Samsung Electronics investors brace for worst profit in at least 14 years amid chip slump

- Samsung, which reports preliminary results for the March quarter on Friday, is expected to say operating profit plunged about 90 per cent to US$1.1 billion

- Prices for DRAM chips slid 20 per cent in the first quarter and are expected to drop 10 per cent to 15 per cent in the second quarter, according to TrendForce

Samsung Electronics is heading for its lowest profit since the global financial crisis, if not longer, due to a sharp slowdown in tech demand that triggered losses at its semiconductor division.

The South Korean chip maker, which reports preliminary results for the March quarter on Friday, is expected to say operating profit plummeted about 90 per cent to 1.45 trillion won (US$1.1 billion), according to analyst estimates compiled by Bloomberg. That would be the smallest profit since 2009. Several profit projections are below 1 trillion won and in some cases just slightly above break even.

While the semiconductor industry is known for its boom-and-bust cycles, it endured one for the history books during the Covid era. Demand soared during the pandemic as consumers bought new computers and smartphones, prompting chip makers like Samsung to crank up production. But sales tumbled as lockdowns lifted and then shrivelled more with soaring inflation, rising interest rates and other global economic trauma.

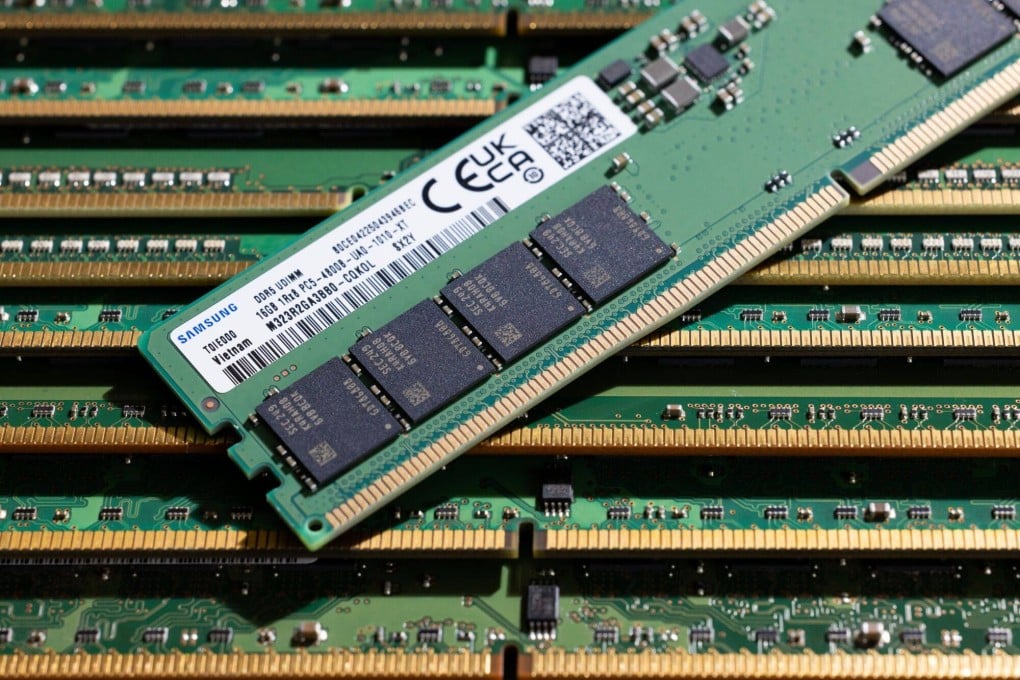

That left the US$160 billion memory chip industry with a yawning mismatch between supply and demand. Inventories spiked. Prices for DRAM and NAND tumbled. Samsung, the biggest player in memory chips, is expected to lose about US$2.7 billion in its semiconductor division.

“The biggest problem right now is that chip inventories are too high and, in order to reduce them, the company will have to cut production,” said Lee Seung-woo, analyst at Eugene Investment & Securities.

Prices for DRAM, a type of memory used to process data in computers and phones, slid 20 per cent in the first quarter and are expected to drop 10 per cent to 15 per cent in the second quarter, according to market research firm TrendForce. NAND storage-chip prices plunged as much as 15 per cent and are expected to fall another 5 per cent to 10 per cent in the second quarter.

“Memory prices declined further than the market’s expectations in the first quarter due to poor demand,” said Baik Gilhyun, analyst at Yuanta Securities. “Prices will fall but at a slower pace in the current quarter. There’s not much further to slide because DRAM and NAND contract prices will soon hit their cash-cost level.”