Nvidia reveals progress in China’s self-driving chip market, setting up competition with domestic players

- Autonomous-driving systems have become a competitive sector as China pushes greater adoption of advanced self-driving technology

- Nvidia has signed up Great Wall Motors, Li Auto, Xiaomi, and Geely-backed ZEEKR for its Drive Thor autonomous driving system

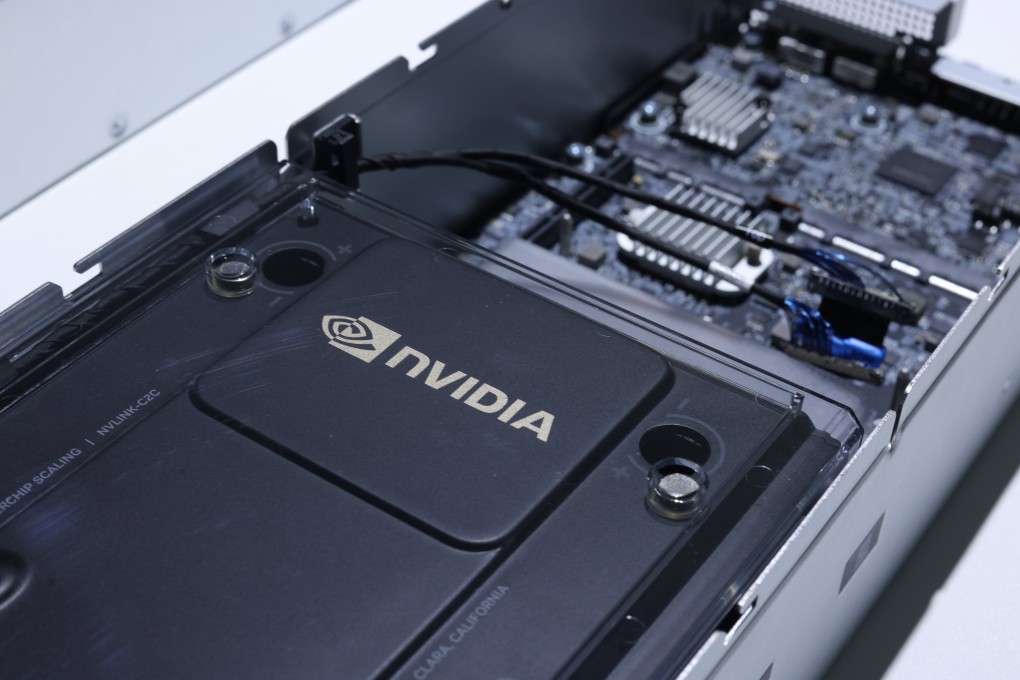

Nvidia, the US chip maker banned by Washington from selling its most advanced semiconductors to China, has revealed solid progress in the mainland’s electric vehicle (EV) market with its self-driving technology.

Nvidia said at the CES consumer electronics show in Las Vegas that Chinese EV makers, including Great Wall Motors, Li Auto, Xiaomi, and Geely-backed ZEEKR, have snapped up its Drive Thor autonomous driving system to enhance performance of their vehicles. This sets up increased competition with local self-driving system providers such as Huawei Technologies.

As of June last year, Nvidia – which is unable to ship its advanced AI chips to China due to US trade sanctions – had about a 52 per cent share of the global navigate-on-autopilot (NOA) market and cooperation agreements with 25 automotive original equipment makers globally, according to data from Gasgoo Institute, a Shanghai-based research company.

“Nvidia remains predominant in terms of smart-driving chips in China,” said Brady Wang, an associate director with research firm Counterpoint. “But competition between Chinese manufacturers and foreign companies is set to intensify as they compete for a slice of the autonomous driving segment in China’s EV market.”

Chinese EV makers have been big buyers of Nvidia auto chips. For example, Nio’s flagship sedans ET5 and ES7, Li Auto’s L9 model and Xpeng’s G9 vehicle all come equipped with Nvidia’s Orin chips. Automotive chips are seen as a less sensitive area of the semiconductor market by US authorities when it comes to setting trade sanctions.