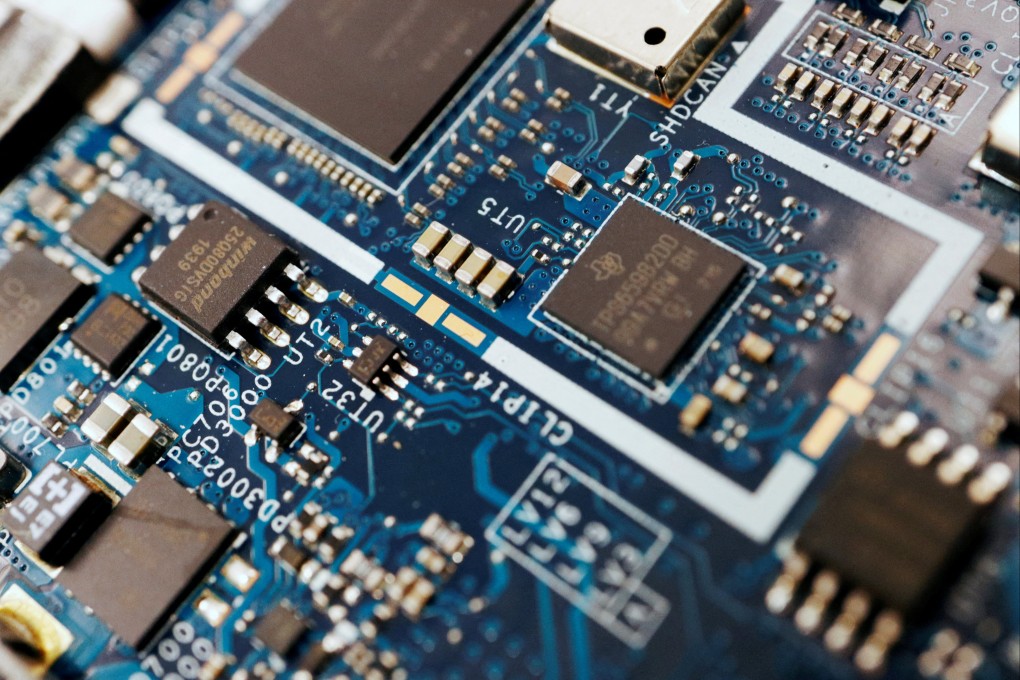

China’s chip imports slump in first half as US sanctions and ongoing tech war take a toll on trade

- Downward trend in trade data comes amid increasing efforts by the US to restrict China’s access to advanced chips

- China’s imports of integrated circuits dropped to 227.7 billion units in the first six months of 2023, down 18.5 per cent

China’s imports of integrated circuits (ICs) slumped 18.5 per cent in the first six months of 2023 from a year earlier by volume, according to newly released customs data, at a time when the US and its allies are continuing to restrict China’s access to advanced chips and technologies.

China’s imports of integrated circuits dropped to 227.7 billion units in the first six months of 2023, compared with 279.6 billion units in the same period last year, according to data published by the General Administration of Customs on Thursday. It slightly narrowed the 19.6 per cent drop in the first five months of 2023.

The total value of chip imports fell 22.4 per cent to US$162.6 billion in the first half year of 2023. The drop was much deeper than the decline in China’s overall imports, which shrank 0.1 per cent from a year earlier for the same period.

The downward trend in trade data comes amid increasing efforts by the US to restrict China’s access to advanced chips and related equipment, especially from Japan, South Korea and Taiwan, which are key players in the global chip supply chain.

China’s total imports from South Korea plunged 19.6 per cent in the period compared with a year ago, while imports from Japan and Taiwan fell 11.1 per cent and 18.9 per cent respectively, according to China customs data.

China’s lack of access to advanced chips is already disrupting supply chains. Inspur Group, the world’s second-largest AI server maker, saw its main-listed vehicle on the Shenzhen Stock Exchange fall 10 per cent yesterday after it issued a profit warning. The company was added to a US trade blacklist earlier this year for allegedly acquiring US-origin items in support of China’s military.

Meanwhile, there has been a surge in China’s domestic output of legacy chips and other mature technology ICs to replace imported products under Beijing’s semiconductor self-sufficiency drive. China’s domestic output of ICs increased 0.1 per cent in the first five months of 2023 to 140 billion units, according to the National Bureau of Statistics.