Advertisement

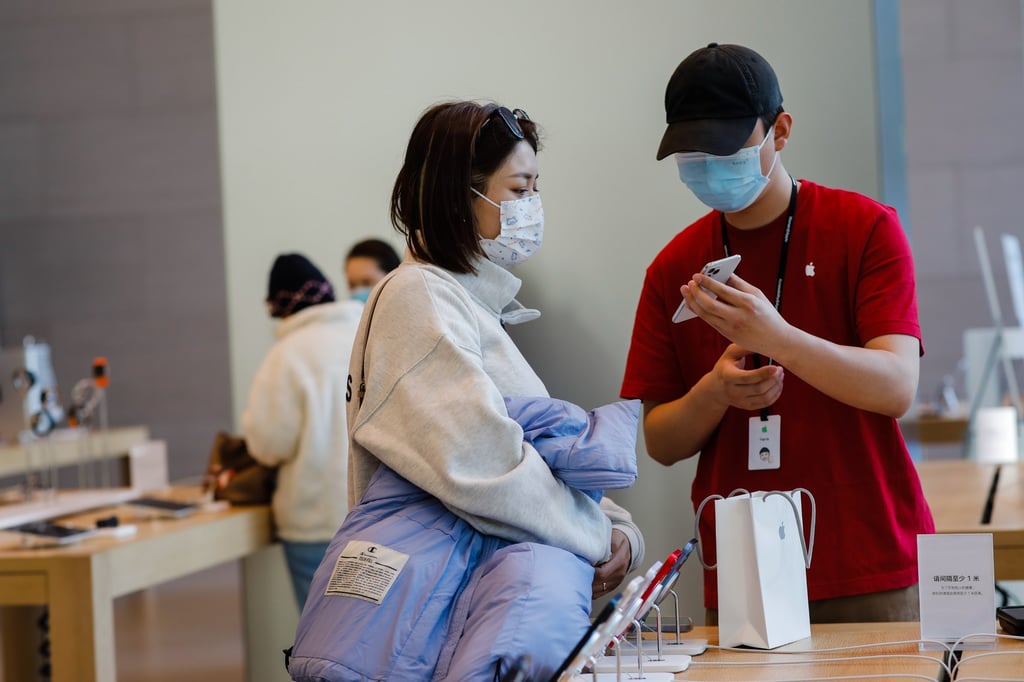

China smartphone sales rise in January amid easing of Covid-19 controls and Lunar New Year break, but industry remains cautious

- Average weekly smartphone sales in January reached 6.7 million units, much higher than the average of 5.5 million in 2022

- That represented sequential growth of more than 40 per cent, although monthly sales year on year were flat

Reading Time:2 minutes

Why you can trust SCMP

Iris Dengin Shenzhen

Smartphone sales in mainland China picked up steam in January after recording their fifth consecutive year of decline in 2022, igniting discussion on whether the stagnant market will finally bottom out and rise in 2023, according to a report by Counterpoint Research.

Average weekly smartphone sales in January reached 6.7 million units, much higher than the average of 5.5 million in 2022, the report said. That represented sequential growth of more than 40 per cent, although monthly sales year on year were flat in the world’s largest smartphone market.

The “good start” was driven by the restoration of normal social activities in the country after a surge of Covid-19 infections in December, according to Archie Zhang, a Beijing-based research analyst at Counterpoint.

Advertisement

“Elimination of major Covid-19 restrictions provides a bigger growth runway,” Zhang wrote in the report published on Wednesday. He added that the Lunar New Year season also started earlier than usual this year, “helping the weekly sales walk out of the trough at the beginning of 2023”.

Apple remained China’s biggest smartphone vendor in January in terms of market share. With strong demand for its iPhone 14 models, Apple’s sales in January increased about 6 per cent year on year, according to preliminary data from Counterpoint.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x