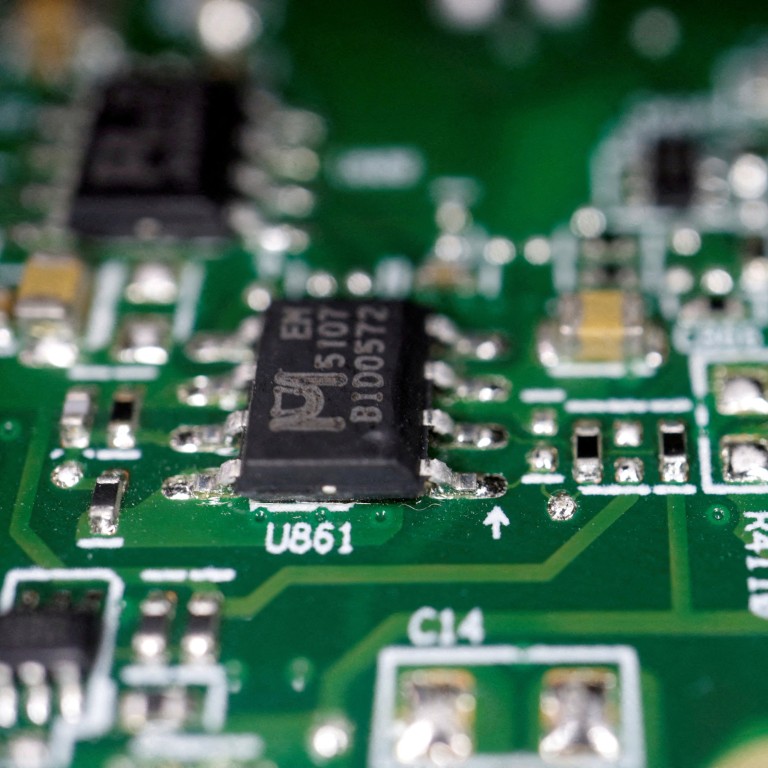

Tech war: China’s chip imports slump 23 per cent in the first 3 months as US trade sanctions, supply glut weigh on activity

- China imported 108.2 billion integrated circuits (IC) between January and March, down 22.9 per cent

- The updated trade data reflects how geopolitical tensions and increased US sanctions on China have weighed on semiconductor transactions

China’s chip imports dropped 23 per cent in the first three months of 2023 in sharp contrast with last year’s position, amid a slower global economy and increased efforts by the Biden administration to restrict the export of advanced semiconductor technologies to China.

China imported 108.2 billion integrated circuits (IC) between January and March, down 22.9 per cent from the same period last year, according to data published by the General Administration of Customs on Thursday.

The total value of chip imports tumbled 26.7 per cent to US$78.5 billion, down from US$107.1 billion last year, according to the customs data. The larger decline in import value reflects the fact that chip prices have fallen this year amid a supply glut and a slowing global economy.

In the first three months of 2022, the total quantity of China’s chip imports dropped 9.6 per cent year-on-year to 140.3 billion ICs, while the total value increased 14.6 per cent amid higher prices a year ago.

China still a key market for Intel, CEO says in Beijing trip

China’s IC exports fell 13.5 per cent year-on-year to 60.9 billion units in the first three months of 2023, compared with a 4.6 per cent drop a year ago. The total value of the exports dropped 17.6 per cent.

The updated trade data reflects how geopolitical tensions and increased US sanctions on China have weighed on semiconductor transactions between the country and the rest of the world.

Since late last year, the US has dialled up measures to curtail China’s access to, and ability to produce advanced chips and chip-making equipment, on the grounds of national security.

Last October, the Bureau of Industry and Security, an agency under the US Department of Commerce, updated its export controls, targeting China’s ability to develop and maintain supercomputers and manufacture advanced semiconductors used in military applications, including weapons of mass destruction.

China’s state assets watchdog calls for more achievements in chip design tools

In January, it was reported that the US had reached a joint agreement with Japan and the Netherlands to coordinate on export controls to China covering certain chip-making equipment. Meanwhile, a US-proposed Chip 4 Alliance – which includes South Korea, Japan and Taiwan – is coming into shape.

However, the import and export data for March indicated a slight uplift from the first two months, when imports and exports volume dropped 26.5 per cent and 20.9 per cent year-on-year, respectively. This reflects the broader trend of recovery in China’s manufacturing activities after Beijing relaxed its stringent zero-Covid policies in December.

The official manufacturing purchasing managers’ index (PMI) recorded a higher-than-expected reading of 51.9 in March, compared with 48 last November, with analysts suggesting that the world’s second-largest economy is “on track” for recovery after its reopening.