Japanese chip gear-maker Kokusai aims to build on 66 per cent rally as China demand booms

- China’s build-up is driven in part by efforts to localise chip production at a time the US is erecting higher barriers on the export of advanced chips and chip gear

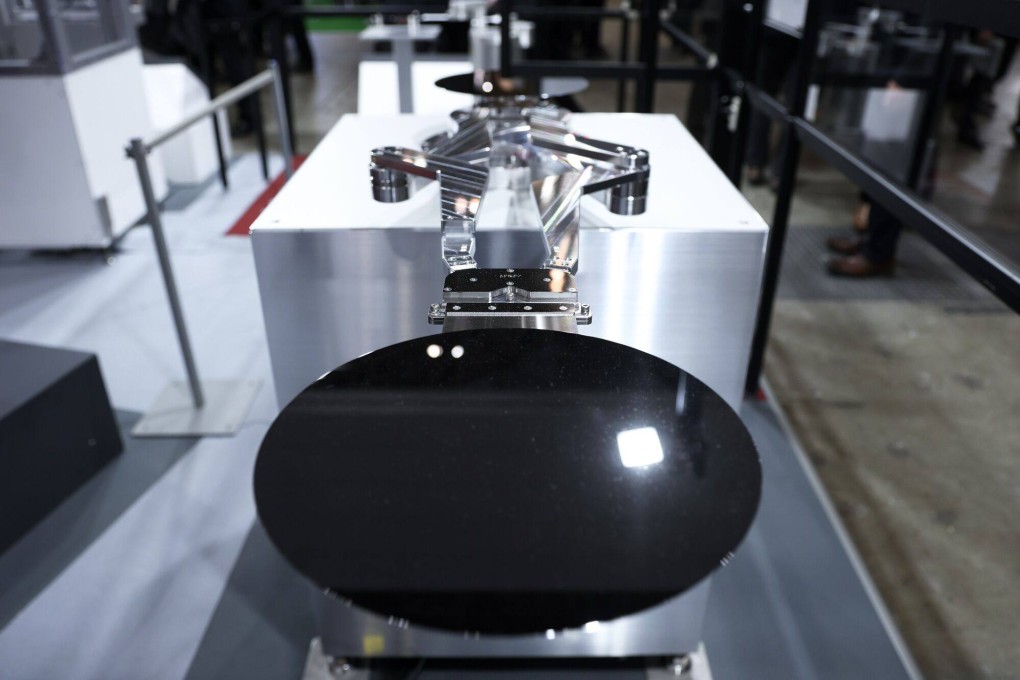

- Kokusai is a key player in what is known as film deposition, the step in semiconductor production when a layer of chemicals is deposited on silicon wafers

Japanese chip gear-maker Kokusai Electric is expanding its staff in China in anticipation of an increase in demand from the world’s largest semiconductor market in 2024.

CEO Fumiyuki Kanai, who presided over the company’s initial public offering in October, foresees sustained investment in capacity in China and plans to expand his local support teams there to better serve clients. Kokusai is seeking to extend the 66 per cent rally in its stock price since its IPO less than two months ago.

China’s build-up is driven in part by efforts to localise chip production at a time the US is erecting higher barriers on the export of advanced semiconductors and chip-making gear to a geopolitical rival. Chinese companies have poured billions into factories for so-called legacy chips that US sanctions do not prohibit, but remain critical components in everything from smartphones to electric vehicles.

“Countless small-scale fabrication plants are springing up like mushrooms in China,” Kanai, 67, told Bloomberg News in an interview. “The Chinese government is providing aggressive support to the industry for activities including the Internet-of-Things, smartphones and personal computers.”

Tapped to lead the company after KKR & Co acquired it from Hitachi in 2018, Kanai said he will prioritise shareholder returns, after making enough investments for production and next-generation tool development. Stock buy-backs are an option the company will actively consider, he said.

China’s investments will be across memory, logic and power chips at 28-nanometres and larger, Kanai said. The country accounts for more than 40 per cent of the Tokyo-based company’s revenue today, an unusually high level due in part to lacklustre demand elsewhere. It expects that percentage will rise to just below 50 per cent in coming months, though China’s historical contribution to Kokusai’s revenue was about 30 per cent.

“We have locations in China only to provide after-sales services and have no plans to do production or research there,” Kanai said. “We will increase personnel to cover the local demand.”