Shenzhen plans to shower cash on local chip industry to bolster development after intensified US trade restrictions

- Chinese city will provide support for design of high-end, general purpose and special purpose chips, and manufacture of silicon-based ICs

- Move comes as China seeks to accelerate development of the local chip industry amid intensifying US trade sanctions

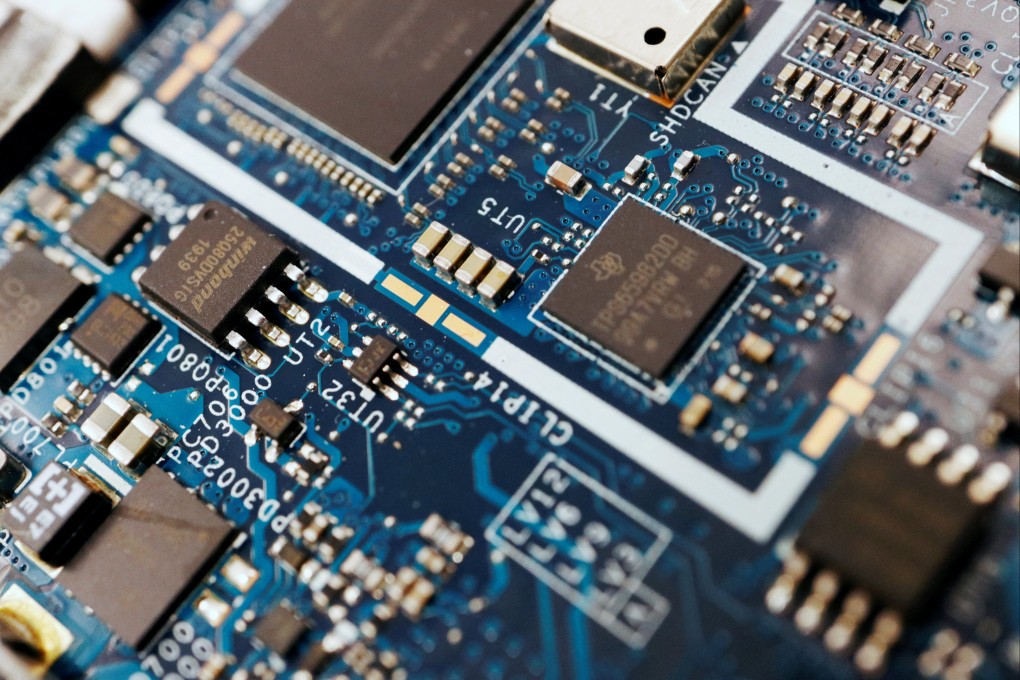

China’s tech hub Shenzhen has doubled down on efforts to grow its local chip industry by promising fat subsidies and cash rewards to semiconductor businesses registered in the city, as the US continues to ratchet up trade restrictions on Chinese chip champions.

According to a draft plan published by Shenzhen’s economic planning agency on Saturday, the Chinese city will provide support for design of high-end, general purpose and special purpose chips, the manufacture of silicon-based integrated circuits (IC), as well as for packaging of chiplets among other parts along the supply chain. These are areas particularly affected by recent US trade restrictions.

The Shenzhen Development and Reform Commission, the government agency drafting the plan, is soliciting public opinion on the proposals through to November 8. At the heart of the plan is a goal to achieve breakthroughs in core links including the design and development of central processing units (CPUs) and graphics processing units (GPUs) – currently a weak link in China’s semiconductor industry.

The Shenzhen government has pledged to provide a maximum of 20 per cent, or up to 10 million yuan (US$1.4 million) each year, towards the IP cores fee for the research and development (R&D) of high-end chips. In other words, the Shenzhen government will foot part the bill for local chip design firms to buy the necessary know-how to progress their research.

The Shenzhen government also wants to boost the adoption of home-grown electronic design automation (EDA) software. Companies and research institutions that buy domestic EDA tools will qualify for a subsidy of up to 10 million yuan each year, or less than 70 per cent of the fees, while those who rent the tools will be given 5 million yuan, or less than half of the expenses.