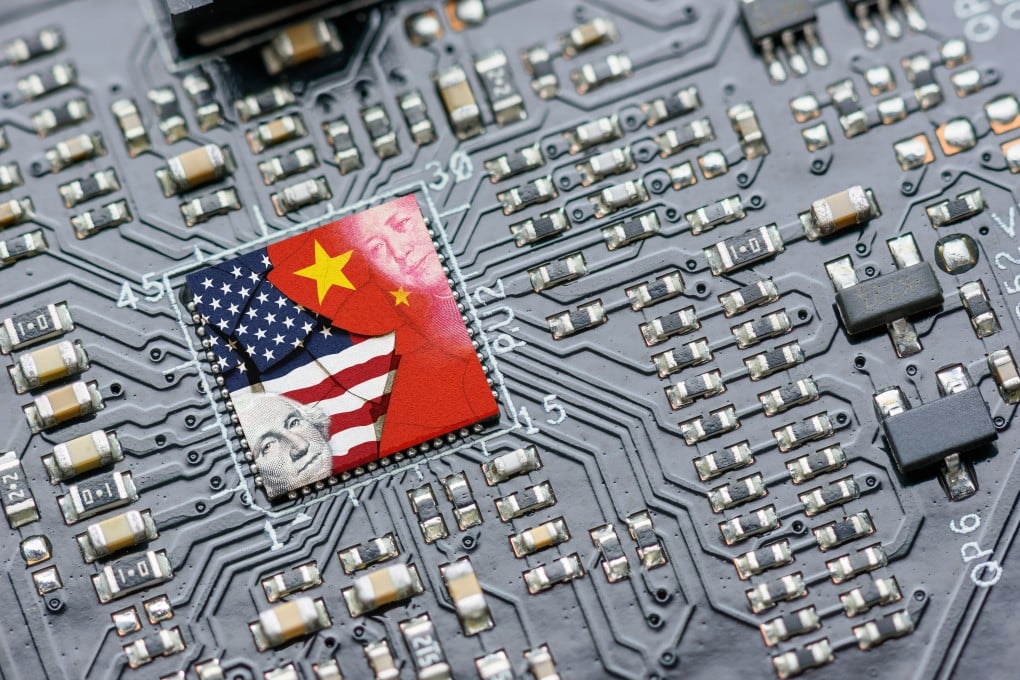

A Chinese chip company founded by a former Intel engineer is set to go public and test restrictions on US citizens

- Lontium Semiconductor’s American founder is seen as a champion of China’s chip industry, but an IPO raises questions about Washington’s curbs on ‘US persons’

- The latest sweeping US export restrictions have left the fate of many American executives at Chinese chip firms in limbo, with some leaving or dumping shares

Lontium Semiconductor Corp is not a household name like Intel or Texas Instruments, but its plans to go public in mainland China could test new export controls that have put the fate of many US executives at Chinese chip firms in limbo.

The company, founded in 2006 by former Intel engineer Chen Feng, has gained approval for an initial public offering on Shanghai Stock Exchange’s tech board, Star Market, according to its prospectus released on October 25.

Lontium did not respond to requests for comment.

Chen, a 57-year-old native of eastern Anhui province, is among a number of Chinese-born entrepreneurs who gained US citizenship after studying and working in the country before returning to China in the early 2000s to start chip-related businesses.