Tech war: Huawei’s growing laptop business in China under threat after US revokes Intel, Qualcomm chip export licences

- Most of Huawei’s consumer laptops launched since 2022 have been powered by Intel or Qualcomm processors

- Further curbs on access to Intel and Qualcomm chips would pose challenges to Huawei’s growing PC business in China

The US commerce department confirmed that some export licences related to Huawei had been withdrawn, the report said.

Beijing called the move “a typical economic coercion practice” and a violation of US commitment to not decouple from China. It “will take all necessary measures to safeguard the legitimate rights and interests of Chinese firms,” a spokesperson of China’s commerce ministry said on Wednesday.

Huawei did not immediately respond to a request for comment on Wednesday.

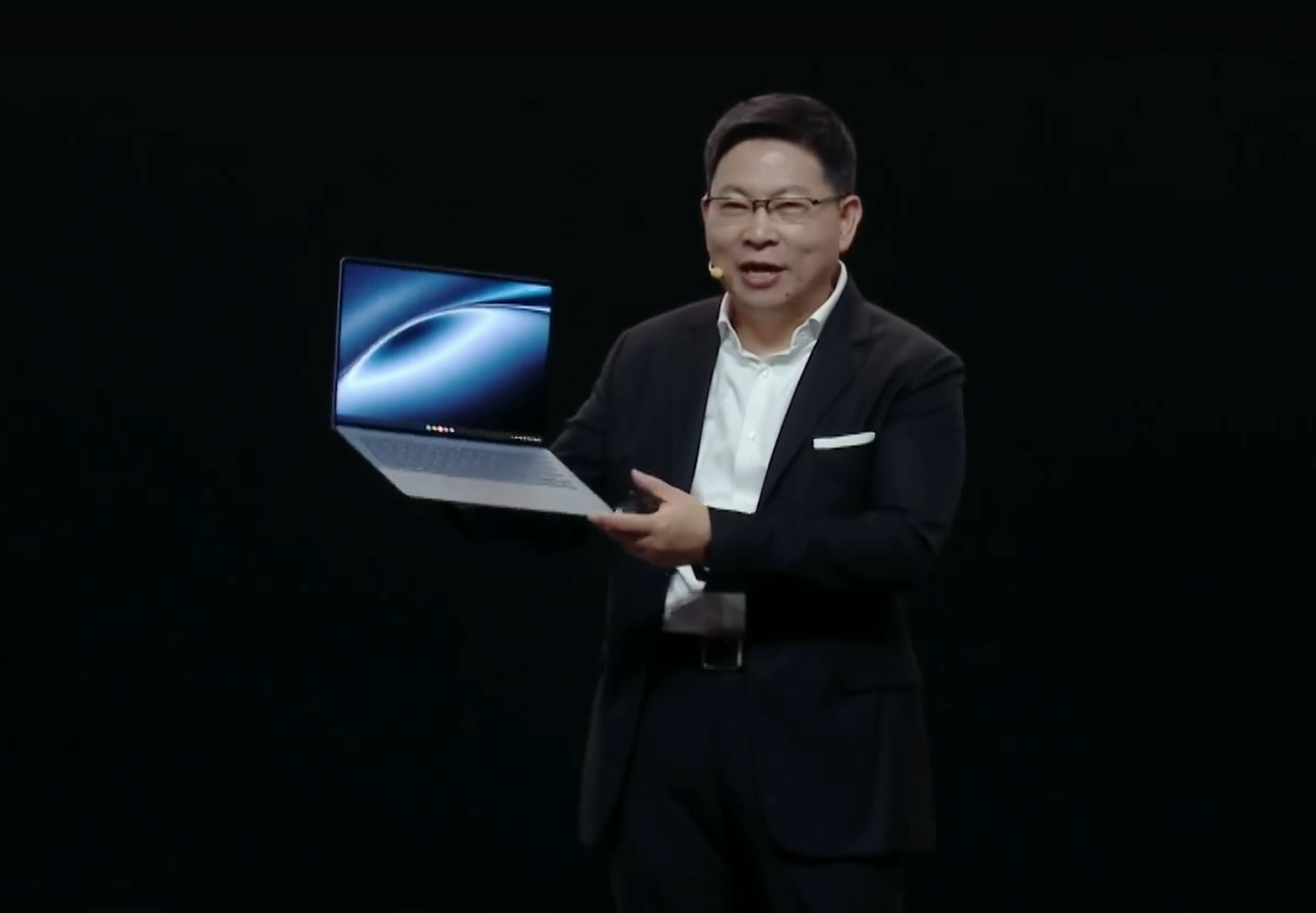

According to the Post’s review of more than a dozen Huawei consumer laptop models launched since 2022, most were powered by Intel’s Core processors, with the exception of the Matebook E Go, which runs on Qualcomm’s Snapdragon chip.

Further restrictions on access to Intel and Qualcomm chips would pose challenges to Huawei’s PC business, which has been gaining ground in the China market.

Huawei’s PC shipments, which include desktops and notebooks, grew 11 per cent to almost 4 million units last year, according to data by market research firm Canalys. The Shenzhen-based company ranked third with 10 per cent of market share, behind industry leader Lenovo Group with 38 per cent and HP, which also held 10 per cent but was slightly ahead of Huawei.

Huawei, formerly China’s largest smartphone vendor, saw its lucrative handset business decimated after the US added the company to a trade blacklist in 2019 and tightened sanctions in 2020 by blocking its access to advanced semiconductors developed or produced using US technology.

The company has been trying to diversify its revenue source, including efforts to promote its desktop and notebook computers, which require less advanced chips compared to smartphones.

Huawei has also drawn closer scrutiny in the US after it surprised the world last year with the Mate 60 Pro, which used a Chinese-made semiconductor. The 7-nanometre Kirin 9000S processor was reportedly produced by China’s top chip maker, Semiconductor Manufacturing International Corporation, despite US sanctions aimed at limiting China’s chip-making capabilities.