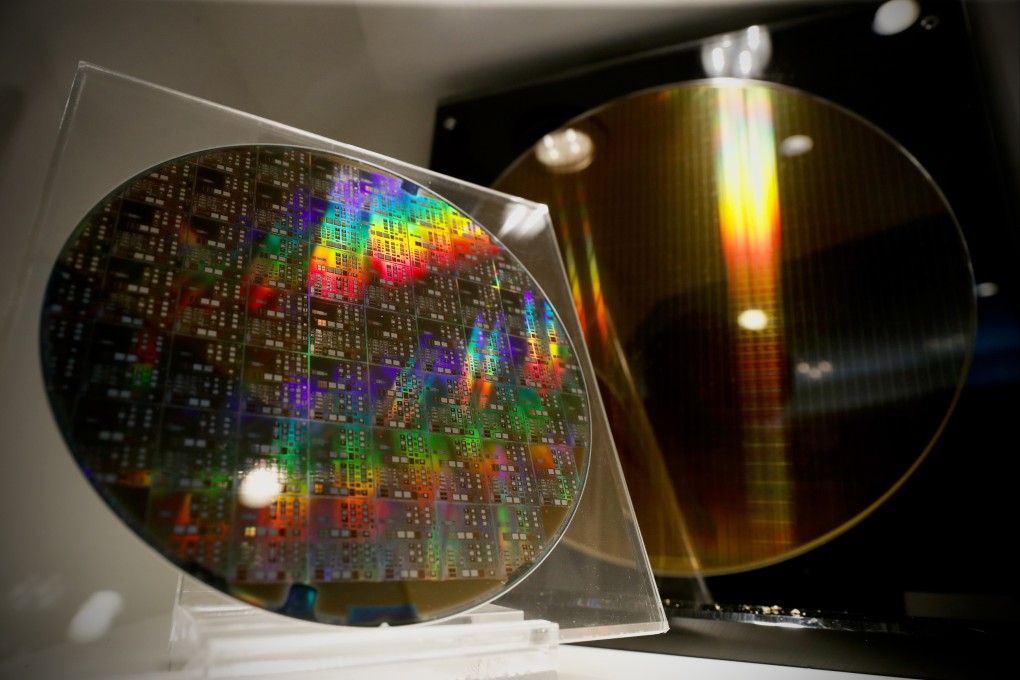

AI frenzy boosts shares of Asia tech hardware exporters amid optimism over chip sales

- Investors looking at chip giants like SK Hynix and TSMC are undeterred by expectations for a US recession and worsening Sino-American relations

- Stocks linked to semiconductors have done well amid a surge of interest in AI following the launch of ChatGPT last year

Investors are “going after technology hardware manufacturers and more specifically, the ones linked to microprocessors, which makes sense considering the surge of AI”, said Tareck Horchani, head of prime brokerage dealing at Maybank Securities in Singapore.

In China, the frenzy ushered in a months-long rally in software developers, chip makers and even healthcare providers, before market players started to question whether the earnings potential justify their rich valuations.

Conviction is also growing that the electronics cycle has bottomed out, with global semiconductor sales rising in March for the first time in 10 months.

Expectations of a turnaround in chip demand have helped benchmarks in Taiwan and South Korea, which are heavily-tilted to technology shares, to be among the best-performing gauges in Asia this year. The Taiex Index has been trading in bull market territory since January, while the Kospi Index is nearing that milestone.