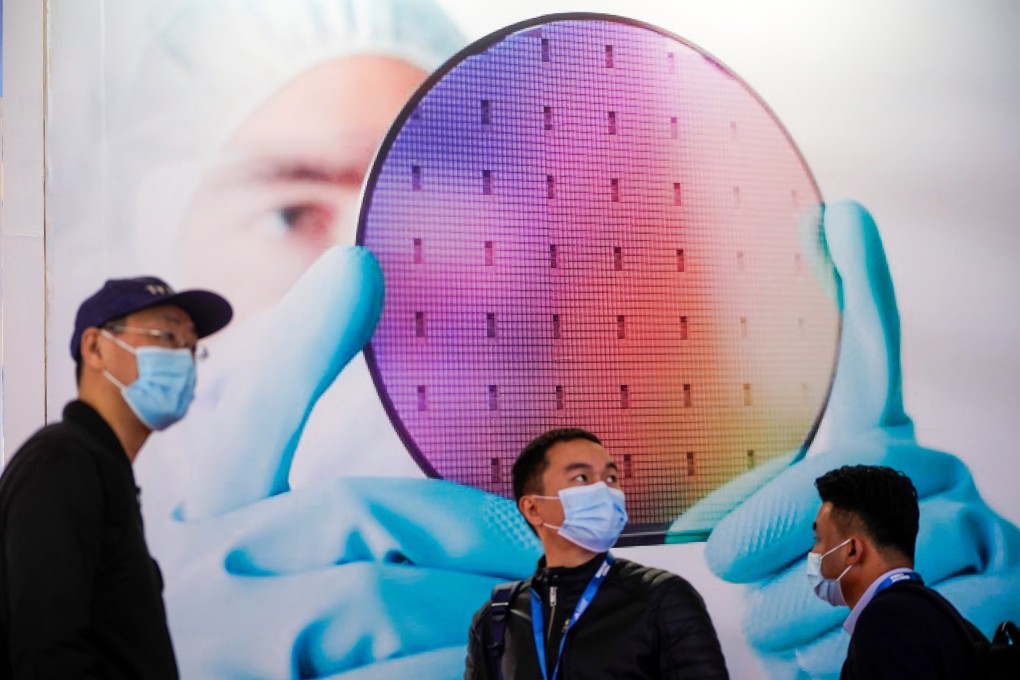

US says Chinese private equity fund’s acquisition of South Korean chip maker poses a ‘national security risk’

- The Treasury Department identified such national security risk in the US$1.4 billion deal involving Wise Road Capital

- The inter-agency Committee on Foreign Investment in the United States will refer the Magnachip review to US President Jose Biden for final decision

The US Department of the Treasury said the acquisition of South Korean chip maker Magnachip Semiconductor Corp by a Beijing-based private equity fund poses a national security risk, casting a shadow on the US$1.4 billion deal and other efforts by Chinese companies to invest in hi-tech industries abroad.

On March 25, Magnachip entered into an agreement with South Dearborn Limited, a company incorporated in the Cayman Islands that was formed by an affiliate of Wise Road, and Michigan Merger Sub, a Delaware-based firm. Under this deal, Merger Sub will be merged with Magnachip, and become a wholly owned subsidiary of South Dearborn under Wise Road.

01:20

What is CFIUS, anyway?

Magnachip is expected to provide additional information to CFIUS, including “proposals to permanently mitigate the identified national security risks”, the South Korean company said in its SEC filing.