Small semiconductor firms say China’s power crunch adding to problems from low capacity and trade war with US

- Small and medium-sized semiconductor companies say they had to freeze production over lack of power, adding to chip industry woes amid low capacity

- Executives and industry professionals discussed the issue at the 2021 Yangtze River IC Summit in Nanjing on Monday

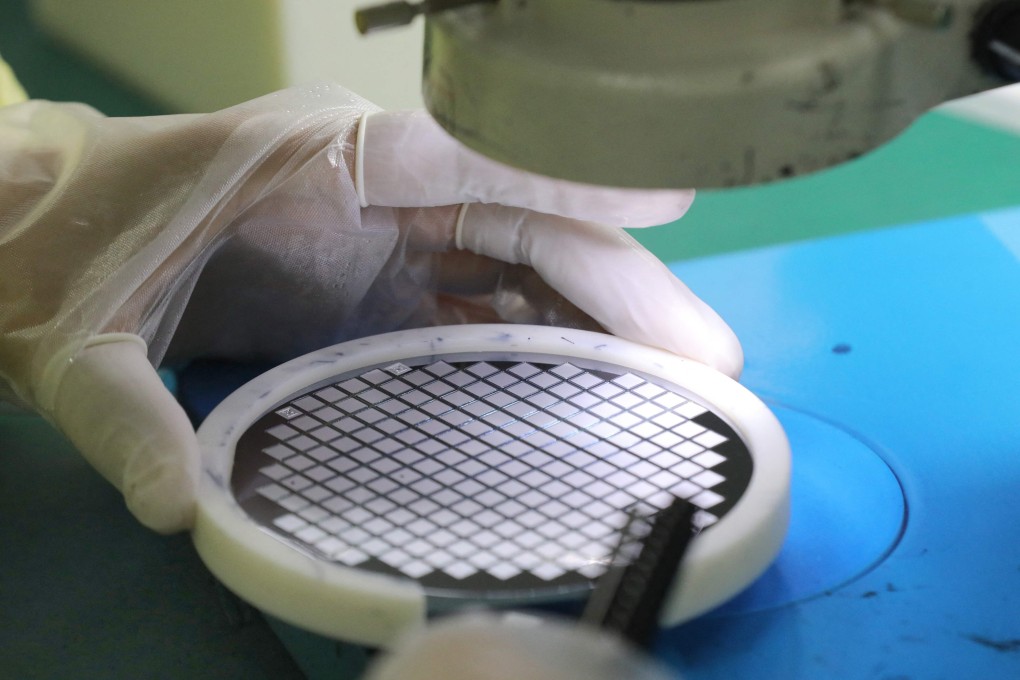

China’s ongoing power shortage is putting a further dent in semiconductor production at small and medium-sized enterprises (SMEs) this year, executives said at the 2021 Yangtze River IC Summit on Monday, exacerbating a global chip shortage stemming from limited capacity.

“We had to halt production due to a power shortage at the end of September, and we will have to suspend production again tomorrow,” Li said.

He was one of several executives discussing the issue at the conference in Nanjing, the capital of Jiangsu province, which gathered hundreds of industry professionals from SMEs and some big names such as Qualcomm.

Semiconductor manufacturing companies need stable supplies of electricity, water and gas to maintain constant operation. Power shortages across northeastern China, Jiangsu and Guangdong have now put factory production in limbo, in addition to leaving many residents without power.