Tech war: Dutch chip manufacturing tool maker ASML still aims to expand China workforce, despite tighter US export restrictions

- ASML’s total employee headcount on the mainland reached more than 1,500 at the end of August, up from less than 500 in 2017

- The Dutch firm is expected to hire more than 200 new employees this year

Shen Bo, ASML senior vice-president and country manager for China, confirmed on Tuesday that the company has grown the number of its local personnel to more than 1,500 as of the end of August, up from less than 500 in 2017, on the back of rapid business growth on the mainland, a development that was first reported last week by Chinese media Jiemian News.

Mainland China’s share of ASML’s total sales of lithographic systems by value dropped to 10 per cent in the second quarter, down from 34 per cent in the first quarter, when the country was the Dutch firm’s largest single market.

By comparison, ASML shipments to Taiwan made up 41 per cent of its total sales in the June quarter, while South Korea accounted for 33 per cent.

China’s chip ambitions face reality check as US set to widen equipment ban

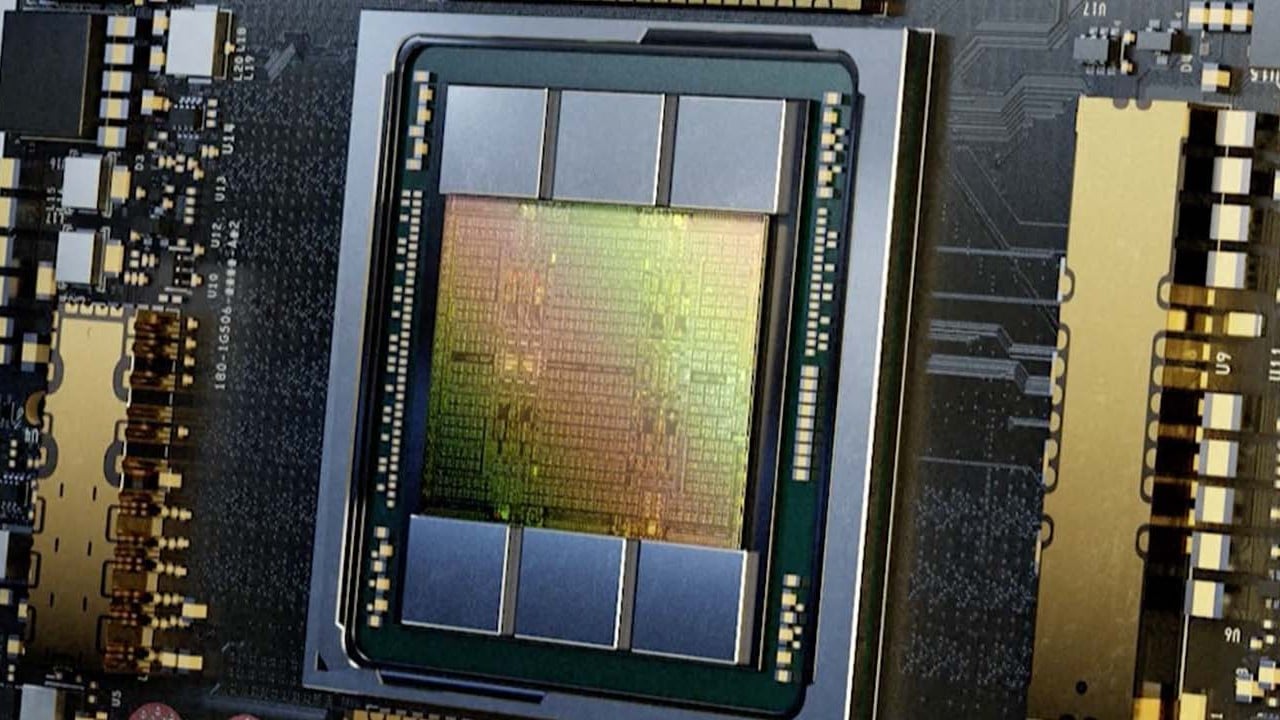

The company continues to sell its older deep ultraviolet (DUV) lithography systems to China.

While ASML’s personnel expansion in China may appear to be at risk because of potential new US restrictions, the company continues to acknowledge the country’s important position in the global semiconductor market.

Commenting on US pressure to further restrict ASML equipment sales to mainland China, Wennink described it as “a political position which we have to wait for politicians to come up with”.

China’s semiconductor industry, however, has recently made some progress, according to a report from a Canada-based tech research firm.