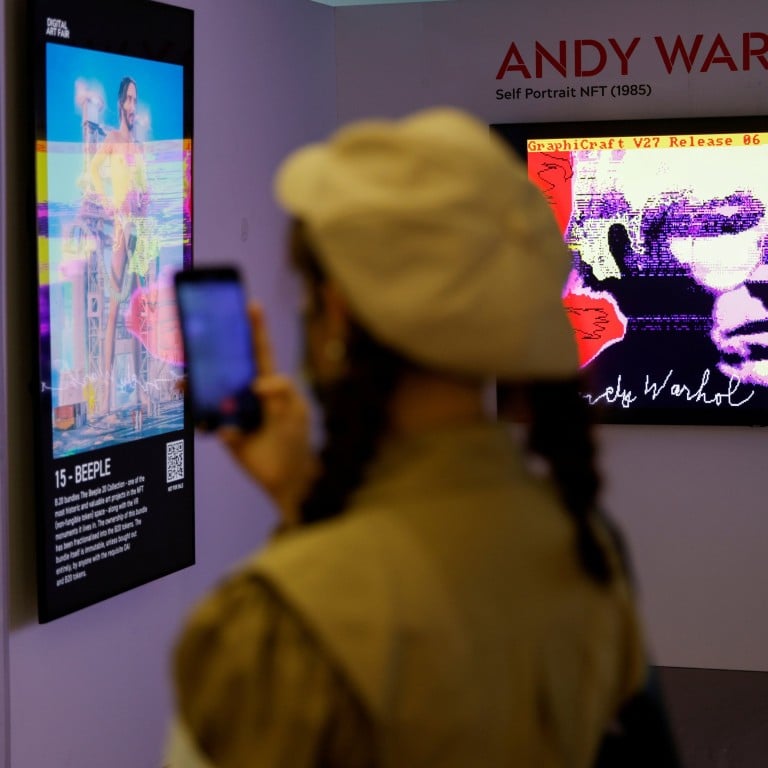

Chinese state media renews warning against NFT ‘zero-sum game’, flagging ‘fraud’ risks as digital collectibles gain recognition

- The People’s Daily newspaper questioned whether NFTs were hype and fraud, given the skyrocketing prices of some digital collectibles

- Beijing has not explicitly banned NFTs, leaving the door open for listed companies to issue announcements that tie future business plans to the concept

The People’s Daily, mouthpiece of the ruling Chinese Communist Party, has spoken out against the investment fever around non-fungible tokens (NFTs), questioning whether it is another “zero-sum game hyped by cryptocurrency investors and capital”.

The latest state-media warning comes as NFTs and the metaverse have been gaining momentum, with a growing list of Chinese firms openly embracing them. Media firm 36kr Holdings gave away 1,124 metaverse-themed digital collectibles at a conference in Shenzhen on Wednesday, the latest sign of growing interest in digital assets despite the government’s previous bans on cryptocurrency trading and mining.

However, the Chinese government has not explicitly banned NFTs or the metaverse, leaving the door open for dozens of listed companies to issue announcements that tie future business plans to the concepts. The hype has created a “metaverse group” of stocks that have had huge bull runs lately, leading market regulators to issue warnings and raise questions.

It also noted that the popularity of NFTs was evident after Chinese tech giants like Tencent Holdings, Ant Group and ByteDance tested consumer desire for digital collectibles.

Metaverse, NFT gain traction in China as ‘digital collectibles’

Unlike overseas markets where cryptocurrencies are accepted as payment for NFTs, Chinese issuers only take yuan, and once bought, the NFTs cannot be resold.

Even so, there has been unregulated speculation. For example, a digital torch for the Asian Games, launched by Ant’s blockchain platform AntChain in September, was originally priced at 39 yuan (US$6.1), but private chat groups stoked up its value to more than 10,000 yuan, according to the People’s Daily article.

“Amid the spree, NFT is deviating from its value and becoming alienated,” the article said.

Ant, the fintech giant affiliated with South China Morning Post owner Alibaba Group Holding, did not immediately respond to a request for comment. However, the company has repeatedly said the digital tokens were for intellectual property protection, and that it is firmly against price speculation around NFT products.

Tighter regulations may be on the way, experts warned.

“When the NFT trading market sees exponential growth of volume, it’s hard to say that NFT has no financial attributes and similarly it’s hard to imagine that NFT can develop in China without being associated with cryptocurrency – and the related regulations,” said Winston Ma, an adjunct professor at NYU Law School and author of The Digital War – How China’s Tech Power Shapes the Future of AI, Blockchain and Cyberspace.

The People’s Daily article cautioned that some cryptocurrency exchanges are conducting ICOs, a popular fundraising method in the sector, under the name of NFTs.

Some domestic NFT platforms claim that they have licences, which “are extremely difficult to obtain” from provincial governments or even the State Council, Xiao Sa, a member of the China Banking Law Society, was quoted saying in the article.