Advertisement

Hong Kong’s time to step up as fallout from crash of crypto exchange FTX rattles digital currency market, Animoca’s Yat Siu says

- The Animoca chairman expects the FTX crash to strengthen Hong Kong’s resolve to build a regulatory infrastructure for its digital-assets industry

- His comments come after the spectacular collapse of crypto exchange FTX, which has filed for bankruptcy protection in the US

Reading Time:3 minutes

Why you can trust SCMP

2

Hong Kong’s efforts to build a digital-assets industry and cryptocurrency hub to rival Singapore is not expected to be set back by the collapse of crypto exchange FTX, which filed for bankruptcy protection in the United States on Friday.

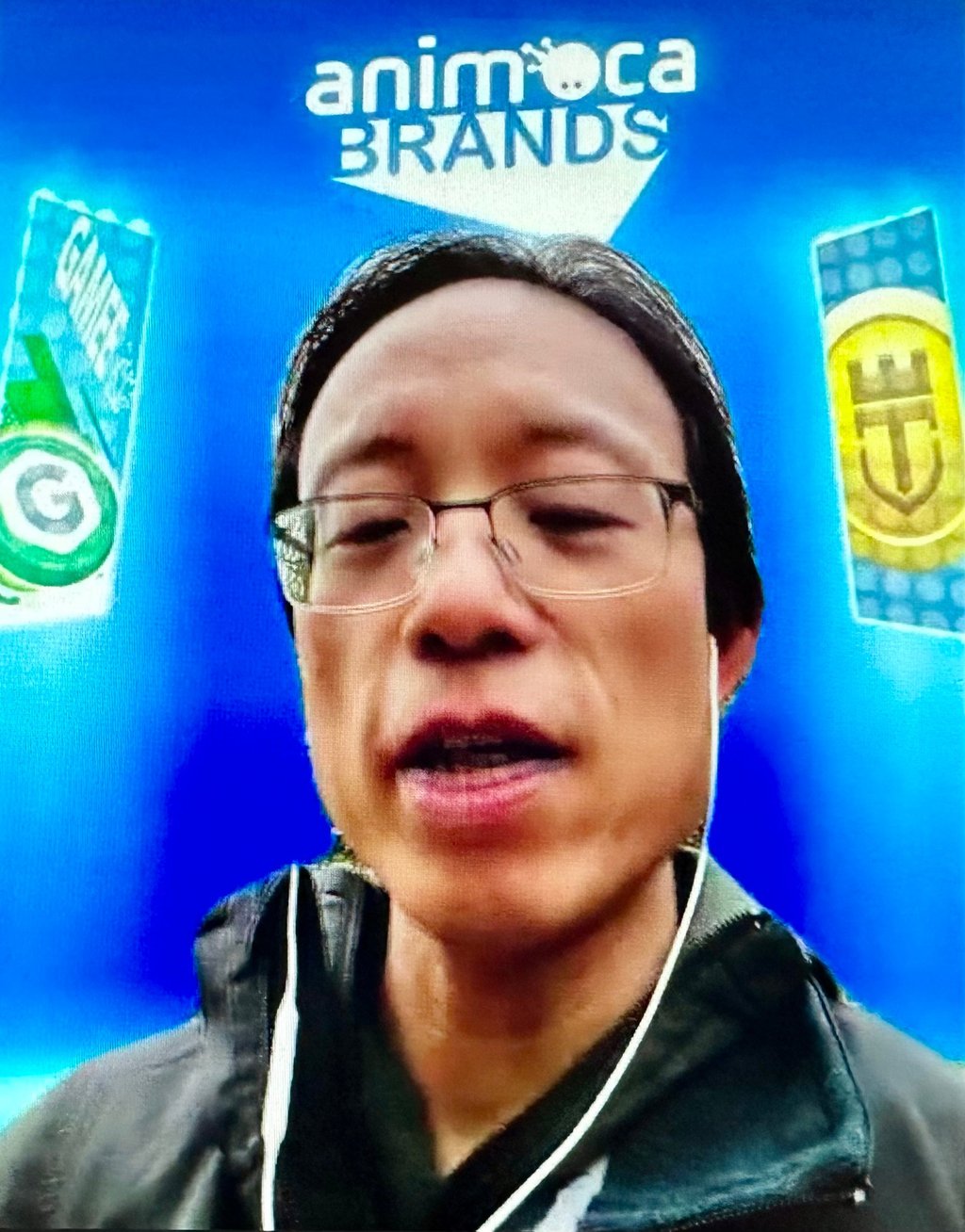

“I see Hong Kong stepping up in the wake of this latest crisis in the crypto industry,” Yat Siu, co-founder and chairman of venture capital and gaming firm Animoca Brands, said in a Zoom video interview on Saturday.

“This is an opportunity for the city to implement a regulatory approach to develop the industry,” the veteran tech entrepreneur and blockchain proponent told the South China Morning Post. “This can help correct what has so far gone wrong in the market.”

Advertisement

Siu’s comments come after the spectacular, week-long downward spiral of FTX, which marked the latest crisis to rattle the market after the collapse of Singapore-based crypto hedge fund Three Arrows Capital and the earlier crash of Terraform Labs and Luna Foundation Guard – the firms behind stablecoin terraUSD and companion token Luna.

Hong Kong is not expected to be negatively affected by the fallout from FTX’s debacle, according to Siu, who sent an open letter on Friday to Animoca’s shareholders, employees and partners about the crisis just hours before the US firm filed for bankruptcy.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x