How this PLA veteran turned online food entrepreneur has made his way to a New York IPO with Dingdong Maicai

- Liang became an online food entrepreneur after serving 12 years in the People’s Liberation Army

- Dingdong Macai’s listing follows hot on the heels of another New York listing by grocery arch-rival Missfresh last week

Born and raised in a remote village in eastern Anhui province in the 1970s, Liang Changlin always wanted to avoid becoming just another factory worker.

And 49-year-old Liang has certainly done that, as the company he founded in 2017, Dingdong Maicai, is about to go public in the US. Backed by investors including Softbank Group Corp and Tiger Global Management, the online grocery platform has priced its offering at US$23.5 per ADS, giving a total size of US$95.7 million.

Liang became an entrepreneur after serving 12 years in the People’s Liberation Army, following in the military footsteps of tech titans such as Huawei Technologies Co founder Ren Zhengfei and Lenovo Group founder Liu Chuanzhi.

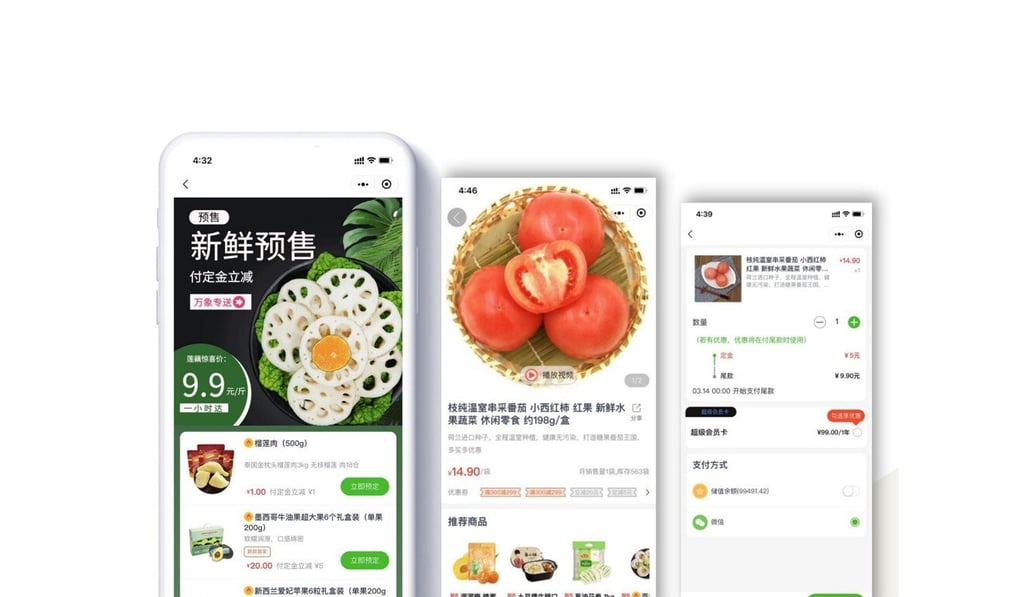

Liang started two businesses, including a video editing operation and an online parenting platform, before seeing an opportunity to deliver fresh groceries to consumers.

“I’ve always paid attention to the needs of users and was keen to tackle the [grocery] market’s pain point,” said Liang in an interview with the South China Morning Post on Tuesday. Liang understood that many people wanted better access to high-quality, safe produce, something he learned during his experience with online parenting when mothers expressed their concerns about food quality for their children.