Europe’s No 2 chip maker STMicroelectronics reportedly to raise prices from June 1, citing materials shortages

- The price hike comes amid a shortage that began in the second half of 2020 and has subsequently disrupted production lines at US, European and Japanese carmakers

- One Chinese carmaker was willing to pay 30-times more for an MCU, originally priced at 10 yuan (US$1.50), to secure supply, according to GIICS

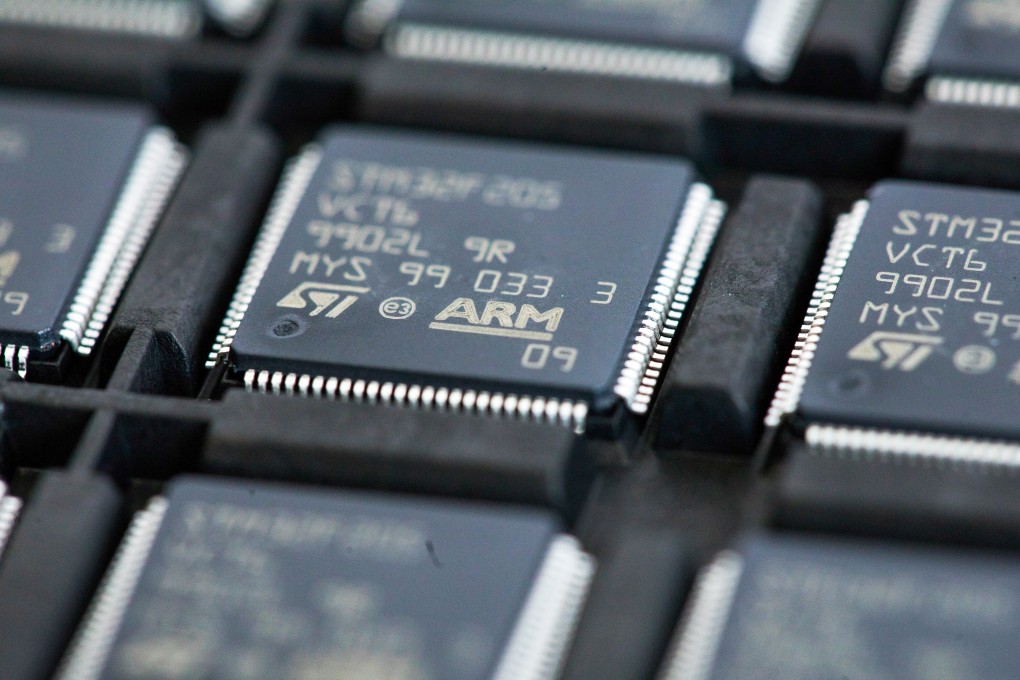

STMicroelectronics (STM), Europe’s second-largest chip maker by revenue, said on Monday that it would raise prices across product lines from June 1, citing rising costs in materials along with challenges in meeting demand as the global semiconductor shortage deepens, according to a statement circulating on Chinese social media.

“Semiconductor demand is currently reaching unprecedented heights, leading to major challenges in meeting orders despite our significant capital investment,” STM said.

The statement was signed by Collins Wu, STM’s regional vice-president for Asia Pacific.

STM could not be contacted to verify the authenticity of the message by the time of publication.

The Switzerland-based company, which specialises in power discrete devices and microcontroller units (MCU) for automotive applications, said materials suppliers have struggled to meet customer demand amid the semiconductor shortage, resulting in “cost increases and more aggressive commercial terms to maintain our supply of these scarce materials”.