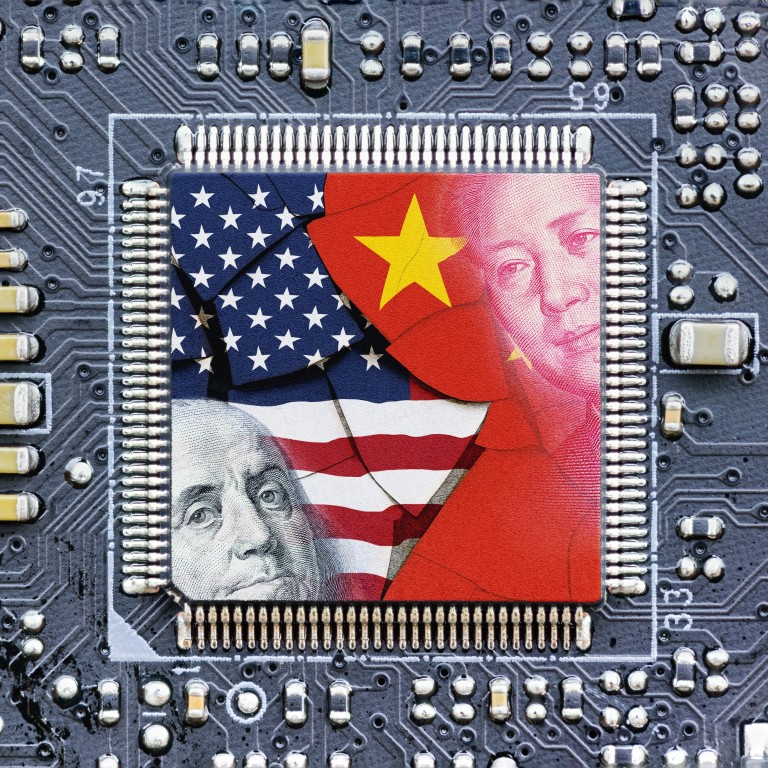

Tech war: Japan, Netherlands said to join US in restricting China’s access to advanced semiconductor manufacturing equipment

- American, Dutch and Japanese officials are set to conclude talks as soon as Friday, US time, on a new set of limits on Chinese firms

- There is no plan for a public announcement of restrictions that are likely to be just implemented, according to people familiar with the negotiations

American, Dutch and Japanese officials are set to conclude talks as soon as Friday, US time, on a new set of limits to what can be supplied to Chinese companies, the people said, asking not to be named because the talks are private.

Negotiations were ongoing as of late Thursday in Washington. There is no plan for a public announcement of restrictions that are likely to be just implemented, the people said.

A spokeswoman for the National Security Council declined to comment. The council serves as the US President’s principal forum for national security and foreign policy decision making with senior national security advisers and cabinet officials.

US equipment makers have complained that the unilateral action by the Biden administration allowed overseas competitors to continue to operate in one of the biggest markets for their products and undermined the aim of restricting China’s military advancements.

China files ‘necessary’ WTO suit against US over chip export controls

Tokyo Electron, which has sold chip-making equipment to China, reversed gains and fell about 1 per cent after Bloomberg’s report.

“This sets the next escalating move in the US-China tech war a bit more meaningfully and could weaken yuan sentiment a tad in the near-term,” said Fiona Lim, a foreign-exchange strategist at Malayan Banking Berhard in Singapore.

“If they cannot get those machines, they will develop them themselves,” Wennink said in an interview with Bloomberg News. “That will take time, but ultimately they will get there.”