At Leap 2024, Hong Kong start-ups and investors lay groundwork to tap future Saudi Arabia growth

- Start-ups and investors say attending the Leap tech conference is about building relationships for a market seen as ‘like China in the late 90s’

- Saudi Arabia is seen by some as a growth market where sanctioned companies like Huawei and DJI can compete equally with US tech giants

The government-backed conference has been able to attract attention from companies large and small because Saudi Arabia is seen as the next big growth market in the region compared with the more mature UAE market, where Dubai typically leads as a destination for tech investment.

“Because [the UAE is] so mature now, it’s actually quite difficult to penetrate the relationships with the top brass and the business leaders,” the British investor added. “Whereas in Saudi, they’re … a little bit after the beginning, and this is the best time to come. So the next 10-15 years in Saudi is a golden period for them, and also for investors.”

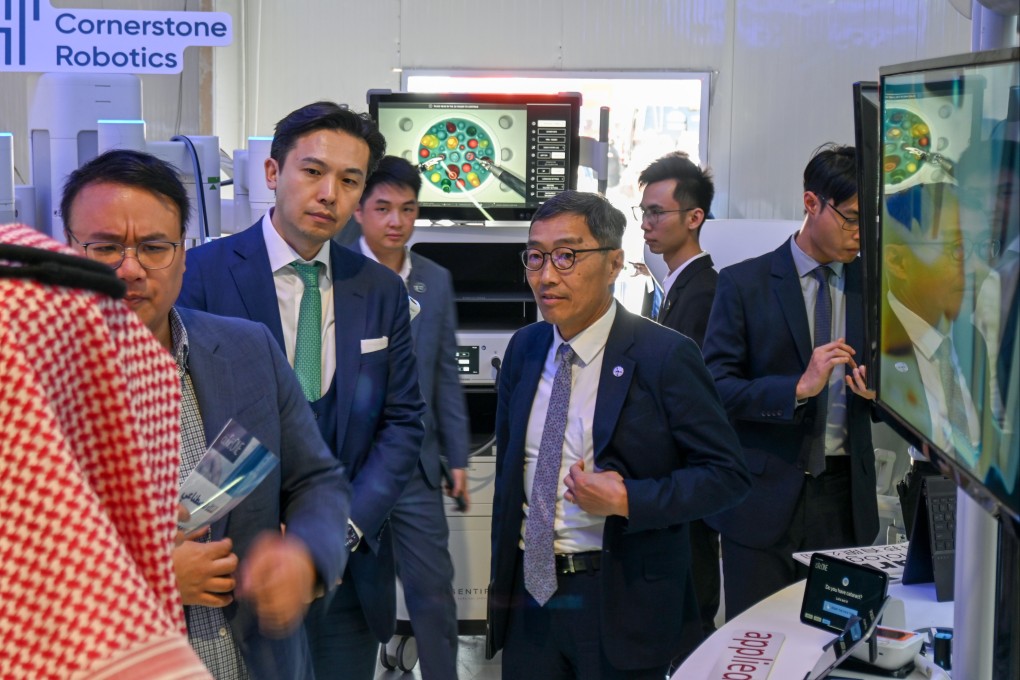

Leap 2024 also marked the first year to host a pavilion dedicated to Hong Kong start-ups. Attendees there noted the potential of the Saudi market as the main driver of their interest rather than any material benefits they might realise today.