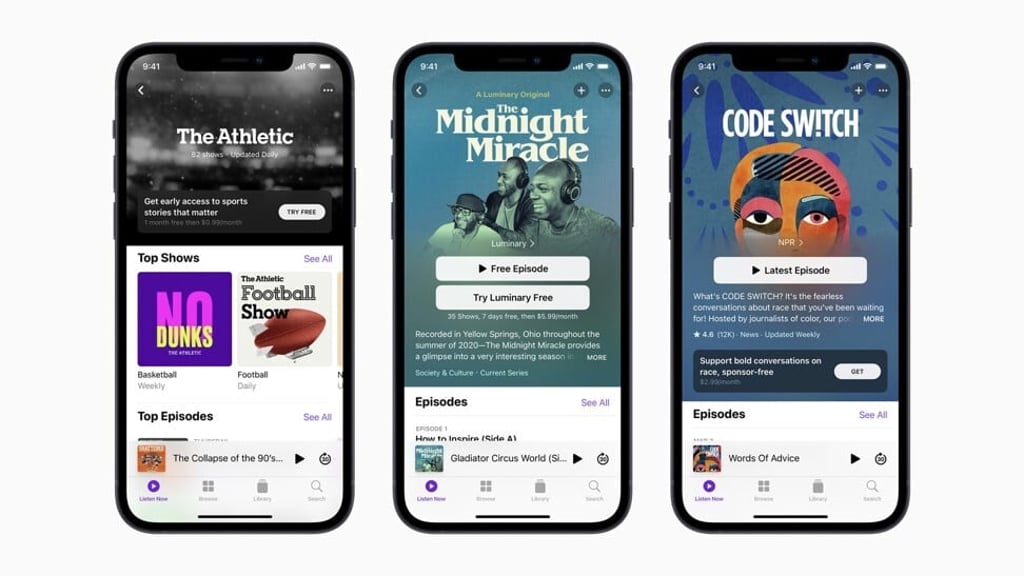

Apple, which played a major role in making podcasting mainstream, announced last week a new subscription platform on its podcast app. Swedish rival Spotify continued to strengthen its audio streaming service by recently introducing its own podcast subscription offering in the US.

Chinese tech companies, ranging from internet giant Tencent Holdings to start-ups like app operator Xiao Yuzhou, are also addressing the podcast boom, according to industry insiders.

Advertisement

“Two years ago, you wouldn’t expect or even think that most of the internet giants would actually go into this kind of niche programming,” said Rio Zhan, a Chinese venture capitalist who also hosts a regular podcast about that topic.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x