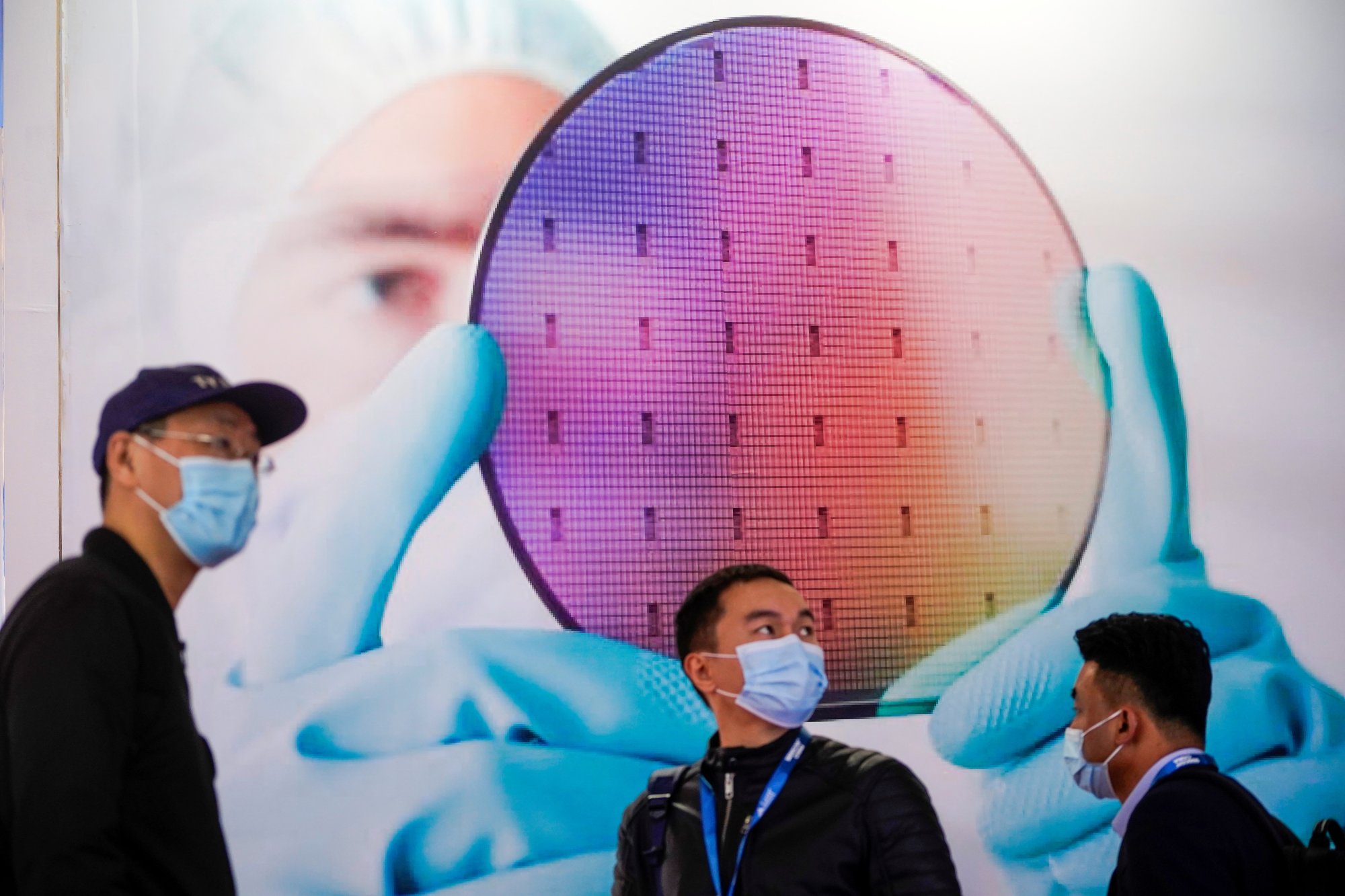

China’s biggest foundry SMIC sees profits fall by one-fourth on waning demand for electronic gadgets

- Profits fell over 26 per cent year on year to US$425.5 million in the December quarter, after SMIC warned earlier about weaker electronics demand

- SMIC reported full-year sales growth of 34 per cent, but it expects the global chip industry to remain at the bottom of the cycle in the first half of 2023

Semiconductor Manufacturing International Corp (SMIC), China’s top contract chip maker, said its profits declined by more than one-fourth in the fourth quarter, as falling consumer demand in smartphones and laptop computers weighs on the industry.

During the three months ended December 31, profits fell over 26 per cent year on year to US$425.5 million, the Hong Kong and Shanghai-listed foundry reported on Thursday. Quarterly revenue reached US$1.6 billion, down 15 per cent from the previous quarter, but up 2.6 per cent from a year earlier.

Total revenue for 2022 increased nearly 34 per cent to US$7.27 billion, compared with US$5.44 billion in 2021, SMIC said.

SMIC said in November that it expected weaker demand for consumer electronics to weigh on its business outlook through the first half of 2023.

Around the world, the semiconductor industry has been facing strong headwinds, with global semiconductor sales dropping nearly 15 per cent year on year to US$130.2 billion in the fourth quarter, according to data from the Semiconductor Industry Association.

SMIC said the semiconductor industry is likely to remain at the bottom of the cycle in the first half of 2023, which could push the company’s first-quarter revenue down by as much as 12 per cent compared with the December quarter.

While SMIC never publicly admitted to or denied the breakthrough, it indicated that the Shanghai-based firm was able to make inroads into advanced nodes below 10-nm without the highly advanced extreme ultraviolet machines made by Dutch chip equipment giant ASML, which stopped exporting such tools to China in 2019 under US pressure.

SMIC, which was added to the US Commerce Department’s Entity List in late 2020, is currently building four mature 28-nm foundries across China, including one each in Shanghai and Tianjin, which are set to go online in the next five to seven years.

As of the end of 2022, the new fab in Shenzhen had entered production, while trial production had begun in another fab in Beijing, where mass production is expected to be delayed by one to two quarters owing to a delay in the procurement of certain equipment, the company said on Thursday.

SMIC said its monthly capacity increased to 714,000 8-inch equivalent wafers last year, while total capital spending amounted to US$6.35 billion. It said the increased budget was to prepay for equipment procurement for its four new wafer foundries, which would provide additional capacity equivalent to 340,000 12-inch wafers per month.