China trails US in government support for domestic chip industry, according to new report

- China’s nascent chip industry needs more than direct subsidies and tax holidays to flourish, researchers at China’s leading investment bank found

- The US remains a leading global supplier of semiconductors, while China is in a “relatively backward position”, said analyst

The Chinese government is not doing enough to prop up its domestic chip industry compared with the United States, according to a new report by China’s top investment bank.

“If we compare each government’s support for the semiconductor industry, the support provided by the US is still more than what China has provided,” said Peng Wensheng, chief economist and head of the research department at China International Capital Corp (CICC), during an online media briefing on Tuesday.

Why semiconductors are important in the US-China tech war

While Beijing has already showered the country’s semiconductor projects with generous incentives such as direct subsidies and tax holidays, CICC researchers found that Washington has “played an important role in technology innovation” by providing financial support at the early stage.

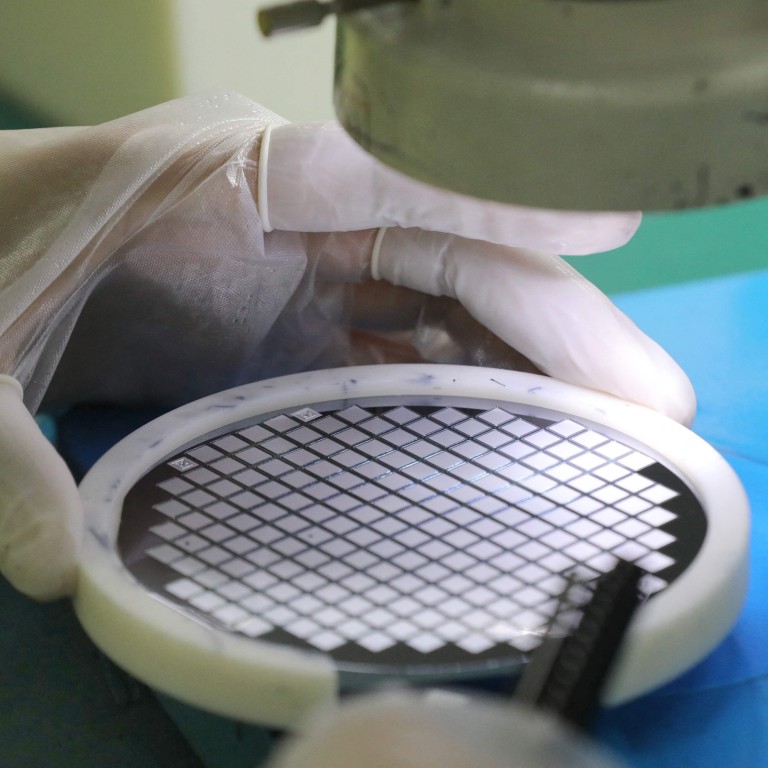

China is determined to strengthen its technological self-reliance as it grapples with a fierce rivalry with the US, as well as a global chip shortage. As part of its 14th five-year plan, Beijing aims to increase its spending on basic scientific research, including on semiconductors, to 8 per cent of the country’s total research and development expenditure.

The US is currently the world’s leading supplier of semiconductors, accounting for nearly 40 per cent of the global market, said Peng Hu, principal analyst of the technology and semiconductor sector at CICC. China, on the other hand, is a major consumer of semiconductors, contributing to more than 20 per cent of global demand.

“We found that in the global supply landscape, China is still in a relatively backward position,” said Peng. “For now, Europe, the US, Japan and South Korea still have plenty of competitive advantages when it comes to key and mature semiconductor equipment.”

While China has seen some progress in chip design, it needs to catch up on equipment and electronic design automation (EDA), a category of software tools used for designing advanced chips containing billions of transistors, said Peng.

In 2020, China ranked third after the US and Europe in the proportion of semiconductor expenditure spent on research and development, as well as in average gross margin in chip design – a category where it ranked higher than Taiwan, Japan and South Korea, according to the report. When it comes to semiconductor foundries, China had the lowest average gross margin compared with Taiwan and South Korea.

The report also showed that China’s enormous population did not translate into talent advantage.

While China has more PhD graduates in science, technology, engineering and mathematics (STEM) majors than the US, many of them have not stayed in the country. Between 2001 and 2010, China had the largest number of inventors leaving the country compared to 13 other countries, while the US was the most popular immigration destination for inventors, the report said.

In response to Beijing’s call for national self-sufficiency, a number of Chinese provinces and direct-administered municipalities have been sharpening their focus on semiconductor development.

Shanghai has drawn up an ambitious plan to lead the country in strategic emerging industries, including semiconductors, as well as artificial intelligence, electric vehicles and advanced manufacturing. Last week, Wuxi, a city in the eastern province of Jiangsu, partnered up with South Korean memory chip giant SK Hynix to develop the China-Korea Integrated Circuit Industrial Park.