Advertisement

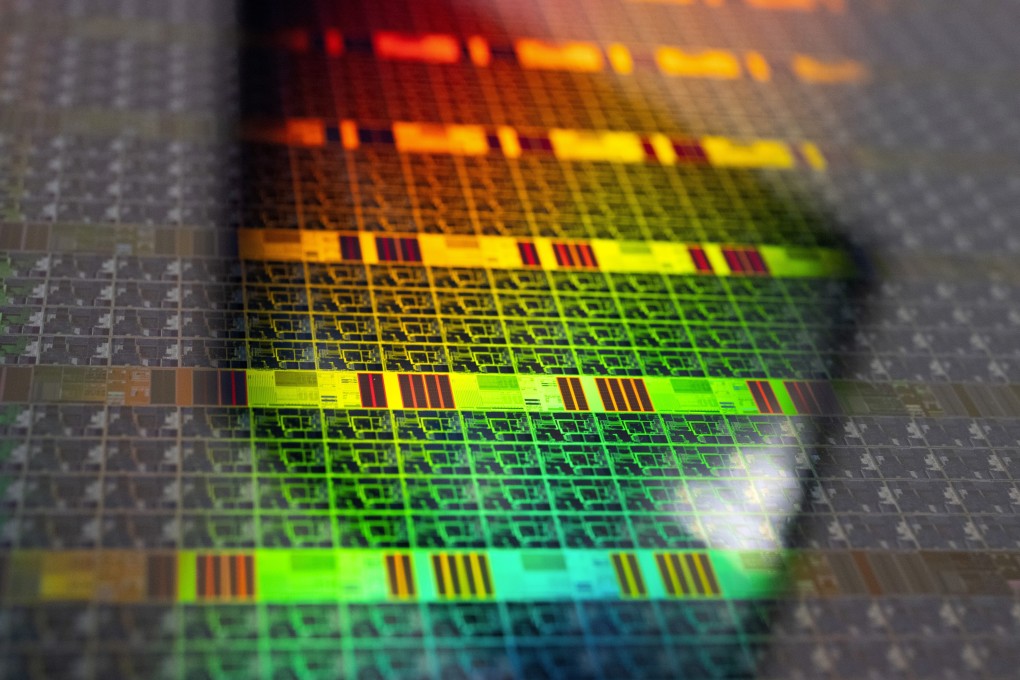

World’s fourth-largest chip maker GlobalFoundries files for IPO that could value company at US$25 billion

- The IPO in New York could value the chip maker at around US$25 billion

- The Wall Street Journal reported last month that Intel was in talks to acquire GlobalFoundries

Reading Time:2 minutes

Why you can trust SCMP

GlobalFoundries has filed confidentially with U.S regulators for an initial public offering (IPO) in New York that could value the chip maker at around US$25 billion (HK$194 billion), people familiar with the matter said on Wednesday.

The move is the clearest sign yet that GlobalFoundries, which is owned by Abu Dhabi’s sovereign wealth fund Mubadala Investment Co, is not eager to accept a potential tie-up with Intel Corp, which The Wall Street Journal reported last month was in talks to acquire the US chip maker.

GlobalFoundries is working with Morgan Stanley, Bank of America Corp, JPMorgan Chase & Co, Citigroup and Credit Suisse Group AG on the IPO preparations, the sources said.

Advertisement

GlobalFoundries is expected to reveal its IPO filing in October and go public by the end of the year or early next year, depending on how quickly its application is processed by the US Securities and Exchange Commission (SEC), the sources said.

The sources, who requested anonymity because the deliberations are confidential, cautioned that the chipmaker’s plans were subject to market conditions and that the timing could change.

Advertisement

Intel has yet to make a formal offer for GlobalFoundries and may not do so, according to the sources.

Advertisement

Select Voice

Select Speed

1.00x