Tech war: China chip veteran says Nvidia is hard to replace in artificial intelligence, urges start-ups to catch up

- Nvidia supplies 95 per cent of general-purpose GPUs in AI training systems, said Lu Jianping of Shanghai-based chip rival Iluvatar Corex

- China’s GPU start-ups should focus on ‘versatility’ by supporting more algorithms to ensure the chips are supported by more systems, he said

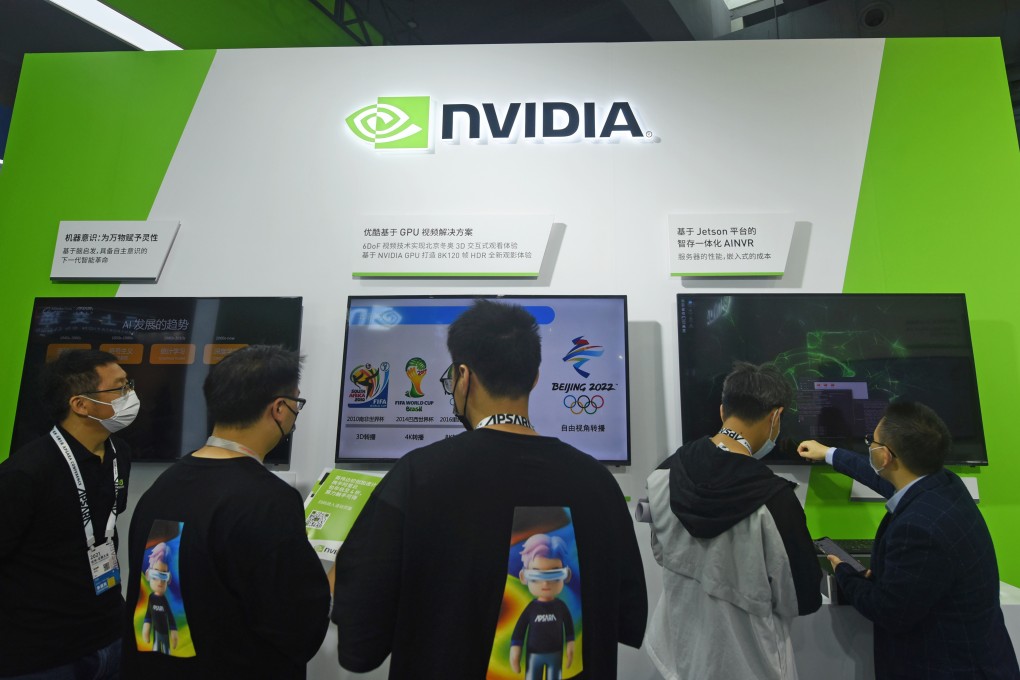

Nvidia has a near monopoly on graphics processing units (GPUs) used to train artificial intelligence (AI), a chip expert at the country’s leading rival to the Californian tech giant said on Wednesday.

Lu Jianping, chief technology officer at Shanghai-based Iluvatar Corex, said Nvidia controls 95 per cent of the market for general-purpose GPUs used to train AI models. He made the comments during an online session organised by China’s ICwise, a consultancy focused on the country’s chip supply chain.

“If a client has developed an AI algorithm … it should be able to run on an Nvidia chip, but also on an Iluvator chip,” Lu said.

Lu said that he was unable to find any mature “rival products” from Chinese GPU start-ups for assessment against Nvidia chips. “So far we can’t get any, probably because everyone is still in the development stage,” he said.