US-China tech war: SMIC secures supply of chip-making equipment from ASML as signs suggest easing of sanctions

- ASML’s extreme ultraviolet (EUV) lithography systems, required for producing leading edge 5- and 7-nm node chips, were not included in the purchase agreement

- SMIC plans to spend US$4.3 billion in capital expenditure this year, with most of the investment supporting expansion of processing capacity for mature nodes

Semiconductor Manufacturing International Corporation (SMIC) has secured supply of deep ultraviolet (DUV) lithography systems from Dutch firm ASML in an amended purchase agreement worth US$1.2 billion, a move that could help ease supply chain risks for China’s chip-making champion that has been under the shadow of US sanctions.

Hong Kong-listed SMIC said in a stock filing late Wednesday that it renewed in February an existing volume purchase agreement with ASML, one of its top three foreign suppliers. The updated agreement, covering shipments of ASML’s DUV systems to SMIC, will be valid through December 31 this year, paving the way for the Chinese foundry to move forward with capacity expansion plans for its mature technology nodes.

ASML’s extreme ultraviolet (EUV) lithography systems, required for producing leading edge 5- and 7-nm node chips, were not included in the purchase agreement, according to two people familiar with the matter, who declined to be named.

The Dutch company is still waiting for a licence from the Netherlands government to export EUV systems to China, according to a spokeswoman at ASML China.

The latest announcement comes two days after Chinese analysts cited unconfirmed reports that the US will soon ease restrictions on export licence requirements for some of SMIC’s US suppliers. Washington slapped trade sanctions on SMIC last year for its alleged ties to the Chinese military, a charge the company has repeatedly denied.

Hopes rise for Washington to ease restrictions on SMIC amid chip shortage

The Trump administration tried to block ASML’s exports of crucial chip-making technologies to SMIC, according to a Reuters’s report, citing sources. Under rules that have not been repealed by the Biden administration, the US Commerce Department has required SMIC’s US suppliers to apply for a licence before shipment of equipment and materials to the Shanghai-based wafer fab over national security concerns.

SMIC said the restrictions would undermine its efforts to develop advanced nodes below 10-nm.

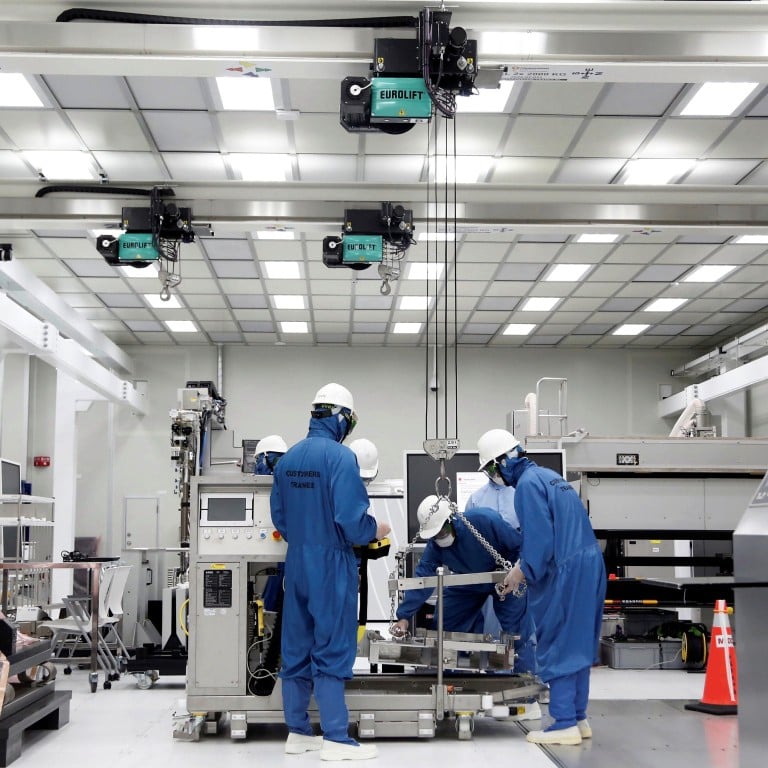

ASML produces lithography systems used by leading global foundries and chip makers including Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics and Intel. These complex machines, indispensable for the chipmaking process, are also used in developing key materials used in chip manufacturing.

China will ‘vigorously support’ semiconductor industry, IT minister says

SMIC used ASML’s DUV lithography systems to produce 14-nm chips for smartphones, including those sold by Honor, the former budget smartphone unit of Huawei Technologies Co. SMIC began volume production of 14-nm node chips in the fourth quarter of 2019, but the technology node was first introduced by Intel, TSMC and Samsung several years ago and used in the iPhone 6 and Samsung Galaxy S6.

A more advanced process node, which SMIC calls 12-nm (N+1), was also developed with ASML’s DUV technology and is aimed at low-cost consumer applications such televisions and wearables. However, to progress beyond N+1 to produce 7-nm chips to power products like budget 5G smartphones, experts say SMIC would need access to ASML’s more advanced EUV lithography systems, but US sanctions on the Chinese foundry effectively block sales of these machines despite the fact that the US government does not have direct jurisdiction over the Dutch company.