Intel still sells to Huawei millions of dollars’ worth of advanced chips, while AMD receives no such licence: sources

- Intel still retains a Trump-era licence to sell advanced laptop CPUs to Huawei despite pressure on Biden to revoke the permission, sources say

- AMD applied for a licence to sell similar chips in 2021 after Biden took office but never received a response to its application, a source say

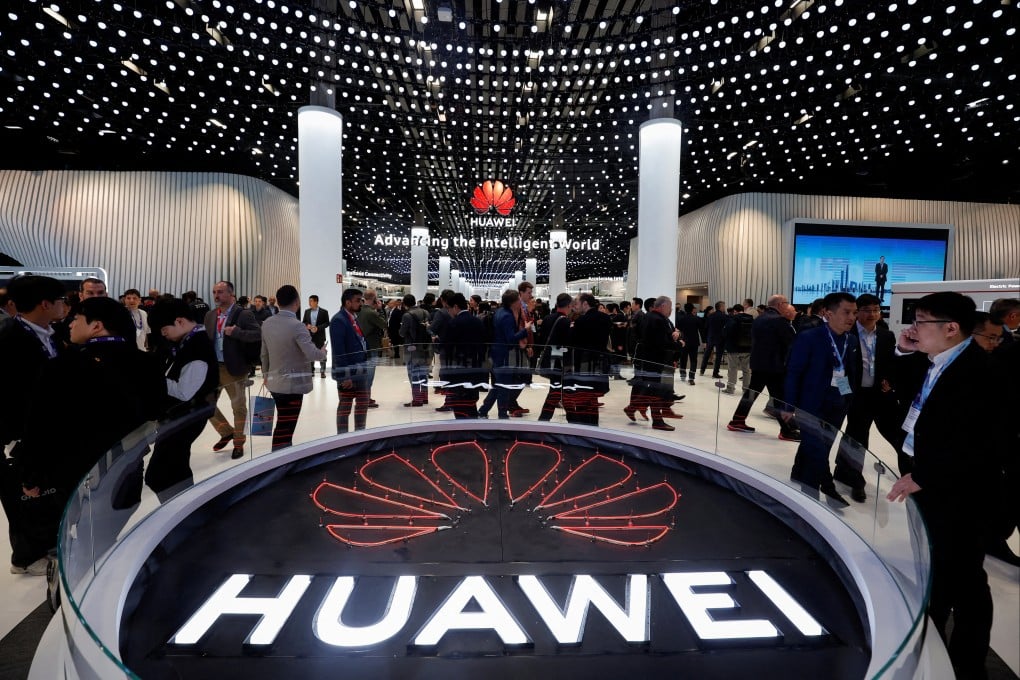

Intel has survived an effort to halt hundreds of millions of dollars’ worth of chip sales to Huawei Technologies, two people familiar with the matter said, giving one of the world’s largest chip makers more time to sell to the heavily sanctioned Chinese telecoms company.

US President Joe Biden has long been under pressure to revoke a licence, issued by the Trump administration, that allows Intel to ship advanced central processors to Huawei for use in laptops.

Intel’s ability to hang on to a licence to sell chips while a rival could not obtain similar permission demonstrates the uneven and uncertain terrain companies face as the US seeks to limit Beijing’s access to sophisticated American technology, especially to a heavily sanctioned company like Huawei.

It has also allowed Huawei to keep a small but growing share of the global laptop market, while AMD was deprived of hundreds of millions of dollars’ worth of sales to the Chinese sanctioned firm, data showed.

Republican Senator Marco Rubio called on the Biden administration to revoke Intel’s licence to sell to Huawei “immediately” following the Reuters report.