Intel ends deal to buy Tower Semiconductor after failure to gain Chinese regulatory approval

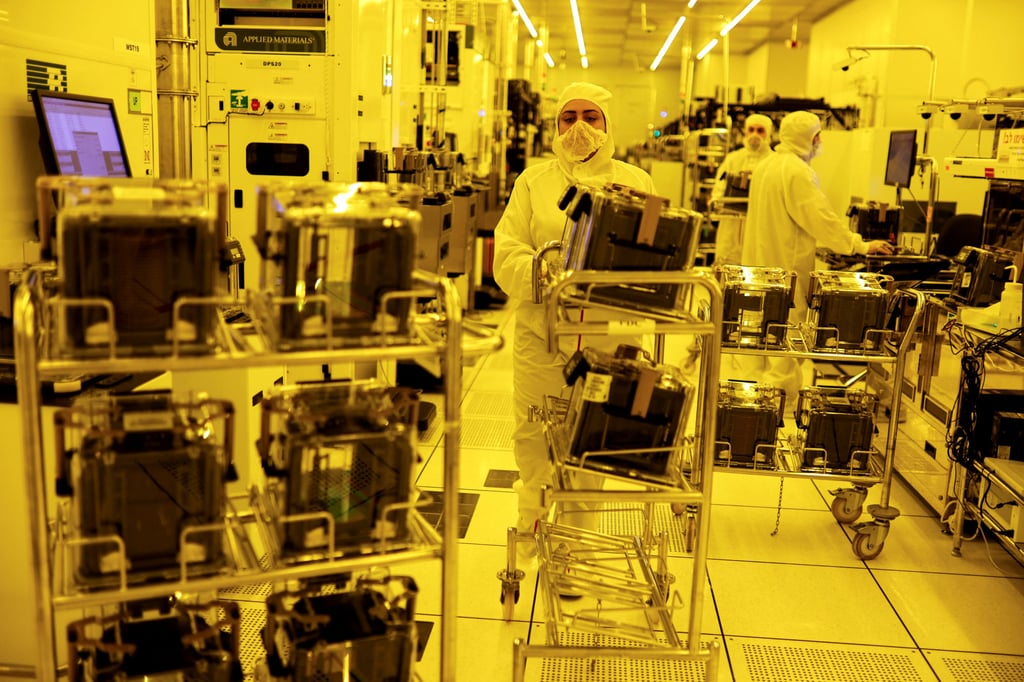

- The US$5.4 billion acquisition had been part of the American tech giant’s plan to expand its foundry business

- The failed deal highlights the precarious situation of US chip companies doing business in China amid geopolitical tensions

The American tech giant on Wednesday terminated its deal to acquire Tower for US$5.4 billion “due to the inability to obtain in a timely manner the regulatory approvals required under the merger agreement”, the company said.

Beijing requires mergers involving companies with a major business presence in China to be approved by the State Administration for Market Regulation (SAMR), the antitrust regulator.

China is one of Intel’s largest markets. The company also houses several factories there.

Intel’s aborted acquisition was largely expected following several delays over the past year because of SAMR’s opposition. Nasdaq-traded shares of Tower have declined by about 22 per cent year-to-date, closing at US$33.78 on Tuesday – compared with Intel’s offer of US$53 per share.